See « A note on Duncan Foley’s circuit of capital » Gérard Duménil and Dominique Lévy in http://www.cepremap.fr/membres/dlevy/biblioa.htm

To the 50 % of American workers and employees whose average earning has stagnated around $ 16 000 a year since 1980 and with almost no savings while the « Top 0.1% now holds as much wealth as Bottom 90% combined ». See: Capitalism in America: How a Dismal Decimal is Robbing Americans Blind, by Jon Hellevig for The Saker Blog in http://thesaker.is/capitalism-in-america-how-a-dismal-decimal-is-robbing-americans-blind/

Foreword

1 ) Introduction

2 ) Origin of another fallacious Marxologists’ problem

2 a ) Rosa Luxemburg and Book II of Capital

2 b ) Circuits vs. Simple and Enlarged Reproduction

3 ) The laughable homothetic presentation of « circuit of capital » by Duménil & Lévy

3 a ) Model vs. the object or investigation or Reality

3 b ) « The basic circuit of capital model with a commodity money » : no more than a useless paid academic game.

3 c ) The pseudo-problem of realization taken from Duncan Foley and « resolved » by these two.

3 d ) A word on classical and speculative credit.

4 ) Conclusion: some paid academics should learn to read and think before pretending to comment on Marx.

Foreword:

The above outline has been followed scrupulously. However, to avoid boredom by restraining myself to the above mentioned two authors’ intellectually barren thesis on realization, I took the opportunity to widen the scope of my refutation. I did this interpolating in my demonstration my critiques of most of the other pertinent bourgeois works on the subject. The usefulness of the result should be that much greater.

1 ) Introduction

The great epistemologist Louis Althusser underlined the fact that of the four volumes of Karl Marx’s Capital only Book I was published and edited by Marx himself. I have demonstrated how Marx’s two main contributions have been falsified with recourse to the usual dominant casts’ and classes’ method which consists in either occulting science or in obscuring it. The aim of this falsification is to deprive the masses of the theoretical and practical (1) tools needed to apprehend reality and to change it in order to fit their own Human needs.

Marx’s first main contribution consists in his elaboration of the Triptych of Human Emancipation, that is to say the historical and logical conclusion of the critique of exclusivism without which no democracy and no emancipation are possible. Theories of Natural Law had preceded this understanding. They took their modern scientific form with Vico’s notion of « diritto delle genti » and their republican form with the powerful refutation of Tradition –according to Ed. Burke et al. – by Thomas Paine’s Rights of Man. (2)

Marx’s second main contribution consists in laying the ground for the scientific basis of economic science with his impeccable investigation and exposition of the labor law of value, a gigantic endeavor which we can admire in many of his works and more particularly in Capital. From the very beginning Marx was the object of vicious attacks, for instance those exposed by Marx himself in his Herr Vogt (3)

The main falsification was due to Böhm-Bawerk. From his bureaucratic position and thanks to his ties with Menger and other highly placed officials in Austria and Germany, he followed closely the publication of Marx’s work. This was especially the case after the publication of Book I of Capital, which Marx himself had intended as a scientific exposition of the political economy field equivalent to Darwin’s magnum opus on evolution. This had created lots of distress among the highest dominant circles and their lodges. Hughes even referred to Max Weber’s bout of quasi-madness after his reading of Book I, a depression that he, interestingly, cured during a trip in Italy where he was probably taught Nietzsche’s falsifying method of which he was soon to give his own sociological version. (Hughes, H. Stuart, Consciousness and Society, The Harvester Press, 1979.)

I personally suspect that Böhm-Bawerk was not ignorant concerning the choices of drafts managed in the back of an aging Engels mainly by Kautsky and Bernstein for the posthumous editions of Books II, III and IV of Capital. Apparently many past and present analysts and editors of Marx’s works are either unaware of the problem or too busy misinterpreting him consciously or not. Be it as it may, when Book III of Capital was published Böhm-Bawerk was already prepared to raise his – self-fabricated – paean of victory. Book III contained drafts where Marx spoke of an average rate of profit imposed by the mobility of capital, one that would lead to the transformation of exchange values as formulated in Book I into « prices of production ». If that were the case, obviously Böhm-Bawerk would be right in claiming that Book III – not edited by Marx himself – does contradict Book I and therefore Marx’s labor law of value could not claim to be scientific.

The first published definitive refutation of this cooked-up ineptitude appeared in my Tous ensemble (1998). I have shown that the origin of the fake problem laid in the choices of manuscripts for Book III. These show a Marx that was still dealing with Smith’s and Ricardo’s concepts. Consequently, most refer to an investigation process that chronologically came earlier than the magisterial exposition laid down in Book I. Few others were work in progress in preparation for the other books of Capital. They were still exploratory. For instance, the tragically misread chapter on the supposed « tendency of the rate of profit to fall » a chapter immediately followed by another chapter on the counter-tendencies …

In these drafts, Marx was still using Smith’s concept of « simple labour » and he was still enmeshed in Ricardo’s differential and absolute rents. Much later, for instance with the M. Rubel’s peculiar edition for La Pléiade, some crucial letters from Marx to Engels dealing with the prices of production « problem » were published in French. Given that the Prussian, English and many other polices networks were actively opening all his mails, it would not be surprising that Böhm-Bawerk was in the known. These letters replaced the so-called problem of transformation of exchange values into prices of production in the framework of economic reproduction which is the specific object of the manuscripts that went into Book II.

These letters still represent a investigation stage entrapped into Smith’s and Ricardo’s thinking. But typically, as is often the case with Marx, they provide the analytic framework in which the problem needs to be resolved, namely within the constraints of Reproduction. I have shown how the problem is resolved once we replace Smith’s « simple labor » with Marx’s scientific concepts of « abstract labor » and « socially necessary labor ». This led me to formulate the Marxist Law of productivity which is at the core of the extraction of surplus-value in a Capitalist Mode of Production (CMP).

Two examples can be used to illustrate the problem and its scientific resolution. From his monumental investigation of economic reproduction – Sismondi ‘s annual revenue, Quesnay Tableau and many many more – Marx was able to formulate a scientific function of production – a microeconomic function of production, in mainstream parlance. It contained the necessary and sufficient number of sectors needed to apprehend it. The function of production: c + v + pv = p where c = constant capital plus v = variable capital or already reconstituted labor ready to be expounded in the immediate production process, plus pv = living labor producing surplus-value, equals p the product. Simple or Enlarged Reproduction – stationary and dynamic general equilibrium in mainstream parlance – can be reduced to a Sector 1 of Means of production (Mp) sending one back to constant capital c and a Sector II of Means of consumption (Cn) that sends one back to the consumption basket that enters into the reconstitution of labor power. As I have shown, one can subsume all sub-sectors into these two main sectors and even statistically recompose intersectoral filières.

Let us first consider the prices of production schema. We take C = (c + v) = 100 and, as Marx does, a rate of profit pv/(c + v) different in SI and SII.

SI c (80) + v (20) + pv ( 20) = Mp (120) rate of profit 20/100

SII c (60) + v (40) + pv (10) = Cn (110) rate of profit 10/100

Of course, through the mobility of capital an average rate of profit would eventually be imposed thus leading to the equalization of the rates of profit. Hence’ we would get:

SI c (80) + v (20) + pv ( 15) = Mp (115) rate of profit 15/100

SII c (60) + v (40) + pv (15) = Cn (115) rate of profit 15/100

Böhm-Bawerk rightly points out that in a Reproduction schema the second round would have to use (c +v ) in prices of production hence the illogical fallacy between exchange values and prices of production.

Note that this averaging of the rate of profit would be redundant because the mobility of capital and labor already insures its consequences at the level of the function of production. The concept of « abstract labor » means precisely that the internal division of labor within the enterprise prevails and, in this sense, one does not need to refer to Adam Smith’s primitive concept of « simple labor ». This is based on the idea that the pin factory would have deconstructed all crafts and trades to recompose them in generalised simple tasks. In a Capitalist Mode of Production – CMP – competition, which represents the rule of the socio-economic legalised game, plays again at the level of the market price but this process is over-determine by social demand which is scientifically formalised by the SR-ER Equations. Marx had already pointed it out in his Parisian manuscripts of 1844 adding that market oscillations average out and therefore the scientific explanation for exchange value laid elsewhere. The definitive demonstration is found in the pertinent chapter of my Synopsis of Marxist Political Economy, freely accessible in my old Jurassic site www.la-commune-paraclet.com

When one reworks Marx’s problems respecting the Marxist labor law of value exposed in Book I, as well as the important critiques contained into the chapter « The last hour of Senior » – an anticipated refutation of Marginalism –, and when one does that in the framework of Simple and Enlarged Reproduction where the coherence of the solution must be retained both in quantitative and qualitative terms, one reaches the Marxist theory of productivity which I alone was able to demonstrate.

This implies an organic coherence of the main ratios of the function of production, namely the organic composition of capital v/C where C = (c + v), the rate of exploitation pv/v and the rate of profit pv/(c + v). In Marx’s formulations as they appear in the letters send to Engels these ratios are not respected. However, and most importantly, Marx had devised a coherence checking method by inserting the problem to be resolved within the tight constraints of Simple Reproduction. The reader is sent back to my Tous ensemble for a full exposé. The English reader will find a pertinent summary in my Keynesianism, Marxism, Economic Stability and Growth (2005) freely accessible in my old Jurassic site www.la-commune-paraclet.com .

In short, the main ratios of the functions of production cannot be given haphazardly because the organic composition of capital (v/C) and the rate of exploitation (pv/v) evolve in a proportionally inverse fashion according to the Marxist productivity law. Looked at form the angle of Simple Reproduction, Productivity is the ability to produce more of a specific product, or of one with a great degree of elasticity, during the same amount of time with the same investment (c + v) and the same v expressed in use value terms – but not the same number of physical workers – hence with an exchange value per unit of product proportionally lower. We can assume full-employment at this stage so that exchange values and market prices remain the same.

Marx’s Equations of SR as summarized by Bukharin are :

c2 = v1 + pv1

M2 = (v1 + pv1) + (v2 + pv2)

M1 = c1 + c2

An example being worth one thousand words we would get the following – the example is copied and pasted from my Tous ensemble:

« In each sector productivity implies a proportionally inverse relationship between v/C (where C = (c +v) and pv/v. Assuming an initial Simple Reproduction system in which SI and SII share the same v/C and the same pv/v, we would get in initial system A :

c1:80€ v1:20€ pv1:20F = M1:120€

80Mp/80h 20Mp/20h 20Mp/20h = 120Mp/120h

c2:40€ v2:10€ pv2:10€ = M2:60€

40Cn/40h 10Cn/10h 10Cn/10h = 60Cn/60h

Here a Cn is worth a Mp and the productive conditions are identical thus labor is naturally homogenous labor according to the terminology used by Arghiri Emmanuel – what Marx called « abstract labor » – and thus immediately commensurable. Let us show that this remains the case when productivity defers in one sector provided that the rules governing productivity are respected.

Let us assume the SR system A’ such as productivity would rise ¼ in SI. We would have:

c1:84€ v1:16€ pv1:20€ = M1:120€

105Mp/84h 20Mp/16h 25Mp/20h = 150Mp/120h

c2:36€ v2:9€ pv2:9€ = M2:54€

36cn/36h 9cn/9h 9Cn/9h = 54cn/54h (45Mp)

Here a Mp = 0,8€ ; and a Cn = 1€ »

Coherently reinserting a scientific theory of productivity in the SR system disposes of the fallacious « transformation problem » and provides a system that is fully elucidated in values, prices, hours and products quantity terms something no other theory, less of among them bourgeois and Marginalist theories, could ever dream of. Another way of saying it is to note that all bourgeois theories, Marginalism included, are incapable of reconciling micro and macroeconomics. I have shown (http://rivincitasociale.altervista.org/the-pseudo-economic-science-of-the-bourgeoisie-here-is-why-we-should-quickly-change-economic-paradigm/ ) that this ex ante/post hoc problem falsely imputed to Marx by the pitre Böhm-Bawerk, in reality applies squarely to the Supply and Demand curves. To draw the Demand curve one needs to give a table of possible supplies in prices, and inversely to draw the Supply curve one needs to provide the Demand table in price terms, then you cross both curves and Voilà! You get the miraculous « market price » and if you persevere you are on track to earn a Nobel Prize – Hi-Ha! – at least if you know how to tow the line.

This is only the most fundamental falsification of Marx’s scientific work. A brief history of the main falsifications is given in my Methodological introduction freely accessible in the Livres-Books section of my old Jurassic site www.la-commune-paralcet.com.

This scientific clarification allow us now to turn to the analysis of two more falsifications that need to be debunked in order to grasp Duménil’s and Lévy’s useless « circuit of capital » little academic game. Their starting point is the theory of capital circuits proposed by Duncan Foley (note the plural here whereas the two authors use the singular … ) Foley, in turn, started form his understanding of Rosa Luxemburg’s critiques of Book II of Capital. We must therefore start with a brief exposition of Rosa Luxemburg’s critiques.

2 ) Origin of another fallacious Marxologists’ problem

2 a ) Rosa Luxemburg and Book II of Capital

The pertinent works of Rosa Luxemburg, both the The accumulation of capital and The accumulation of capital: an anti-critique are readily available here : https://www.marxists.org/archive/luxemburg/index.htm. A shorter reformulation of the main critique is provided in Tony Cliff, « Rosa Luxemburg The Accumulation of Capital » in https://www.marxists.org/archive/cliff/works/1969/rosalux/8-acc-cap.htm. The rest of the article is well-intentioned but erroneous. This is because like most academic Cliff does not know my scientific contributions or, like others, he chose to ignore them. As we all know academics are paid and most do tow the dominant narratives lines especially when dealing with Marxism and social sciences.

As for Rosa Luxemburg she had the dubious honour to live in Vienna where, together with her comrades, she contributed to instil rigorous scientific analysis into the study and furthering of Marxism. Like all great Marxists she admired Marx but still read him with a critical mind as Marx had demanded. Janek Wasserman spoke of Red Vienna and Black Vienna. Despite long-lasting rivalries, German and Austrian politics were closely netted if only because of the substitution of the republican regime in both countries after the WWI. Unfortunately his analysis of Red Vienna starts after 1919 hence after the savage murders of Communist revolutionaries by the German Weimar Republic, most notably Karl Liebknecht and Rosa Luxemburg. In so doing he missed the main point about both Red and Black Vienna: with Austro-Marxism, the dominant Imperial and later « Republican » circles including Böhm-Bawerk, Menger and the rest of the so-called Austrian School or Marginalists, the dominant classes were able to control both the dominant ideology and the dominant opposition. Jewish over-representation as a group mediating within the various nationalities of the Austrian Empire goes a long way to explain this. Unfortunately, the intra-dominant classes cleavages took the form of the opposition between the Austrian version of philo-Semite Nietzscheism – including Freud – and the Catholic Wagnerian interpretation. The latter was still aggravated by Imperialist contradictions between the great European Powers and, for the sake of the argument that concerns us here, by the contradictions between Wagner and Chamberlain. This exclusivist cleavage will take a deadly form with the affirmation of Black Vienna that is to say of Fascism and Nazism.

The falsification of economics by the Austrian School had started before Rosa Luxemburg’s death but really flourished soon after her savage murder. It mainly rests on two ideological lines of thought. First the critique of Marx’s work as unscientific thanks to the academic accreditation of Böhm-Bawerk’s original falsification,. This was immediately followed by the subjective falsification that lies at the heart of the concepts of « utility » and « marginal utility ». The opposition between the more historically inclined German School, led mostly by Gustav Schmoller, pointed out that the Austrian Marginalist efforts were bound to fail simply because no scientific method could rest on subjective theories. The Austrian School, through their ready access to State circles and therefore to the power to control syllabuses together with the selection process imposed on academics and students, fought back with the pretention that the capitalist mentality – the « acquisitive mind » already criticised at birth by Hobbes and many others – was diachronically and synchronically universal! It followed for instance that there is no difference between feudal, potlatch and capitalist societies. Falsified ethnologist and anthropological theories were thus allowed to flourish as well as falsified psychoanalytical theories. The worst of them all being Freud’s philo-Semite Nietzschean reversed plagiarism of Vico’s work on human becoming mainly carried out in his Scienza nuova as I have demonstrated in the second part of my Pour Marx, contre le nihilisme (2002) ( See a partial translation in English in the Livres-Books section of my old Jurassic site www.la-commune-paraclet.com )

Coming back to Rosa Luxemburg, she was a true Marxist and a true International Communist. Although she was not able to re-establish the scientific labor law of value as we did – see above – she clearly saw that Book II contained contradictions. She soon felt obliged to criticise the Gotha of Austro-Marxists from Kautsky to Bernstein to Otto Bauer and to Hilferding, even before Lenin accused them of being « renegades » for their support to the war waged to share the World among imperialist powers. Traveling in the footsteps of Ferdinand Lassalle, the Austro-Marxists tried their best to deprive the working class of their own voice just as Freud did for Ida, alias Dora, the sister of Otto Bauer. (https://en.wikipedia.org/wiki/Dora_(case_study) )

She understood that they were eviscerating Marxism of its scientific spirit and methodology and she did not hesitate to say it out loud, refuting their criticism rather brilliantly. And that, more than anything else, did probably cost her her own life. She could not prove that the drafts retained in the published Books II, III and IV were, as I think, the result of a planned forgery carried out through the selection of the drafts chosen for publication, but she revealed the contradictions emerging from them. One can deplore that she attributed these contradictions to Marx without differentiating clearly between the investigation and the exposition stages; however she did not deduce from this the necessity to abandon the labor law of value but instead to contribute to the furthering of scientific Marxism. Indeed, from the contradictions she pointed out in Book II as published by Kautsky et al., she derived a brilliant and fittingly descriptive theory of Imperialism that kept Marxism alive despite the fact that the falsified transformation problem invented by Böhm-Bawerk remained to be clearly refuted.

The theory of circuits of capital proposed by Duncan Foley serves as a starting point for Duménil’s and Lévy’s inquiry. It initiates with a presumed problem of realization which Rosa Luxemburg saw in the drafts that were selected for the publication of Book II of Capital. The problem disappears once productivity is coherently integrated in the SR-ER Equations. But we must understand the crux of Rosa Luxemburg’s reasoning. As Marx explains exchange value has to be realized to exist as a merchant or capitalist reality. In a capitalist society this realization takes the form of money, the privileged form of the accumulation of capital within the CMP. But money is only a general equivalent though a very convenient one. Realization could also be effectuated through a particular commodity used as a means of exchange, that is a particular equivalent. In the end, realization needs to rest on the exchange value of the labor force, the universal equivalent. But forms and mediations are important.

Rosa Luxemburg knows the difference between the simple exchange between commodity A and commodity B where in money terms A = B. She also knows that the circulation of capital in its money form (M), its commodity form (C) and its production form (P) is based on the extraction of surplus-value so that the circuit M – C … P … C’- M’ produces an accumulation of exchange value or capital (M’>M). She also knows that the analysis of these two complementary forms of circulation needed to arrive at the realization stage are summarised in the Equations of Simple and Enlarged Reproduction proposed in Book II. Unfortunately, the drafts retained in Book II are not finished drafts. Bukharin was able to formalise in three lines the Equations of Simple Reproduction, although this brilliant exposition appeared as a special case restricted to SI and SII sharing the same v/C and pv/v until I solved the so-called transformation problem. Indeed, it is perfectly coherent when all ratios (v/C and pv/v ) are kept identical in Sector I and Sector II. As soon as the ratios change the most incredible confusion ensues. I have demonstrated that this is the case only when the Marxist law of productivity is not coherently integrated within the SR-ER Equations.

That was not the sole problem Rosa Luxemburg faced. The few draft pages dealing with Enlarged Reproduction in Book II are fragmented at best and use arbitrarily chosen examples. The greatness of Rosa Luxemburg consists in reading Marx as an honest Marxist and in pointing out the contradictions in order to propose a way out, namely her theory of the relationships of capitalism with other modes of production which led to her theory of imperialism.

Rosa Luxemburg proposes a theory of money in her Accumulation of capital. But it is very sketchy – and, in reality, wrong. It boils down to saying that one needs to introduce a sufficient amount of money to ensure the realization of the whole production without specifying was this would be. She is tempted to follow Tugan-Baranovsky in introducing a third sector of money but does not develop this to endorse the (Marginalist) absurd position which consists in equating the amount of production with the amount of money necessary for circulation and realization. This would have abolished the role of what Marx calls « rotations » of money particularly those of the salary masses. Her reading of Marx’s schematic formulations of Simple and Enlarged Reproduction pushes her back to her main problem which she sums up in one sentence: « What has to be explained is the great social transaction of exchange, caused by real economic needs. » (in https://www.marxists.org/archive/luxemburg/1913/accumulation-capital/ch09.htm ). In the end when each Mp and Cn can be exchanged as is the case in the SR Equations no realization problem would arise independently to the recourse of the money form. But this was not the case with Enlarged Reproduction as portrayed by the drafts used for Book II. As she understood it there was an amount of production that could not be realised within the CMP with the available amount of money, hence imperialism, necessarily violent, was understood as the necessary opening of new markets where surplus production could be sold and realized.

Tony Cliff, who is not helpful in the rest of his article because he does not understand productivity, sums up this critique rather neatly. See the full quote below.

We can synthesize further presenting the SR Schema followed by the ER Schema at t0 and at t1.

SR Schema:

S I 4000c + 1000v + 1000s = 6000 We have c/v= 4; v/C= 0,2; pv/v = 1

S II 2000c + 500v + 500s = 3000 We have c/v= 4; v/C= 0,2; pv/v = 1

Here Marx SR Equations apply. They mean that the total production of Means of production (Mp) must cover the total Mp needed in c1 and c2. Similarly the total production of Means of consumption (Cn) must cover the consumption needs of the labor power and of the capitalist – assuming here that the surplus-value is totally consumed by the capitalists. Finally c2 must be equal to v1 plus pv1. This last condition is the key of the SR equilibrium although it is less obvious.

c2 = v1 + pv1 was derived by Marx from his critical analysis of the stocks and flows of reproduction analysed by various classical authors, mainly by Sismondi – annual revenue – and in Quesnay’s Tableau. To understand this it is important to keep in mind that SI produces Mp so that pv1 is first available to the SI capitalist as Mp or as a fraction of the total product of his specific sectoral production. This transforms into Cn only through the series of exchanges or circuits of capital between SI and SII which are summarised by the SR Equations. In the framework of the CMP characterised by the mobility of capital from industries to industries and sector to sector. This is all that is needed for so-called competition to enforce its rule. But behind this competition mediated by exchange value, or prices, are the technical conditions of production and reproduction which over-determine the reproduction process through the two main social demands, that for Mp and that for Cn.

Here is the ER Schema at t0 that pretends to provide the starting conditions.:

S I 4000c + 1000v + 1000s = 6000 We have c/v= 4; v/C= 0,2; pv/v = 1

S II 1500c + 750v + 750s = 3000 We have c/v= 2; v/C= 0,33; pv/v = 1

Notice here that the necessary condition for c2 = v1 + pv1 is broken. It is assumed that ½ of pv1 is consumed by the capitalist and the other half is reinvested proportionally in c1 and v1. Of course, given the starting assumption concerning c2, it does not help to extend the ER Schema from t0 to t1 to t2 and tn. This will only reproduce and aggravate this initial error.

We expand SI calling pv1c the part that is reinvested in c1, pv1v the part reinvested in v1 and pv1a the part that is consumed:

SI = 4000 + 1000 + [(400 + 100) + 500 ]= 6000

From this would follow:

c1 + pv1c = 4000 + 400 = 4400

c2 + pv2c = v1 + pv1a + pv1v

= 1000 + 500 + 100 = 1600

Here would be the first round or t1:

S I 4400c + 1100v + 1100s = 6600

S II 1600c + 800v + 800s = 3200

Rosa Luxemburg rigorously follows the investigation drafts published by Kautsky and others in Book II and analyses the results of ER after a few rounds. (For the full presentation see the note below). She rightly concludes that there would be an increased disequilibrium between both Sectors. She attributes this to the invisible hand propelled by the capitalist profit motive and arrives at her theory of the relationships between various modes of production with the CMP, hence at her theory of Imperialism.

In reality the SR Equations must underline the ER Equations taking into account the rate of accumulation or re-investment. Both social demands for Mp and Cn must be covered: the profit motive or capital mobility would ensure this. Hence, we should have:

ER Schema at t0:

SI = 4000 + 1000 + [(400 + 100) + 500 ]= 6000

SII = 2000 + 500 + 500 (this is given by pv/v = 1 and we do not need to develop it here)

ER at t1 where SI reinvests ½ of pv1. We get:

SI = 4400 + 1100

pv1/v1 = 1 hence we deduce that M1 or total production of Mp = 6600 Mp

As we said above c2 must be equal to (v1 + pv1) because this is enforced through the series of exchanges imposed by the mobility of capital and summarised in the SR Equations in a framework in which the conditions of production, namely the organic composition of capital and the rate of extraction of surplus-value are said to remain identical.

We have:

SI = 4400 + 1100

SII = 2000 + 500

This in turn means that in order to maintain an equilibrium – the SR Equations – both sectors must reinvest at the same pace.

Of course, the invisible hand, contrary to socio-economic planning, does lead to this result only through recurrent crisis characterised by expansion in some industries that are accompanied by contractions in others. We already said elsewhere that there always is a capitalist equilibrium, but it is always an ex post equilibrium which is never a socially optimum equilibrium. The Capitalist Mode of Production is inherently wasteful and the purges that unfold during the inevitable recurrent crises are but one dramatic illustration. The most damning and enormous waste induced by the CMP is a systemic and silent one, it is based on the fact that only solvent demand is met by a supply. The process involves a massive disregard for the environment as explained in my theory of Ecomarxism exposed in the Introduction and Appendix of my Keynesianism, Marxism, Economic Stability and Growth. (2005) This explains why, within the CMP, most essential social needs are not satisfied and must therefore be abstracted from the reach of the « animal spirits » of capitalism and be entrusted to national public companies.

Rosa Luxemburg is very sarcastic when she rules out Otto Bauer’s attempt to confute her argument about disequilibrium. Pointing to the arbitrary set of equations provided by Bauer she concludes:

« The capitalists in Bauer’s first department ‘want’ to reinvest 12,500 of their surplus-value. Why so much? Because Bauer needs this figure for his calculations to work out.

« Bauer comes along and casually hurls Marx’s entire analysis to the ground by ‘transferring’ the commodities backwards and forwards from one department to the other without exchange, and flying about in the rigorous model like a wild goose in the sky, to use a Polish proverb. » in https://www.marxists.org/archive/luxemburg/1915/anti-critique/ch03.htm »

She was particularly sensible to the washing away of class struggle at the domestic level and of global imperialist contradictions that characterised all the so-called Austro-Marxists which Lenin called « renegades » when the outbreak of the First WW unmasked them. In the end, she noted that Bauer could not reconcile his diagrams without exogenously introducing an adjustment variable, that is to say demography. But she was right only by default. She was even more caustic when she dealt with Tugan-Baranovsky’s remark pointing to the necessary intersectoral proportions needed to maintain a systemic equilibrium. She denounces it as a useless tautology. However, Tugan-Baranovsky had something else in mind, namely the resolution of the so-called « transformation problem » or, to put it simply, the incoherence of the SR Equations when a productivity increase – or a change in the initial v/C and pv/v – happens in only one sector.

This is the crux of the question. Referring back to the ER (false) Equations dealt with above – with c2 + pv2c = v1 + pv1a + pv1v – we notice that, once we correctly take the organic composition of capital as v/C instead of c/v, not only the equations sets appear arbitrary, as Rosa Luxemburg rightly pointed out, but more importantly they are incoherent. And given that the Marxist law of productivity imposes a determinate relationship between the organic composition of capital v/C and the rate of extraction of surplus-value or rate of exploitation pv/v, the Schemas are utterly wrong.

The capitalist socio-economic disequilibria do exist but they must be scientifically analysed respecting the necessary SR Equations which must underline the ER dynamic. For instance, productivity increase « frees » labor power leading to unemployment, thus raising the underlying problem of overproduction and under-consumption, hence the problem raised by imperialist mediations. Free labor cannot always be absorbed into new or intermediary sectors – which are now increasingly capital intensive – at least not without recurrent general Reduction of the Work Week. The Reserve army of the proletariat is also at the heart of the scientific understanding of money and of inflation/deflation.

Marx famously said that analysis was the microscope of thought. Aside from the Equations of Reproduction in other drafts he proposed a method to clarify the formulation of the problem of comparing functions of production, namely using C = (c+v) = 100. The main ratios are v/C, the organic composition of capital; pv/v the rate of exploitation and v/(c+v) the rate of profit.

If we reformulate the above we would get for the SR starting point:

SI = c1 (80) + v1(20) + pv1 (20) = Mp (120) where v/C = 0,2 and pv/v =1 and v/(c+v) = 0,2

S II = c2 (40) + v2 (10) + pv2 (10) = Cn (60) where v/C = 0,2 and pv/v = 1 and v/(c+v) =0,2

If we reformulate the above we would get the following for the ER starting point:

SI = c1 (80) + v1(20) + pv1 (20) = Mp (120) where v/C = 0,2 and pv/v =1 and v/(c+v) = 0,2

S II = c2 (30) + v2 (15) + pv2 (15) = Cn (60) where v/C = 0,33 and pv/v = 1 and v/(c+v) = 0,33

In the second round (just considering SI for short where ½ of the pv1 is reinvested ) we would get:

SI = c1 (88) + v1 (22) and so on for SII and for successive rounds as shown by Rosa Luxemburg.

At a glance we see what is wrong. It is not only, as pointed out by Rosa Luxemburg, that the examples are arbitrary but that they are not coherent. The discrepancy in the main ratios from SI to SII will become the nest of crabs know as the (forged ) transformation problem necessitating an average rate of profit to get at (forged ) prices of production. Which was the real problem to solve …

This disequilibrium is the basis of what she sees as a realization problem and the driving force of imperialism.

Let us take another look at our own formulation.

Starting Schema A:

c1:80€ v1:20€ pv1:20F = M1:120€

80Mp/80h 20Mp/20h 20Mp/20h = 120Mp/120h

c2:40€ v2:10€ pv2:10€ = M2:60€

40Cn/40h 10Cn/10h 10Cn/10h = 60Cn/60h

Let us assume a SR system A’ such as productivity would rise ¼ in SI. We would have:

c1:84€ v1:16€ pv1:20€ = M1:120€

105Mp/84h 20Mp/16h 25Mp/20h = 150Mp/120h

c2:36€ v2:9€ pv2:9€ = M2:54€

36cn/36h 9cn/9h 9Cn/9h = 54cn/54h (45Mp)

Here a Mp = 0,8€ ; and a Cn = 1€ »

Since the main ratios v/C and pv/v in both the A and A’ Schemas remain coherent, the initial Schema A can no longer be considered as special case. In fact, this coherence explains why the SR Schema was used so powerfully by the initial Bolshevik – i.e. Stalin’s – planning. Stalin underlined the need to always introduce the greatest productivity possible. And to adjust things along the way to deal with the discrepancies introduced. The process was considerably eased by two elements: a ) wage equality, aside from the so-called material emoluments; and b ) the accounting in terms of the so-called Material Net Product, that is to say in use value terms.

On that basis, as demonstrated in my Synopsis of Marxist Political Economy – freely accessible in the Livres-Book section of my old Jurassic site www.la-commune-paraclet.com –, it is easy to apprehend Enlarged Reproduction. To keep the dynamic system in a harmonious equilibrium one needs to plan a symmetrically proportional reinvestment rate in both SI and SII. This is the object of public credit which is the anticipation in monetary form of growth. Failing that, for instance with private credit, speculative or not, the system induces expansions in one sector or industries and contractions in others, namely cyclical crisis.

As Marx specified many times that the coherence problem must be dealt with first at the SR level, where parametric constraints are tight and straightforward.

Referring to my own examples above, we notice that when we respect the needed coherence – the relationships between the main ratios – if productivity goes up in SI only, SII continuing to produce with the same ratios, SII is forced to adjust. In Tous ensemble I called this process the SR Effect. That Effect can also be traced in the adjustment of labor power « v » since, in exchange value terms, total active labor power amounts to 25 Euros (translating into 25 Cn) compared to 30 euros (for 30 Cn) in the starting schema. Giving the numbers in hours terms shows that, as expected, the rising of productivity « frees » a determinate amount of hours of labor. This is the origin and illustration of the process that creates the Reserve Army of the proletariat, corresponding to the 5 hours missing (30 hrs to start with and 25 hrs when the productivity increase has been introduced in SI.)

When the coherence between the main ratios are respected in SI and SII, the real problem is no longer the disequilibrium in real terms between SI and SII because it has been organically resolved by the coherence imposed by the ratios. This sends us back to the organic equalizing of conditions enforced by the mobility of capital from one sector to another and from branches to branches. The real discrepancy lies in the creation of the Reserve Army which sends us back to the main contradictions which characterise all modes of production and particularly the CMP, namely the contradiction between the relations of production and the evolution of the productive forces which take the forms of cyclical and structural crises.

Moreover, given the organic coherence imposed by the law of productivity – or coherence imposed by the main ratios, which is the same thing – we can now see clear in the circulation and realization processes. The secret of any mode of production is the advance made by the laborer – any kind, peasant, worker, salesperson etc – to the production process in the form of living labor– see Tous ensemble. The « worker » comes to the production process as past labor or reconstituted labor – worth the consumption basket that keeps her/him alive and able to work, i.e., « socially necessary labor ». As living labor it is able to produce a surplus – surplus-value – that is then pocketed by the Owner of the Means of production. That advance in real – use value – terms or in monetary terms – exchange value of the labor power or salary mass – is all it takes to effectuate all the exchanges necessary for SR and ER. The worker advances his/her labor power but his salary is always paid at the end of the labor process.

However one can ask how the system deals with the « maintenance » of the Reserve army.

(Note: The rather « mechanical » term « maintenance » was used in the original Tennessee Valley Authority’s reports that were the starting point of Kuznets’s statistical work so vital to the management of the modern capitalist economy with fallacious concepts such as GDP etc. This Marginalist national accounting rests on value added and does not account for the essential contribution to real national and social growth contributed by public services such as Health-Care etc. It is utterly absurd because the expenses for public services are counted in the public debt but not in the GDP and this in a speculative monetarist context in which a absurd « fiscal consolidation path » is ferociously imposed on these terms. Public services are the main contributors to macroeconomic competitiveness which, in turn, is the main support for microeconomic productivity. For instance, universally accessible public health-care necessary for the maintenance of the working force costs around 9 % of GDP, but it costs more than double that number for the private American system which leaves close to 40 million citizens without coverage! Idem for pension regimes: not so long ago GM and the US auto-industry had to be bailed out at a gigantic public cost because, due to the attrition of their labor force, they were no longer able to honor its in-house pension scheme. A fraction of this public money could have erased the presumed problem of the mid and long term financing of the US Social Security deficit … Nevertheless, the Tennessee Valley Authority managed to show that after 2 years of unemployment the labor force was victim of physiological lacunae and was bound to lose its professional efficiency and thus became incapable to work without retraining. From these irrefutable facts followed the post-WW II concept of Social Security, including UI and professional retraining, as collectively financed fundamental social rights instead of ad hoc, means-tested and often confessionnally and morally stained assistance programs.)

The monetary management of the Reserve Army of the proletariat that should distinguish between a real salary mass and a social salary mass, is the source for the understanding of the quantitative theory of money – to be distinguished from credit, of which more later.

2 ) Origin of another fallacious Marxologists’ problem

2 b ) Circuits vs. Simple and Enlarged Reproduction

We saw above that Rosa Luxemburg had realised that, in the end, the so-called realization problem had to be dealt with in the Schemas of Simple and Enlarged Reproduction. This explains why her analysis of circuits of capital and of money is rudimentary. The solution is quite simple: The fully understood Marxist circuits of capital are summed up in the Equations of Simple Reproduction, namely a two-sector model in which the main ratios (v/C and pv/v and v/(c+v) ) are identical in both sectors:

SI = c1 (80) + v1 (20) + pv1 (20) = M1 (120)

SII = c2 (40) + v2 (10) + pv2 (10) = M2 (60)

Here, with implied full-employment, the real salary mass (v1 + v2) which is necessary and sufficient to allow all economic exchanges through rotations is identical to its monetary expression or social salary mass.

To repeat the SR Equations are:

c2 = v1 + pv1

M2 = v1 + pv1 + v2 + pv2

M1 = c1 + c2

I have shown that when the Marxist law of Productivity, which I have demonstrated following Marx, is coherently reinserted in the SR or ER Schemas, the fundamental Equations do not change. With Enlarged Reproduction one only needs to decompose pv1 into two parts, pv1a that is consumed and pv1b that is reinvested proportionally in c1 and v1. Idem for pv2. If the re-investment is symmetrically proportional in both SI and SII, the ER System – or dynamic equilibrium – is harmonious in socio-economical terms. Otherwise, the over-expansion in one sector is accompanied by contractions in the other, hence unemployment and crisis.

For instance, assuming a productivity increase of ¼ in SI we would get:

SI = c1 (84) + v1 (16) + pv1 (20) = M1 (120 euros/150 Mp)

SII = c2 (36) + v2 (9) + pv2 (9) = M2 (54 euros/54 Cn)

In this situation, the real salary mass ( v1 + v2) goes from 30 Euros to 25 Euros. Therefore 5 « workers » or units of labor power are unemployed. During the early days of liberal capitalism « freed labor » survived either going back to the countryside or resorting to the informal economy or, more likely, it relied on the enlarged family which, up until the post-WW II, operated as a safety net. After that the Capitalist State reorganised its management of social relationships. Suffices here to say that the active force is called upon to finance the inactive force. This is mainly done through the Central Bank emission of the portion of the money necessary to sustain the unemployed and inactive. It can take the form of institutionalised saving contributions levied on the gross paycheck.

This solidarity is effectuated in a moralising and means-tested logic which implies that the 5 unemployed in our example would receive much less that the lower paid active worker, say ½. The Central Bank provides these extra 2.5 Euros which added to the real salary mass brings us to the social salary mass. The capitalist redistribution of the share of wealth allocated to the active and inactive working classes is simply effectuated through this invisible monetary exchange mechanism. Which in turn is the cause of what I called the structural rate of inflation – there are other kinds, for instance imported inflation etc.

One would need to multiply each parameter – c, v, pv, M – by that structural rate of inflation to get what I called in Tous ensemble , not the « prices of production » – it has nothing to do with this forgery – but « the value-price equilibrium ». This I called a civilisational equilibrium because, while it is true that a return to full-employment is the only measure that would equate the real and social salary masses, it is equally true that a complex dynamic system needs some mediations to function smoothly. This particular monetary mediation is not really harmful if it is contained – i.e., insuring minimum unemployment – and if it is scientifically understood, thus allowing to needed corrections. It would also facilitate the formulation of correct indexes that would not be as lunatic as those imagined by Irving Fisher and now universally accepted. For a discussion of the essential difference between inflation or purchasing power and standard of living see : http://rivincitasociale.altervista.org/purchasing-power-standard-of-life-socially-necessary-working-time-and-global-net-income-of-the-households-2-31-dec-2018/ )

Leaving these considerations aside we can see that the discussion can be conducted within the most essential SR Schema with identical sectoral ratios transforming it into a ER Schema in which we only deal with the different allocation of surplus-value. It is clear that if the reallocation happens in SI only, SII will have to adjust. If – as could be possible with central or socialist planning- both sectors reinvest in a symmetrical proportional fashion, then the dynamic growth becomes harmonious again. And this dispels the logical contradiction of ER that Rosa Luxemburg formulated, although it should lead to the reworking of her always illuminating theories specially those which deal with crisis and with the relationship of coexistence and dominance of various modes of reproduction with the CMP, namely here theories of imperialism. Against Otto Bauer’s laughable Reproduction Tables, she is right to point out that the « invisible hand of the market » driven by the profit motive cannot reach such a socio-economically harmonious equilibrium. As we all know, capitalist economic equilibrium is always ex post including in times of crisis; more often than not is a cemetery equilibrium.

Let us now turn to the circuits of capital. We have already underlined the fact that the culmination of the circuits are the series of exchanges needed by economic reproduction such as formalised by the Equations of SR-ER. However, the discussion of SR in Book II is complete. Bukharin was able to summarise the SR Equations brilliantly as we indicated before. However, this is not the case for ER: the drafts written by Marx are short and incomplete. As Rosa Luxemburg indicated they were based on « arbitrary » figures and, I might add, they did not include the necessary proportionally inverse relationship between v/C and pv/v which is necessary to maintain the systemic coherence – and to avoid the fallacy of the procedure used to arrive at the prices of production. In other words, these drafts were still at the stage of investigation. But they still testified to Marx’s incomparable rigor.

However, the presentation of the SR-ER Schemas in Book II is preceded by long developments on circuits of capital before their confluence into the SR-ER Equations. Marx distinguishes between two types of circuits mediated by money. The first is a simple exchange of commodity A for commodity B. The commensurability of both takes a monetary form but this is only a social convention. One remembers that Capital Book I starts with Aristotle’s unresolved economic – or rather chrematistics – question, namely how can we exchange a tripod for a bed? Book I presents a brilliant scientific exposition on the fundamental distinction between particular, general and universal equivalents. Any commodity, be it potatoes or Virginia tobacco, can act as a numerary or monetary unit of account, in its quality of a particular equivalent used to mediate economic exchange. But this would be rather cumbersome. Gold, paper currency etc are easier to handle and are therefore used as a general equivalent. But they too are commodities which must be measured against a universal standard, namely against the only economic measuring stick that exists, the exchange value of labor power. The exchange of money (M) for a commodity C is an equality and it would be the same economic equality than that established by the direct exchange A = B . We remain here at the level of the circulation of commodities.

Different economic circuits specifically linked to the circulation of capital were investigated. We might sum them up in one main chain – at least, if we consider only money as distinct from credit. The capitalist mode of production is based on the accumulation of capital driven by a specific form of extraction of surplus-value, namely productivity which is a structurally defined intensity of work. Pre-capitalist modes of production were based on the extraction of absolute surplus-value based on the duration of work. Socialism is based on what I called « social surplus-value » because it will further develop productivity but ensure that the fruits of the labor process is shared collectively and allocated in an egalitarian fashion. Conjunctural intensity is proper to all modes of production but is occasional.

The Welfare or Social State was invented to counter the revolutionary threat posed by the communist Revolutions; it experimented for a while with modest versions of the « social surplus-value » mainly through the extension of the individual capitalist salary with the differed salary – paycheck contributions levied to finance pensions schemes and UI etc – as well as with the tax area that would presumably come back to households in the form of universal access to public infrastructures. I called this the « global net revenue » of the households not to be confused with the Marginalist « disposable income » which abstracts from institutional social safety nets and access to public infrastructures. The neoliberal and monetarist philo-Semite Nietzschean State is now reversing to the sole individual salary causing a domestic and global race to the bottom. It embodies an unprecedented social and ethico-political regression which is now enshrined in domestic laws as well as in the current anti-dumping definition implemented by the WTO. This definition excludes from the calculation of the anti-dumping any reference to labor’s rights – even in their minimal ILO form – and to environmental criteria …

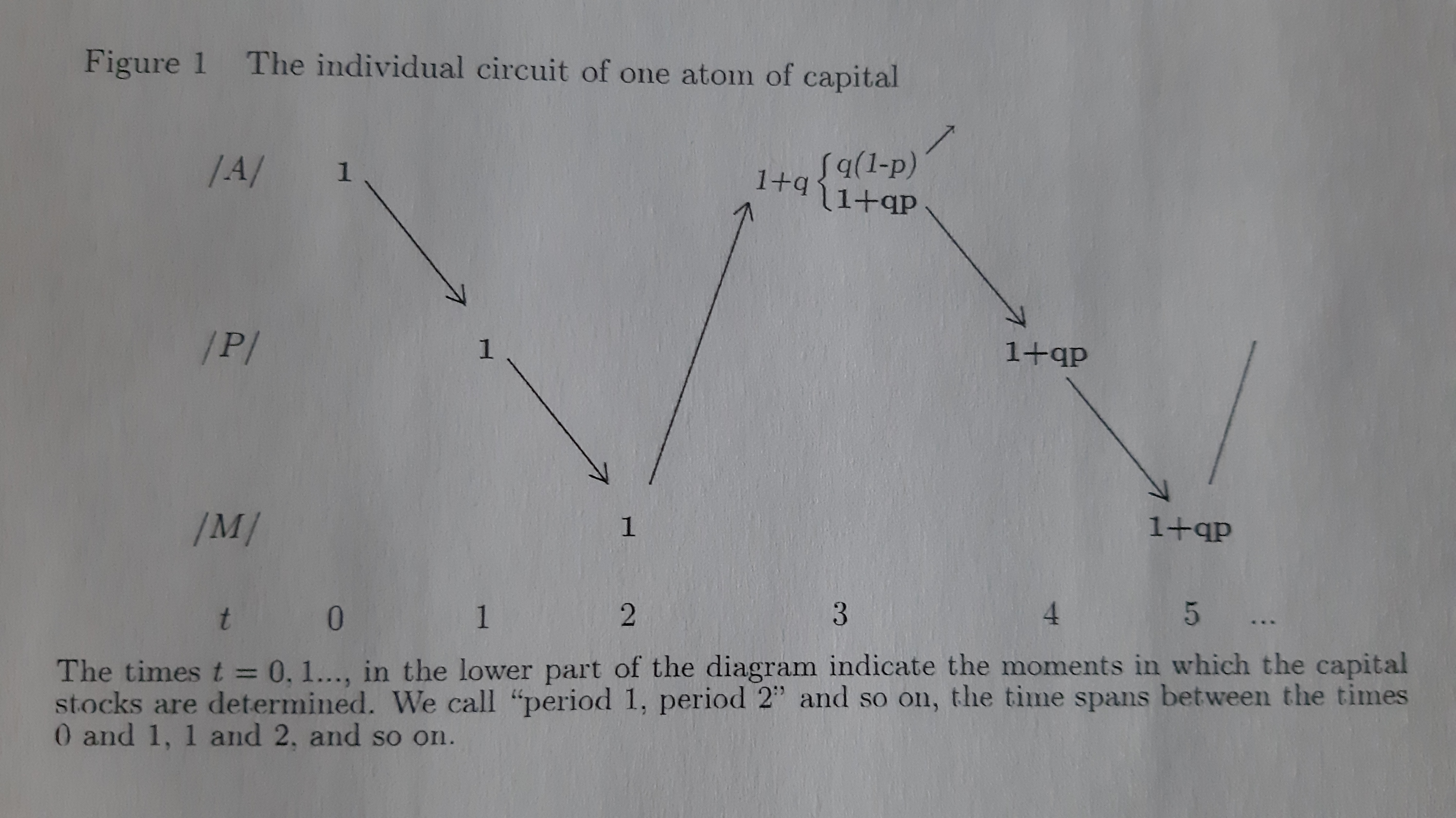

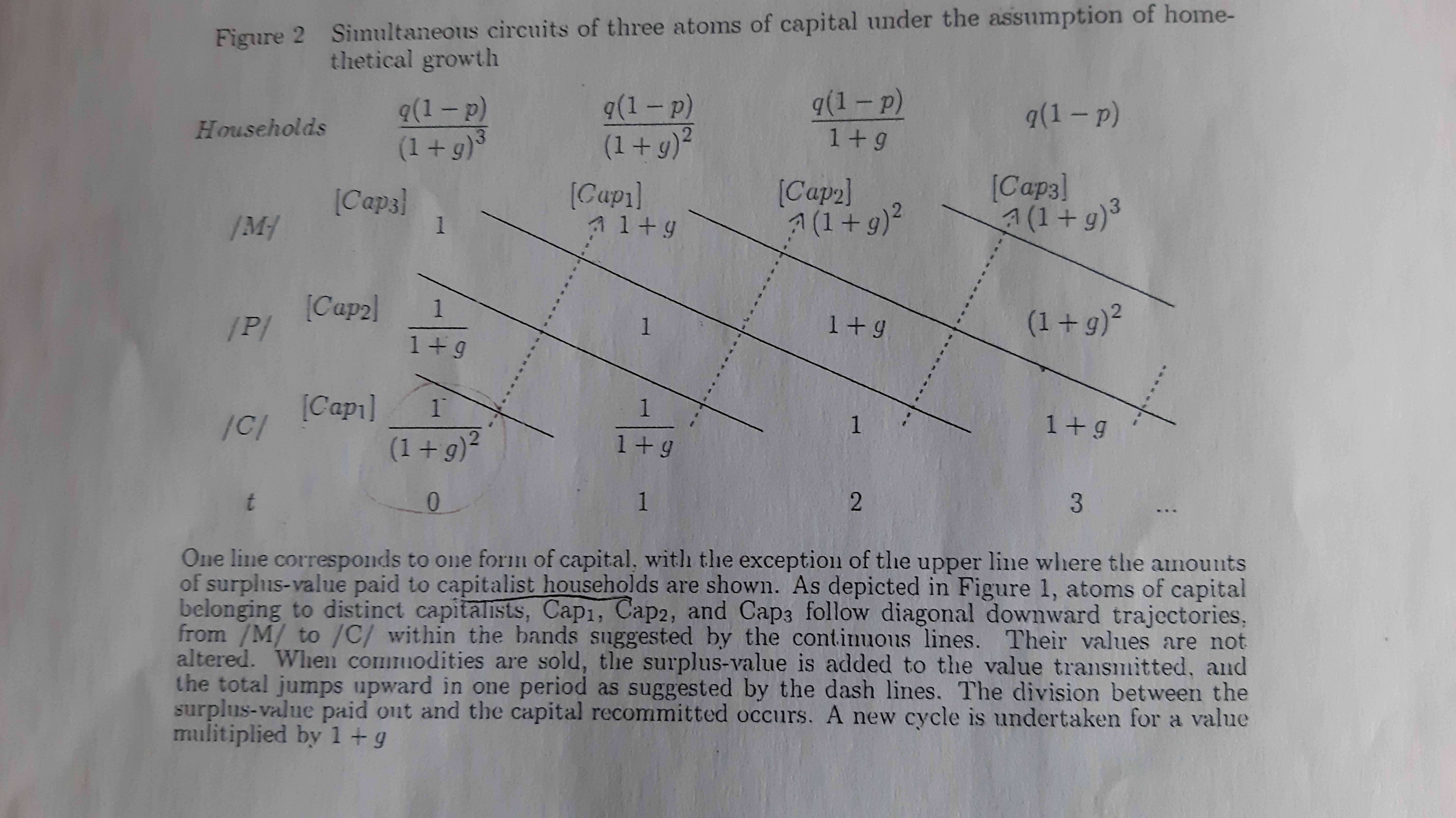

Noting money as (M), commodity as (C) , the process of production where surplus-value is extracted as (P) and the new and more valuable commodity that comes out of the production process as (C’) – for instance C is wood and C’ is that wood transformed into a chair – and noting M’ the greater amount of money gained by the sale of C’, we get the comprehensive circuit:

M – C … P … C’- M’ and so on and so forth.

When dealing with this Marx does not make the distinction between money and credit – however credit is distinct from money because it is an anticipation of production. His litmus test is realization. What does that mean? Simply that a commodity and money itself as a commodity being specific social relations – here specifically capitalist relations – all commodities must exchange in that main circuit in a rigorous fashion. Each must find an equivalent in the system to « realise » itself as an economic reality. If one decomposes the main circuit in a money circuit and in a commodity circuit one can analyse that specific part of the chain better but, in the end, one would be forced to come back to the main circuit given above. If the process were left at that, it would be totally unhelpful.

But Marx does not lose sight of the fact that he is dealing with the reproduction of the entire economic system. He has a vast knowledge of the way this problem was dealt before him and most notably Sismondi’s annual revenue which formalise the idea of a system that can be defined as a temporally-bounded system, but one which can be refined further by the incomparably rigorous critical analysis which Marx deducted from Quesnay’s Tableau.

Despite the drafts that were retained by the notorious renegade Kautsky and others of that ilk to form the published Book II, this is what we can still read in that Book- the translation is mine:

« Over and above the qualitative division of the sum of commodities realised by A, A-M (M decomposing in v and Mp still represents a very quantitative relationship between the sum disbursed for the labor power v and the one invested in means of production Mp; this relationship is from its origin determined by the sum of surplus labor contributed by the number of workers » in Book II, La Pléiade ed., 1968, p 515 .

And:

« The apparent autonomy of the monetary form of the exchange value of capital in the first figure of his circuit disappears as soon as in his second figure it is reduced to its real content : the specific mode of existence of value as a creator of value. This explains why Dr. Quesnay essentially opposes in his Tableau économique this form II – which we give in III – to the mercantilist system. However, he does not present it in its pure expression; he mixes with it concretes determinations, in turn obscured by some misunderstanding as to their process of valorisation » in idem, p 335.

In other words the realization problem needs to be solved in real terms namely by the coherence given by the SR-ER Equations because, as the quotes indicate, the Commodity C takes two distinct use value forms, namely Mp and Cn. Rosa Luxemburg toyed with the money aspect of realization but quickly realised that the problem had to be solved in real terms. She sums up her stance in one sentence: « What has to be explained is the great social transaction of exchange, caused by real economic needs. » (in https://www.marxists.org/archive/luxemburg/1913/accumulation-capital/ch09.htm )

She never provided a Marxist theory of money and did not solve the problem posed by the productivity changes introduced in the SR-ER Schemas. But she rightly pointed out that the realization problem had first to be assessed dealing with the contradictions emanating from the ER drafts published in Book II of Capital. From this she developed a very powerful descriptive theory of Imperialism, for instance her brilliant rendering of the triangular opium-based trade between India and China organised and imposed through military force by the British empire.

In her major work The accumulation of capital when she was still dealing with the role of « money » Rosa Luxemburg noted critically that Marx dealt with the role of gold but finally decided to place the production of gold into the Sector I of Mp. (see note below) In so doing she overlooked Marx’s exposition of the crucial distinction between particular, general and universal equivalents to measure the commensurability of all commodities, including the commodity used as an economic measuring stick. Furthermore, like Marx when he was still dealing with the circuits of capital, she does not make any distinction between money and credit. We know that later on, Marx spend many years following the events of the economic crises of 1853-58 and 1873-78 to arrive at the Marxist concept of credit later refined by Paul Lafargue – and by me. In the volume Economie II, La Pléiade 1968, M Rubel cite Marx on credit and on the development of the stock-exchange (p LXXXVIII) during the first mentioned crisis. He equally shows how Marx let aside the work on Capital Book II and III to fill-up voluminous notebooks on Russia and on the financial-economic crisis of 1873-78.

At this stage of our critique, it would be useful to briefly inquire into the influence played by Tugan-Baranovsky. Not only because of his influence on Rosa Luxemburg but more ominously on all bourgeois economists after him. The fallacious reasoning of simultaneous resolution offered by Tugan-Baranovsky is found in Léo Walras. It took the form of the puerile equilibrium reached on the « market of the markets ». Imagine each market – microeconomics disconnected from macroeconomics – being determined by the silly crossing of Supply and Demand curves, this being synthesized in an overall « market of markets » plagued with the same ex ante-ex-post Supply/Demand procedure!!! It was even worse for all other Marginalists most specifically for what came to be known as neoliberal economists or « Keynesians bastards » according to the phrase used by economists from Cambridge UK such a Joan Robinson.

This was particularly the case of poor Hicks who tried to generalise Marshall two-commodity system into a three and n commodities system. But he had the misfortune to publish his book just after Keynes’s General theory of employment, interest and money (1936) Unfortunately Hicks’s was indirectly very influential through the so-called economic synthesis widely pedaled by various pitres – many Americans among them – such a Samuelson and Solow. (For my critique of Solow see my draft Hi-Ha! : The bourgeois economist’s donkish visual hallucinations (2009) Basically in his ludicrous 1956 Nobel-winning article, in order to get to his razor-hedge reasoning – which by the way rests on a fallacious stable physiological level for the labor force – and their households ? – Solow gets rid of Keynesian reasoning by positing a phony function of production Y = f (K,L) where L is employment independently of the level of unemployment … In this way he sat the stage for the evacuation of the main determining variable in Keynes’s set of interconnected variables namely full-employment. In one of her always refined songs Coralie Clément warns that once one falls on the ground, one can still dig she/his way down … https://www.youtube.com/watch?v=OHNOQ5RWY-k&list=RDOHNOQ5RWY-k&start_radio=1#t=61 As the average longevity of 40-42-Year of our ½ billion Dalits comrades show, the physiological level can be very elastic, especially once the philo-Semite Nietzschean mentality succeeds in blowing away all ethical and civilisational limits to exploitation … )

Either consciously or not, Tugan-Baranovsky was the prey of Böhm-Bawerk’s initial falsification known as the « transformation problem » of exchange values into prices of production as reformulated by the statistician Bortkiewicz. To solve the problem Tugan-Baranovsky proposed the following Equations of Reproduction :

c1 + v1 + s1 = c1 + c2 + c3

c2 + v2 + s2 = v1 + v2 + v3

c3 + v3 + s3 = s1 + s2 + s3

They substituted Marx’s SR Equations, namely the SR Schema:

SI = c1 + v1 + pv1 = M1 (Mp)

SII = c2 + v2 + pv2 = M2 (Cn)

Such as:

M1 = c1 + c2

c2 = v1 + pv1

M2 = (v1 + pv1) + (v2 + pv2)

We immediately notice the third line which for Tugan-Baranovsky represents gold. In so doing Tugan-Baranovsky simply plays a little trick. Adding gold and using it as a unit of accounting he gets the same number of equations as of variables and is thus able to provide a simple algebraic simultaneous resolution of the transformation problem, which is supposed to represent economic equilibrium. The problem is that it has nothing to do any longer with the economic field of enquiry and even less with Marx!

Nonetheless, many attempts were made to understand equilibrium in these terms. The well-intentioned but dramatically wrong Oscar Lange used it in his attempt to provide a so-called Marginalist theory of socialist planning. (See https://www.la-commune-paraclet.com/EPI%20TWOFrame1Source1.htm#marginalistsocialism) Oscar Lange’s knew of the transformation problem and he took it seriously. To repeat, I was the first and only one to solve this fallacious problem re-establishing the Marxist labor law of productivity and re-inserting it coherently into the SR-ER Equations. His argument was that since Marginalism claimed to be scientific, it had to apply universally, hence it also had to apply to socialist planning. The great classical Walrasian economist Maurice Allais later came up with a different version of Marginalism as science. He based himself on Auguste Walras’s advice to his son Léon never to forget that the inputs of his « economic science » or equations must come from social economy. But this would not be enough as I demonstrated in my critique to Allais in the « Note** » of my Book III entitled Keynesianism, Marxism, Economic Stability and Growth. As we know Schumpeter transformed this into an ontological dichotomy in order to preventively evacuate any discussion on this crucial subject. Any sensible person – perhaps note « economists » – does understand that this dichotomy hides the ex ante/ex post problem that plagues both the supply and demand curves as well as the impossibility for all brands of bourgeois economics to coherently reconcile micro and macro-economy.

In the hands of capitalist roaders and revisionists such as Liberman and Khrushchev this Marginalist socialism led to the self-destruction of the USSR. ( See: https://www.la-commune-paraclet.com/EPI%20TWOFrame1Source1.htm#marginalistsocialism ) On the contrary, Stalin had relied on the coherent SR Schema and used it to correct the divergence that fatally ensued when introducing the highest productivity everywhere possible, as he demanded. In so doing, Stalinist planning was extraordinarily efficient and more so since the economic calculus relied on a basically equal salary – with some material emoluments – and on use values or quantitative accounting known as the Material Net Product.

In retrospect, we can see that Lange relied on very pragmatic solutions to overdetermine the needed supply and demand curves. For instance, warehouses would keep track of their shelves and send orders as soon as the productive or consuming demand would threaten to deplete them. Notice that this is exactly what capitalist business accounting does, at least if one also adds the credit part of the trade. Ironically, it was Hayek, in his role as guard dog of the self-proclaimed elected race and affiliated groups, who came up with a criticism to Lange’s socialist Marginalism. He intended it as a criticism to simultaneous calculus as a planning tool: he wrongly but plausibly advanced that a modern economy is made up of millions of goods and services and, since each exchange implied a simultaneous resolution, this was impossible. He never said however how this argument is different for his own Marginalist supply-demand curves – the ex ante-ex post problem which extends into the contradiction which plagues all bourgeois economy between micro-economics and macroeconomics – For a critique see my Note on socialist planning 2 available here http://rivincitasociale.altervista.org/note-socialist-planning-2/ . In the end as we know, Hayek would quickly trade the supply/demand logic for his own authoritarian brand of anomism, badly known a libertarian ideology. Mises was even worse on this score.

Sraffa was also heavily influenced by Tugan-Baranovsky in his attempt to rehabilitate the classical economic labor theory, in particular that of Smith and Ricardo. Let us just say here that in so-doing his matrices have no clue about the productivity problem, they are thus arbitrary. And because no necessary relationships is established between the organic composition of capital and the rate of profit, that rate of profit ends up provided in an exogenous fashion! Economically speaking this is meaningless. Sraffa knew Marx and the role of « socially necessary labor » which he re-baptised in a reified form as a consumer basket for the workers. The title of his major work, namely « the production of commodities by way of commodities », clearly indicates this. In so doing, he evacuates the role of living labor and of labor exploitation, if you will, the essential role of extracted surplus labor – in use value terms – forming the surplus-value – in exchange value terms – which is the basis for capitalist profit.

At this point, we should perhaps mentioned the influence of Tugan-Baranovsky’s approach on Irving Fisher’s so-called « quantitative theory of money ». It is a pure tautology because it equates the national revenue Y to the amount of money needed for all economic exchanges – Rosa Luxemburg would say for the commodities to be realised without contradictions … He adds some circulation to it but basically this changes nothing as circulation is a primitive concept that sends back to the management of money by the central bank, not to Marx’s rotations. Originally this circulation involved the retirement of old metallic or paper money replaced by new. The amount needed remains tautological and this explains why the conscious economic forger Fisher spends so much time in laughable pages to explain that this tautology is not a tautology. He also makes a forced detour into Menger’s proposal to treat the supply of money like any other commodity and through this route you eventually end up to the Marginalist monetary aggregates used by bourgeois central banks, aggregates which happily confuse money, credit and speculative credit and have no clue whatever about inflation as admitted by poor Janet Yellen (http://rivincitasociale.altervista.org/the-fed-finally-admits-it-does-not-know-what-inflation-is-sept-21-2017/ ) Note that with the dominance of speculative credit or « credit without collateral » – see https://www.la-commune-paraclet.com/MandelbrotFrame1Source1.htm – the FED does not even bother to measure M3 any longer …

Of course, Irving Fisher was not a dupe. He was a chosen disciple of Böhm-Bawerk who was instrumental in pushing him into the economic field because of his alleged mathematical inclination. In fact, Fisher used the same falsifying method used by Böhm-Bawerk against Marx’s Capital. Whereas his master had falsified Book II with the invention of the so-called transformation problem, Irving Fisher sat out to falsify the reasoning of Book III. In Book I Marx had exposed the theory of the labor law of value and the forms of extractions of surplus-value. In Book II he had exposed the logic of Simple and Enlarged Reproduction. In Book III Marx was therefore ready to address the redistribution of the wealth produced and reproduced, an eminently political process. Hence, Book III proposed to illuminate the unfolding of class struggle in that specific context on the basis of three revenues corresponding to the three main social classes present in the Capitalist Mode of Production of his time, namely salary, profit and rent. Marx’s historical writings, in particular those dealing with France, are the perfect illustration of how the historical materialism method can be used for concrete historical analysis. Althusser rightly spoke of a « grille d’analyse ».

To evacuate any investigation into the origin of these revenues and into class struggle, Fisher simply proposed to merge all three in his ludicrous « income stream » which all economic agents – capitalists, workers, salespersons, etc and housewives – are supposed to manage according to universally valid psychological principles, namely risk preference and time preference both being linked to the plainly inept idea according to which a long-term investment needs a higher return. If, as was done in Europe – let alone in Communist countries – the investment is done through public credit, this is obviously false. Public credit only needs to provide for its administrative costs and for some provisioning, it does not need to extract profits or pay dividends. Public credit is therefore always affordable at a very low rate provided it corresponds to real economic needs and to real anticipated socio-economic growth. In particular, when public credit finances the public debt the latter remains very low because, almost by definition, it corresponds to the anticipation of growth which transform credit into real economic value.

However, as we know, the Austrian School had to pretend that the specifically capitalist psychology was valid for all times and space or else their subjective theoretical crap could not pretend to any scientific status. If you select the academics and their students and screen their publications, you might have a chance to impose such a plain ineptitude as a universal truth. However you still need to control the publication of your potential adversaries creating the clique of so-called Austro-Marxists and other such renegades. (Verification of this method: the modern crews all ignored my unparalleled scientific contributions in the field, which is contrary to any deontology and amounts to a social-intellectual crime.) As we saw Rosa Luxemburg was not duped and that caused her and her comrades their lives at the hand of these dirty and criminal crews.

As we said, Irving Fisher knew exactly what he was up to. This is also evidenced by his obsession with indexes. Narratives rely on plausibility to fool the masses as well as the « useful idiots » among the dominant classes, especially the Weberian middle classes employed in bourgeois education and public and private bureaucracies. To maintain the plausibility of the main narratives recurrent corrections are needed, but they must be presented as further scientific developments not as corrections, and they must be granted the full weight of Authority. Just like the old Inquisition did with its Index and its selection and its persecutions. Bourgeois Nobel Prizes play this specific role and no other, particularly in the « dismal science ».

As far as Fisher is concerned, one intuitively grasps the fact that his money theory is good for nothing and moreover it cannot lead to any scientific understanding of inflation or deflation. To put it simply, it confused inflationary indexing with the objective evaluation of standard of live. The complete argument is presented here http://rivincitasociale.altervista.org/purchasing-power-standard-of-life-socially-necessary-working-time-and-global-net-income-of-the-households-2-31-dec-2018/ .) In the end and fittingly, Irving Fisher was a true « pitre » in the conceptual understanding of the term presented in my Marxist Theory of Psychoanalysis ( see the excerpts in English in the Livres-Books section of my old Jurassic site www.la-commune-paraclet.com )

Irving Fisher’s monetary tautologies are widely used today including by the capitalist Central Banks. Hence the recurrent crises always managed on the back of the workers. But his name is rarely mentioned. One reason for this is that Fisher was systematically wrong in all his economic predictions including the Great Depression and later in 1936-37 the so-called Recession in the Depression. Comically, he started as a rich heir and ended-up ruined. As a ruined pitre thinker, he ended up preaching in favour of the 100 % Money theory. We leave it at that, mentioning only that current theorists of the lunatic Modern Theory of Money should perhaps do some historical work before proposing recipes especially when they intend to finance Green Speculation …; and they probably would gain something by taking a look at my Quantitative Marxist Theory of Money and Credit – See for instance in English in the same old Jurassic site my Synopsis of Marxist Political Economy. )

A word on Keynes is here in order. Keynes lived in a world in which the contradictions of capital led to dramatic crises transforming colonialism into aggressive imperialism. Inter-imperialist rivalries led to two World Wars waged, as Lenin rightly pointed out, in an attempt to divide the World among imperialist powers. But the First World War equally saw the rise of the USSR and its highly successful egalitarian economic planning. It did rapidly transform its underdeveloped land mass into a superpower which was eventually able to defeat, by itself, the powerful industrial and military machine of Nazi Germany. The birth and development of the Welfare or Keynesian State has rightly been presented, for instance by Fred Block, as a defensive capitalist strategy to co-opt its working class. Keynes’s work cannot be understood outside of this context. His purpose was to save private property even if this implied reigning in the capitalist « animal spirits » through State intervention and going as far as lowering the work week to 15 hours, a idea he borrowed, as usual without acknowledgment, from a Marxist thinker, in this case from the great Paul Lafargue.

Like all other original bourgeois thinkers, Keynes tried to falsify Marx in a plausible bourgeois fashion. Many people knew that he was well appraised of Marx’s work, much more than he ever admitted. In my Tous ensemble (1998) I wrote :

« Despite these slags and with a few precautions, the macroeconomic foundations of Keynesianism remain largely valid. Besides, the complete publication of Keynes’ works (The Collected writings of John Maynard Keynes, Cambridge University Press) made it possible to confirm that the source of Keynesian macroeconomics lays, in addition to thinkers like Emile Pacault and the heterodox economists identified in a chapter of the General Theory, in the Marxist cycles M-P-M ‘and A-P-A’ transmitted to Keynes via Sraffa (despite the late claims of Mr. Maurice Dobb). »

The obscuring of this essential influence was long-lasting. In fact, these Keynesian Marxist connections were not made officially public before the publication of the last two volumes of the Collected writings … It also took the form that is usually used by pseudo-aristocrats and elite members. This consists in disparaging the work of authors considered as class enemies but who are nonetheless at the core of all their intellectual and political worries, enquiries and endeavors. These people pretend to despise Marx as being unscientific but they spend their life fighting against him and anything that sounds authentically Marxist – i.e. escaping from their falsification. It is a very old strategy. But we know the ropes. Sometimes it is laughingly used by plain imbeciles who cannot even answer when asked and who are not even able to grant a right to respond, for instance Ugeux who would pretend that Marxism is degree zero of economics!!! See here : « Négation de mon droit de réponse : odieuse censure philosémite nietzschéenne en France et au journal Le Monde » in http://rivincitasociale.altervista.org/negation-de-mon-droit-de-reponse-odieuse-censure-philosemite-nietzscheenne-en-france-et-au-journal-le-monde/. As underlined in my Book III « A few years ago Susan George noted that the austerity plans unflinchingly imposed to Latin-America had produced close to half a million dead in Peru alone, within the space of few years. » What is the score, for instance in Greece, for pitres such as Ugeux, Dallara and the rest of them? ( See Body Economic: Why austerity kills in https://www.la-commune-paraclet.com/Book%20ReviewsFrame1Source1.htm#thebodyeconomic )

In this respect Michael Roberts has provided this beautiful quote:

« Keynes’s ‘socialism’ was openly designed as an alternative to the dangerous and erroneous ideas of what he thought was Marxism. State socialism, he said, “is, in fact, little better than a dusty survival of a plan to meet the problems of fifty years ago, based on a misunderstanding of what someone said a hundred years ago.” Keynes told George Bernard Shaw that the whole point of The General Theory was to knock away the ‘Ricardian’ foundations of Marxism and by that he meant the labour theory of value and its implication that capitalism was a system of the exploitation of labour for profit. He had little respect for Karl Marx, calling him “a poor thinker,” and Das Kapital “an obsolete economic textbook which I know to be not only scientifically erroneous but without interest or application for the modern world.” » in Keynes: socialist, liberal or conservative? MICHEAL ROBERTS BLOG, June 5, 2019, https://thenextrecession.wordpress.com/page/6/

Things are rather easy to understand. Keynes’s General theory of employment, interest and money – 1936 – is a bourgeois reworking of Marx’s SR Equations as formalised by Bukharin. And this explains precisely why his system remained stationary. It was left to the Oxford economist and Keynes’s first biographer Harrod to make the system dynamic, smoothing he did taking his cues from the Soviet planning of his time, namely that influenced by so-called « Marginalist socialism » but as it was reformulated in the hands of Liberman.