Introduction

Money vs. credit. Quantity of money and credit. Credit and thus bilateral credit lines are anticipations of exchange value.

The real exchange rate of the national currency.

The advantages of a “fixed” exchange rate for trade and for the bilateral credit line swaps.

Fixed exchange rate, hedging, CDS, financial instruments, speculation and insurance

Rigor and flexibility of bilateral credit line swaps.

The productive advantage of bilateral import-export agreements.

Import-export, import substitution, joint ventures and intra-firm trade.

NB: Some suggestion to override sanctions

Introduction

Today more and more people understand what should have been obvious: when a country A wants to trade with a country B, neither of them has to accumulate US dollars beforehand, which most often implies subaltern economic and commercial exchanges with the US financial and technological superpower. This is true for the euro and in general for all currencies. A and B can simply negotiate a medium or long term bilateral import-export agreement involving goods and services and proceed immediately with the trade involved. To provide maximum commercial flexibility and economic rationality, especially in terms of economic calculation, these barter agreements will be mediated by bilateral credit line swaps in national currencies. In reality, these are only « jeux d’écriture », but they make it possible to lend more fluidity and to economically calculate the underlying concrete exchanges. These bilateral agreements will initially meet an immediate need, but once their formidable efficiency is understood, nothing will prevent their accumulation from covering the whole bilateral trade. They also allow us to bypass the illegal imperial sanctions which aim, among other things, to impose a pathological and perverse “return” to a New Cold War, along with the corset of a neo-CoCom entirely subjected to the military-industrial complex linked to the Pentagon.

Two major cases will arise. First, import-export agreements for goods and services will be negotiated in such a way as to be perfectly balanced in monetary terms, which will involve the exchange rate of the currencies involved. This will define the amount of credit lines to be granted to each other. Second, these import-export agreements may be asymmetrical, with one partner exporting more than the other can initially absorb. In this case, it will be necessary to add to the swaps of credit lines in national currencies, the difference in another currency or in a commodity recognized internationally as a secure store of value – which excludes bitcoin and other non-State crypto-currencies – such as gold, silver, rare metals etc. Alternatively, one could conceive of using one or more currencies from the basket of currencies of the countries participating in such bilateral exchanges brought together on a single global platform. (Note that crypto-currencies do accentuate the lethal confusion between money and credit, a dangerous risk which could also face State’s digital currencies unless the Central Bank, which issues them, takes the necessary measures. At a minimum, this would entail different credit or banking cards specifically tied to personal or business accounts. )

Why is it not necessary to first accumulate hard currencies such as the US dollar or the euro? This is explained in the first chapters of Marx’s Capital, Book I, which sets out the scientific understanding of the problem. The exchange of one commodity for another commodity of a different kind requires a standard of measurement to gauge commensurability. Thus, commodity X = commodity Y, or more often, commodity A = x times commodity Z. Exchange is always done at equal exchange value, which is why it is always bilateral, whether or not it is mediated by money.

Every commodity, including the commodity “labor power”, is dual; it exhibits a use value conferred by Nature or by its concrete function and use, and an exchange value that makes it an economic good and therefore a commodity that can be socially exchanged.

Any commodity, for example a tripod or a bed, or a bag of potatoes, can serve as a means of exchange. We will say that this commodity is a particular equivalent. It is understandable that the mechanism is not very practical; but it was that of the silent exchange illustrated in Virgil’s Aeneid, or even that of the more usual barter exchange. Therefore general equivalents were developed that offered additional ease of use both for the expression of unity and for ease of transport. A necklace of similar shells often did the trick; quickly, metallic money was introduced, since copper, silver or gold were more sought-after, more precious, and could represent a large exchange value for a smaller weight that was easier to handle; moreover, these metals were less prone to oxidization and could be split up as desired, since each aliquot part would have the same intrinsic value, but would always conserve a perfectly measurable magnitude and weight. Paper money, or even electronic money, which is easier to transport, allow for even more efficient and equally safe manipulations, as long as they are legal tender. The fact remains that particular equivalents and general equivalents are themselves goods whose commensurability must be measured on a common standard, namely a universal equivalent. There is only one, and that is the exchange value of labor power. The commensurability of labor power between them results from their respective productivity measured for the same working time.

An exchange between two different goods can thus be made by bartering a particular good against another particular good; but we know that this exchange can be mediated by money, that is, by a general equivalent. The fetishism of money disappears as soon as we understand that money is only a social relation, namely that its own exchange value is based on the exchange value of the corresponding labor power.

We can already conclude that our two nations A and B can trade with each other without hindrance by resorting to barter and that they can mediate these exchanges through money, since money operates as a homogeneous unit of account, which consequently facilitates economic calculation.

Money vs. credit. Quantity of money and credit. Credit and thus bilateral credit lines are anticipations of exchange value.

Bourgeois economics in all its variants, especially of the Marginalist kind, confuses money and credit. It also confuses profit and interest, the latter always being deduced from the former, as well as classical interest – banking and financial intermediation – and speculative interest. The latter is falsely but legally posited as a legitimate profit, thus cannibalizing the real economy. The bourgeois economy also confuses public credit, issued by the public central bank, private classical credit based on a fractional banking system that respects its prudential ratios – thus without QE etc. – and speculative credit, which refers us to a system that I have called “credit without collateral” since the creation of money ex nihilo by the central bank, privatized for the benefit of a dozen large private primary banks, replaces de facto the work of cybernetic self-control operated by the prudential ratio, thus imposing the disastrous hegemony of speculation over the real economy. In short, the fractional system allows banks to lend in the form of credit more money than they have in assets, in return for respecting their prudential ratio under central bank control.

This constitutes the strength of the capitalist system as well as its weakness. Investments are multiplied tenfold by credit in exchange for the interest demanded. Theoretically, when the economy grows, the interest enriches the lending bank, which can then lend more; when the economy slows down, the respect of the prudential ratio forces the bank to reduce its size. The Achilles heel of this system is that investments – profits and credit – are subject to the logic of profit maximization operated within the framework of a blind allocation of resources according to the diktat of the “invisible hand” of the markets. As a result, the most financially profitable sectors will be preferred to the others. In addition to the systemic waste of resources with regard to social priorities that are not or poorly respected, this system will lead to an expansion in certain sectors accompanied by a contraction in others, which explains the recurrent purges operated by cyclical crises or business or trade cycles. On the other hand, structural crises originate from the contradiction which opposes overproduction and under-consumption in a given Social Formation (SF). This contradiction is most often based on the exhaustion of the massification of technological waves in new or intermediate sectors such as, during the post-war years, the automobile, transport and aeronautics, household appliances, infrastructures and public utilities, etc. This constitutes the objective basis of the long Kondratiev cycles. Today, these sectors are more capital-intensive and pose with greater acuity the problem of the global management of the labor force through the reduction of annual working time – paid vacations, sick leave and maternity-paternity leave, retirement, etc. – and weekly working time – (See “Credit without collateral” in https://www.la-commune-paraclet.com/EPIFrame1Source1.htm#epi )

Money, be it metallic, paper or electronic money, is the most common means of exchange. It does not materialize the exchange value of goods and services, it is only the sign of it. Its quantity must be equal to what is necessary and sufficient to allow the exchange of all the goods and services needed for stationary equilibrium – Simple Reproduction, or SR – and for dynamic equilibrium – Enlarged Reproduction, or ER. This can be verified by referring to Marx’s Equations of SR, pointing out that the choice of two main Sectors, SI, the Sector of the Means of Production (Mp ) and SII, the Sector of the Means of Consumption ( Cn ) refer very precisely to the two inputs of any production function which is written : c + v + pv = p where “c” the constant capital refers to the Mp and “v” the variable capital refers to the Cn, “pv” being the surplus value that refers to surplus labor while “p” represents the product of the production process. In this consists the brilliant overcoming of Sismondi’s annual income and Quesnay’s Tableau by Marx.

The Equations of SR are written as follows

SI = c1 + v1 + pv1 = Mp

SII = c2 + v2 + pv2 = Cn

——————————–

= c + v + pv = p, the Social Capital for a given SF. Here “pv” is the social surplus-value, the allocation of which is the key to any system of social redistribution; as we shall see, this allocation will also involve credit, which increments investments over and above the share of surplus-value or profit that can be reinvested. Extending Book 3 of Capital, we will say that social redistribution defines the Epochs of redistribution within the same Mode of Production according to the state of the class struggle over-determined by the Constitution and by the institutions in place.

We have said that the two main sectors reflect the two inputs ( c + v ) of the typical production function. It will therefore be possible to add all the sub-sectors one wants; moreover, Marxist scientific accounting centered on the Equations of SR-ER will make it possible to conceive very clearly the intra-sector and inter-branch statistical-practical arrangements that make up what is known as a “filière”.

Let us note that the above Equations of SR can be given in quantities of Mp and Cn as well as in hours of work, in money, or in quantities produced. Thus Marx’s schemes are the only ones that allow us to obtain these coherent results thanks to my scientific contribution on the Marxist law of productivity which allows us to keep this coherence for the ER even when the rates of organic composition (v/C or C = (c +v) and the rate of surplus-value or exploitation (pv/v) change due to the increase in productivity. No other model is capable of simultaneously giving quantities and their exchange values and prices. So much so that the pitre Joseph Schumpeter tried to hide this fatal flaw by declaring that the contradiction between microeconomics and macroeconomics was “ontological” to the discipline! (I refer here to my Methodological Introduction and to my Synopsis of Marxist Political Economy in the Livres-Books Section of my old experimental site www.la-commune-paraclet.com )

The Equilibrium of SR must satisfy the following conditions :

c2 = (v1 + pv 1 )

Mp = c1 + c2

Cn = (v1 + pv1 ) + ( v2 + pv2)

If we consider a situation of full employment, the real wage bill “v” will give the sufficient and necessary quantity to circulate all the Mp and Cn in order to ensure Reproduction. (see the Précis)

Structural inflation – there are other types of inflation – emerges with unemployment according to the forms of social insurance and social assistance put in place. In general, with the classical liberal State, devoid of institutionalized social services, the sustenance of the Reserve Army led the liberal bourgeois central bank to issue a money supply – the equivalent of M1 and part of M2 – greater than the real wage bill, thus causing structural inflation. We call this new money supply the social wage bill. This maneuver of the bourgeoisie amounted, by means of consumer exchanges, to making the active labor force pay for the minimum support of the passive labor force, in addition to the support provided by the extended family or by the return to the countryside. In an advanced capitalist system, this redistribution will be mediated in part by the institution of the deferred wage – social contributions, thus eliminating the inflationary part linked to the emission of additional money: what was at issue here was a better social justice that was economically virtuous since it stabilized the functioning of the system. Indeed, the deferred wage simply revised the distribution of the wealth produced, which until then had been too unequal between “v” and “pv”, i.e. between labor and capital. This attenuated the contradiction between overproduction and under-consumption. This was the path of the mixed but planned economy of the European Social State or the Anglo-Saxon Welfare State, which were set up after the First and especially after the Second World War because of the salutary fear aroused in the West first by the Bolshevik Revolution and then by the victory of the Red Army against Nazi-Fascism. Thus a more equitable division of “social surplus value” was established.

This will lead to the progressive affirmation of the three components of the “net global income” of households, namely net wages, deferred wages – pensions, unemployment insurance, etc. – plus the share that goes to households in the form of guaranteed universal access to public infrastructure and services. Notice here that the Marginalist « disposable income » eliminates everything that counts for the standard of living of the households, namely access to public services and infrastructures. The same applies to the Marginalist GDP. The soundness of the system was also based on the definition of the anti-dumping – e.g., GATT – which protected both the micro-economic productivity – cost of production – and the macro-economic competitiveness of the SF expressed respectively by the “net global income” of households and by the exchange rate of the currency, thus by the performance of the external balances. This definition also made it possible to preserve “food and agricultural sovereignty” since the European PAC or the Ever Green Granary of the American New Deal, defined the national agricultural sectors to be protected by all the appropriate mechanisms, including agricultural zoning and mechanisms of control and support for national supply and demand, while using for this purpose the customs revenues collected on agricultural imports. It is also known that an Enlarged Reproduction will be all the more dynamic if it can count on energy and food surpluses as well as on planning and public credit. This evolution towards an advanced Social State stemmed from the need to resolve the crisis of capital accumulation in the 1930s and 1940s by means of a better social redistribution that took into account, in particular, the fact that the human being is a member of a sexually reproducing species, so that it is imperative to reproduce as a human within a household. Equal net wages for all workers doing the same work is therefore not enough, given the different sizes of households. I refer here to my Synopsis of Marxist Political Economy – freely accessible in the Livres-Books Section of my old experimental site www.la-commune-paraclet.com .

With the neo-conservative counter-reform launched by Thatcher, Volcker and Reagan in 1979-82, the systemic attack on labor, unions, collective agreements and wage indexation – the Cola clause – dealt a severe blow to the “net global income” of households. But by reducing deferred wages to almost nothing and substantially replacing social insurance and welfare with part-time work and gig jobs, structural inflation disappeared in favour of wage deflation. What the Marginalists and their media call “inflation” today is not monetary in nature and therefore cannot be managed by the monetary policy of the central banks and even less by their monetarist policies which confuse economic and monetary levels all together. On the contrary, it is now an eminently national and global economic problem that calls into question the current definition of anti-dumping at the WTO, the respect of the most-favored-nation clause against illegal sanctions and the repudiation of regressive socio-economic policies by returning to the recurrent cycles of the Reduction of Working Time (RWT). (see a ) “The Socio-Economic Consequences of Volcker, Reagan and Co.” in http://rivincitasociale.altervista.org/another-america-possible-feb-1-2017/ , and b ) http://rivincitasociale.altervista.org/inflation-a-new-absurd-ecologist-bourgeois-cycle-is-announced-with-a-hike-in-prices-going-hand-in-hand-with-wage-deflation-but-this-is-given-as-inflation-12-may-2021/ and c ) http://rivincitasociale.altervista.org/purchasing-power-standard-of-life-socially-necessary-working-time-and-global-net-income-of-the-households-2-31-dec-2018/ )

Money, in the strict sense of the word, refers to the money supply, i.e. to the wage bill, real or social. As such, it is distinct from credit. Credit is an anticipation of growth in the precise sense that it is added to the share of surplus-value or reinvested profit, which contributes to a strong acceleration of the process of Enlarged Reproduction. Credit is realized in the new exchange value – and its quantitative supports in goods and services – whose production it facilitates. As such, in a closed economy, this “monetary” anticipation must be able to be realized in exchange value, and thus find real supports, either Mp or Cn. This will imply the use of the installed production overcapacity. It is known that production capacity is usually used up to 80%, which allows for the proverbial necklaces and overtime. However, no economic system is capable of surviving in complete autarky unless it has half a continent at its disposal… The fact remains that the capitalist system has been an open system on a global scale since its inception. . In such an open economy, growth can be strongly accelerated by credit, since this anticipation of growth will put the necessary supply of imports to work. For often the productive inputs in the form of capital – raw materials, machinery, etc. – or labor are not, or only partially, available in any given Social Formation. Of course, the logic of the law of value will quickly raise the question of the balance of external accounts – balance of trade and balance of payments.

If the credit is public, it will be issued by the public bank. This is why its cost will be almost zero, since the public bank only has to cover the costs of its operation while ensuring provisioning for losses, which in its case calls into question the magnitude and strength of its reserves. This is crucial for a planned economy, including a mixed economy, since in this case the anticipation of growth, and thus of the additional inputs needed, will be calculated by the Plan rather than left to the chance of markets and the “invisible hand. The amount of credit will therefore be adjusted as closely as possible. The anticipation of the necessary investments by credit, in addition to the reinvested part of the social surplus value, will carry an extremely low interest rate, but moreover, the expenditure of this anticipation will imply a larger real wage bill as well as the growth of fixed capital, the real wealth of Nations – public infrastructures, factories, R&D etc. The economic multiplier will then play its full role both for productive consumption and for household consumption. Moreover, planning will proceed to an optimal allocation of both reinvested social surplus value and credit, so that growth can be maximized according to democratically set socio-economic priorities while relying on a substantial economic Multiplier. Since public credit can theoretically be created at will by the public central bank, it must be carefully framed by planning. This will define the size of the necessary anticipation as well as its intersectoral allocation, taking into account the symmetrical proportionality implied by the ER Equations – and the SR Equations underlying any ER – which will have to be realized at a higher level. Furthermore, when a project is selected, it will be based on a strict evaluation of the required investment. The public credit will therefore be disbursed in quarterly instalments, which will be accompanied by accounting audits to prevent corruption and unjustified cost overruns.

Let us note briefly that the private central bank is said to be autonomous because it does not report to the Treasury or to the government; however, it is subject to the private banks, which are often its shareholders. It ensures that the prudential ratio of the banks is respected while, in principle, ensuring price stability by preserving the “confidence of the markets. Sometimes, as in the case of the US Federal Reserve, it is supposed to promote full employment. However, its main mandate is price stability, which is ironic given that capitalist central banks do not know how to define “inflation” (see: http://rivincitasociale.altervista.org/the-fed-finally-admits-it-does-not-know-what-inflation-is-sept-21-2017/ and: http://rivincitasociale.altervista.org/inflation-a-new-absurd-ecologist-bourgeois-cycle-is-announced-with-a-hike-in-prices-going-hand-in-hand-with-wage-deflation-but-this-is-given-as-inflation-12-may-2021/ )

To implement its mandate, the capitalist central bank uses mainly its key rates. This is economically absurd, except perhaps to manage loans to households. Indeed, these uniform rates do not differentiate between small and large economic actors nor between sectors and branches. In the end, this encourages speculation that leads to cyclical crises or trade cycles. But this is necessary for what Marx called “the communism of capital”, since all economic actors have the impression that their equality is respected, whereas it is only their formal equality that is.

A public central bank that issues public credit within the framework of planning will reserve its key rates for the management of household consumption. This will be all the easier if a) it manages the real and social wage bill with full scientific hence Marxist knowledge; b) an important part of the workers’ savings contributing to social welfare, which eliminates “the fear of tomorrow”, will be institutionalized through contributions to the five branches of Social Security; and c ) that the autonomous savings of the households, necessary for the circulation-consumption of durable consumer goods in addition to the more restricted daily consumption, will be commensurate with the purpose it serves, knowing moreover that education, public transport, access to culture and sports would be largely public.

With regard to economic management, it will ensure the modulation of the prudential ratios of its member banks, which must be functionally linked with their assigned sub-sectors, branches and industries. This targeted modulation makes it possible to expand or restrict the credit granted according to sectoral needs while maintaining the socio-economic coherence of the SF. In this way, the public banking system will support the economy by determining the necessary level of credit, thus avoiding expansion in certain subsectors and branches accompanied by contraction in others, which is the lot of capitalist banking management. The central bank will thus be able to assist the Plan to ensure that the proportional symmetry implied by the ER Equations – and therefore by the underlying SR – is respected.

The crucial difference between monetary management through modulation of prudential ratios rather than through uniform guiding rates is unfortunately not yet well known. Today, what most differentiates central banks, public or private, is the financing of public and para-public debt. This depends on the place given to indicative and incentive planning and to what was called after the WWII “State interventionism” by both Anglo-Saxon Keynesianism and European theories of regulation. In our mixed economies, the banking and financial system had finally been carefully compartmentalized to avoid the speculative excesses of the Boom and Bust years, which had led to the 1929 Crash and to the Great Depression that followed. The soundness of this reform was quickly demonstrated by the exploits of the post-war Reconstruction, an Epoch which Jean Fourastié called the “Thirty Glorious Years” because of the rise in the standard of living achieved. This compartmentalization allowed recurrent bankruptcies to purge speculative excesses without presenting any systemic risk, at most by pushing for bank mergers. Moreover, public credit continued to play its role in supporting growth. The public central bank in Europe and elsewhere directly financed public and para-public debt, i.e. the public part of the anticipation on investment in the form of credit at an extremely low cost. No speculative interference added to the burden of financing these debts, which in fact contributed to economic growth thanks to the optimal allocation of resources provided for by the Plan.

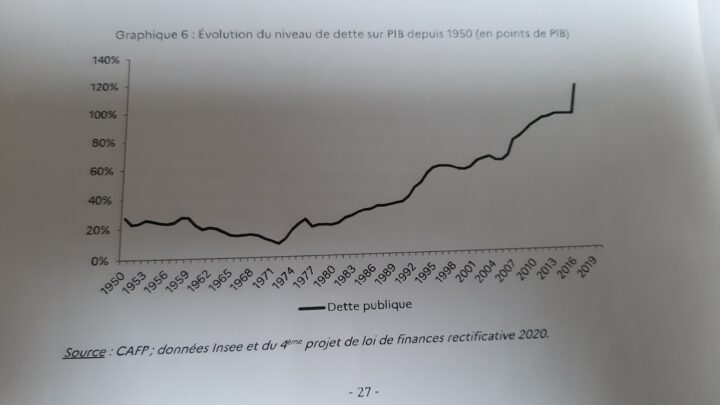

One need only look at the debt/GDP ratio in France before and after 1973, the date at which the Banque de France was privatized by the Pompidou-Giscard-Rothschild law, to understand the importance of this issue. The same dynamic is found in more or less the same terms elsewhere, for example in Italy, where the privatization of Bankitalia occurred in 1981-1983. These countries are still living on the public heritage built up during the post-war years, a heritage that the wave of regressive neo-liberal and monetarist reforms launched in 1979-82 by Thatcher, Volcker and Reagan almost succeeded in dismantling completely.

The privatization of the central bank has the effect of subjecting public borrowing to private banks, especially the handful of primary banks of global size. Private banks, like the rating agencies and their shareholders, live by maximizing profits, and in the current monetarist neo-liberal phase, by making short-term profits. The cost of financing the public debt will automatically be aggravated, thus burdening the share of tax revenues necessary to finance the Regalian functions of the State, notably of the European-style Social State. The deregulation and privatization of the financial banking system confirm the end of the anti-speculation partitioning between the four main pillars, deposit banks, commercial banks, insurance and credit unions, which the New Deal had put in place in 1933 with the Glass Steagall Act. This system was finally repealed in 1999 in the United States and then everywhere else in the West. This quickly led to the subprime crisis of 2007-2008. The hegemony of speculative finance, the surge of its “irrational exuberance” – as Greenspan put it – strongly supported by the issuance of money ex nihilo in the form of QE and other liquidities, including repos and reverse repos by the private central bank, led fatally to an unprecedented accumulation of public and private debt.

Source : Rapport Arthuis 2021, p 27

In addition to managing public and para-public debt, the central bank also manages the credit granted by banks within the framework of the fractional system. These banks must be functionally linked to their reference sectors or branches.

We must now distinguish between public credit, classical capitalist credit and speculative credit. Indeed, the Capitalist Mode of Production is based on a private allocation of social surplus-value and of capitalist credit issued by private banks. It will therefore be determined by the necessity of private accumulation generated by competition in an open and chaotic system. The allocation of available resources will follow the blind logic of the “invisible hand”. In this way, at the national level, the more profitable sectors will attract more capital to the detriment of others; this is what underlies the recurrent mechanism of cyclical crises with the expansion of certain sectors going hand in hand with the contraction of others. These crises – trade or business cycles – serve to purge the system of this destabilizing speculation. Structural crises, sometimes called Kondratiev cycles, refer to the successive waves of introduction and massification of new technologies. In the past, this led to the creation of new economic sectors and intermediate sectors – automobiles, household appliances, avionics, etc. – that were labor intensive; today, the new technologies are more and more capital-intensive, which poses the crucial question of the sharing of socially available work among all citizens capable of working with greater acuity than ever before. Externally, this deleterious symbiosis between the acquisitive mentality and the “invisible hand” led to the capitalist conquest of the colonies, to neo-colonialism and imperialism. In addition to the raw materials, new markets had to be conquered as well, serving as outlets.

Things get definitely worse when we move to speculative credit. Let us say at the outset that interest differs from profit in that it is always deducted from profit. An investment bank, say the Morgan Bank, lends money to industry, say here to H Ford, so that it can increase the production and sale of its Model T. After renewing his production costs, he will be left with his company’s profit, from which interest will be deducted to repay the bank loan, the rest going to reinvestment and to the remuneration of the capitalist owner of the means of production. We can thus see the origin of the near-hatred that H. Ford felt for bankers and financiers because of their capitalist « parasitic » intermediation (see, for example, H. Ford The International Jew). However, since the privatization of the central bank, followed by the decompartmentalization of the four pillars of finance – depository bank, commercial bank, insurance and credit union – as well as by the deregulation of the banking system, ratified in 1999 by the repeal of the Glass Steagall Act of 1933, speculative interest operates legally as a profit in direct competition with other profits.

In short, public credit and classical capitalist credit are intermediations – public or private banking – that ensure the anticipation of investments in addition to the reinvestment permitted by the magnitude of the available surplus-value. Speculative credit perverts the logic of capitalist accumulation by positing banking and financial interest – intermediation – as a legitimate and legally sanctioned profit. A so-called universal bank, an investment fund of any kind, are considered today as economic entities on an equal footing with other sectors, industry, infrastructure, public utilities, transport, marketing, sales etc. The inter-sectoral mobility of capital, strongly increased by the financialization and stock marketization of the economy, means that the speculative banking and financial sector will enjoy a considerable advantage because of their lesser need for fixed capital – requiring heavy medium and long-term investments. With such a greater “productivity”, it will therefore easily cannibalize the other sectors, while imposing an unsustainable speculative rate – Ebitda, Roe – leading to all sorts of restructurings and LBOs, etc.

The real exchange rate of the national currency.

Let us take up the canonical production function: c + v + pv = p. First of all, at the micro-economic level, the essential relations are a ) the organic composition of capital, i.e. v/C, where C = (c + v); b ) the rate of surplus-value or rate of exploitation pv/v; and c ) the rate of profit, i.e. pv/(c + v). The Marxist law of productivity which I established on the basis of Marx’s work, implies a relation of inverse proportionality between v/C and pv/v. It then allows for consistency in all terms – products, exchange values and prices, labor time and even units of full or part-time labor or physical workers. No other theory is capable of doing this, and especially not bourgeois economics, of which Marginalism is the fraudulent flagship. (The reader is sent back here to my Methodological Introduction and to my Synopsis in the Livres-Books section of my old experimental site www.la-commune-paraclet.com )

The sum of Sectors I and II gives us the macroeconomic production function of the Social Capital working in the given Social Formation – SF -. In this case, the global v/C ratio will not represent a specific microeconomic productivity rate of a specific immediate production process but instead what I have called the macroeconomic competitiveness rate of the SF. The exchange value is formed in the SF within which the Equations of the SR-RE are inscribed. Thus the different Social Formations compare each other very concretely via their economic exchanges on the basis of their macro-economic competitiveness rate, which excludes the half-baked a-scientific nonsense known as “unequal exchange”. Exchange can only be made at exchange value, the scientific basis being the rate of productivity and the rate of competitiveness. (The theorists of “unequal exchange” were not able, as were all the others, despite the culpable concealment of my scientific contributions, to solve the so-called problem of the transformation of value into price of production invented by Böhm-Bawerk against the work of Marx and against the emancipation of the working class. (I refer the reader to my Tous ensemble – 1998 – for my first published exposition of the solution. The academic world is like that – see also the “Lancetgate” accompanied by the Covid and Health dictatorship which shows the extent of the a-scientific and a-human narrative metastasis in the other branches of science. Exclusivist class and cast over-representation and false representation is a crime against Humanity and the Human Spirit. Ironically it is achieved on the public purse in frontal contradiction to the democratic Law of great numbers. I refer here to: http://rivincitasociale.altervista.org/sars-cov-2-brevesflash-newsbreve/ or to : http://rivincitasociale.altervista.org/synthesis-on-the-genocidal-sars-cov-2-illegal-experimentation-based-on-the-illegal-negation-of-early-symptoms-care-with-efficient-generic-drugs-july-25-2021/)

If we consider what was said above in relation to the real and social wage bills, which brings us back to the basic monetary aggregates that are scientifically constructed and understandable, it is clear that the macroeconomic competitiveness rate in a situation of full employment defines the real exchange rate of the SF. Since there is always at least a frictional and seasonal unemployment rate, it will be necessary to take into account the structural inflation given by the ratio of social wage bill to real wage bill. Of course, there are other kinds of inflations, but we shall confine ourselves here to this structural inflation, which is the main source of endogenous or imported inflation. It could, therefore, be very finely controlled by returning to full or near full employment. In Tous ensemble – in the same old experimental site – I took note of the fact that frictional unemployment is part of the game, so that it is taken care of periodically by unemployment insurance – part of the deferred wage – and structurally by the recurrent cycles of the Reduction of Working Time (RWT). Residual structural inflation, which emerges from frictional unemployment, can therefore be considered as “civilized”. Knowing its origin, we can keep it as low as possible while controlling its micro and macroeconomic effects, borrowing – for once – his Fisher Chain from the ineffable Irving Fisher.

The exchange rate will therefore take into account these endogenous and imported realities. This is why the macroeconomic competitiveness rate will be permanently corrected by the Fisher Chain and by the performance of external balances. Within the framework of these quarterly adjustments, the exchange rate of the national currency will therefore have to be “fixed”, i.e. it will be fixed on the competitiveness rate and its quarterly adjustments.

The advantage is obvious. With such an exchange rate, constructed to reflect the social exchange value of the SF, there will be neither over – nor undervaluation of the currency. Moreover, an exchange rate fixed on the rate of competitiveness and its adjustments will not be susceptible to hostile speculative attacks – private or politically motivated. The opposite is true when a national currency is abandoned to a free-float exchange rate regime. Note that no central bank is capable of defending its currency once it is abandoned to the free-float exchange rate system without losing all its reserves for naught within an hour or two. This was the case in September 1949 when the British pound was attacked by the US which was intent on forcing Britain into the GATT and thus to abandon its Imperial Preferences. H. White has thus won against Keynes. This has been the case ever since, for example during the crisis of the peso, the baht, the ruble, etc. In these cases, what helped to cope with the crisis were the very strict capital controls.

The advantages of the “fixed” exchange rate for trade and for the bilateral line swaps.

Today we live in a world largely subject to the “private global governance” of speculative and stateless transnational capital. Global competition operates 24 hours a day on the various financial and stock exchange platforms. Privatization and deregulation reign supreme to impose the mechanism of the “invisible hand” and its inequitable and problematic allocation of resources to the benefit of the private sector, and it does so on a global scale. With central banking privatized as well as credit, it follows that exchange rates are free-floating. The proponents of modern Marginalism, from Ludwig Mises to the Chicago School to the ineffable theorists of “efficient capital”, thought that floating exchange rates would have led to global financial stabilization through global competition. Some of us predicted from the beginning that this choice would have favored the erratic aspect of the markets instead and led to increased turbulence. All of this under the influence of the American dollar, which is imposing itself as the suzerain reserve currency. This ontological instability is further aggravated by the hegemony of speculative finance.

In order to exchange (x) units of commodity A for (y) units of commodity B within the same SF, it is necessary to establish their commensurability – their respective rates of productivity – and to mediate the exchange through a general equivalent, money. Between different SFs, the same applies, but the exchange rate of the currencies depends on their respective macroeconomic competitiveness rates. Once these rates are respected, the trick is done and prices oscillate very close to the axis of real exchange value – see above the distinction between real and social wage masses.

When speculation becomes hegemonic, exchanges are no longer made around the exchange value but around its highly deformed speculative form. Marginalist GDP is now deformed to the tune of at least 9% by speculative financial metastasis (see: http://rivincitasociale.altervista.org/gdp-marginalist-narration-tool-against-the-welfare-of-peoples-and-the-prosperity-of-nation-states-may-24-2020/ ). The buyer of wheat or nickel appears on the various wholesale, forward or spot markets. Purchases are made at t0 for forward deliveries at t1. To cover the risk of delivery, the contracts include hedging for exchange rate fluctuations and for various types of insurance or CDS. This perfectly useless little game increases the exchange value and the initial price by an average of 20% to 25%. This is done by piling up the various stages, including transport. To this must be added the financial manipulations of the various players, in particular the traders who manage positions for banks or funds that are sometimes considerable. Depending on their “technical” understanding of market trends and of the « profits » to be made, these contracts may be subject to margin calls, which is not insignificant for CDS chains. The spot markets are probably even more speculative than the others markets.

The final buying and selling prices are then strongly influenced by all these parasitic financial instruments, which are themselves influenced by the unprecedented amount of speculative liquidity that the central banks are constantly maintaining, notably through QE or even, more recently, through repos and reverse repos. These prices have little to do with the real exchange value of goods and services and therefore with their production cost. Take the energy sector, divide it into different branches and put all the companies of a branch in competition with one another and all the branches in competition with each other as well and you will have the European free market of energy which is supposed to give you the best price!

Ignoring disruptions in supply chains, assume a wind failure on the UK’s offshore wind turbines; this will involve transfers of electricity on the so-called European smart grid. But if surpluses are not immediately available, coal or gas will have to be used to generate the missing electricity, often using the spot market. However, coal and gas are already subject to very strong constraints, notably because of the EU carbon taxonomy. Among other nonsense, this tax is the result of the Paris Agreements; it has led to a reduction in investments, thus increasing prices in a very environmentally friendly way, sort of « bon chic bon genre ». Some smart guys will then explain to you that all this is normal since the price of electricity – in the present case – depends on the “last unit produced”. At what point? And then the same inept people will continue to privatise what remains of the public monopolies, including EDF – for example, the Hercules plan.

All this is dangerous. The free float invites speculative attacks or at least extreme turbulence, especially those caused by the management of the US dollar and its international suzerainty. For example, the unilateral lowering or raising of U.S. interest rates causes a chain reaction in global capital flows, including carry trades and reverse carry trades. The situation is no better when a national currency is subject to a currency peg, i.e. when it is chained to a fixed parity with the USD, a currency over which other governments have no control. Add to this the dangers of internal and global speculation.

A national currency can be managed through a basket of currencies corresponding to major trading partners, which amounts to managing the exchange rate of one’s own currency relative to trading partners as best as possible. But such an approach requires that the central bank be public and that the exchange rate chosen be as close as possible to the national macroeconomic competitiveness rate, taking into account systemic distortions, notably those of the USD, which brings us back to the adjustment of the exchange rate by the level of external balances. (Within the same multinational customs and trade area, for example the EU before the creation of the Euro, the convergence of the various exchange rates can adopt a central axis within a tolerated band of oscillation, which then implies a strong and often perverse macroeconomic discipline to stay in line. In the European Monetary Snake, stalls or competitive devaluations were not uncommon, especially from Italy, since the exchange rate did not correspond to the deteriorating macroeconomic competitiveness rate – largely due to privatisation in particular that of the Bankitalia which was totally delinked from the Treasury after 1981-1983.

We note that all these contradictions, often very deleterious, can be largely avoided by adopting a fixed exchange rate adjusted quarterly according to external balances, which in the long run will unerringly translate into strong international confidence in this currency.

The advantages of such a system are even more evident when we address the issue of bilateral trade by planning concrete import-export volumes together with the accompanying bilateral credit line swaps to facilitate immediate implementation, while providing rational and efficient accounting and economic calculation.

Fixed exchange rates, hedging, CDS, financial instruments, speculation and insurance

The exchange value of the national currency corresponds to the macroeconomic competitiveness rate of the SF, which can therefore be adjusted every quarter to take into account pertinent developments, particularly the performance of the external balances. The exchange rate must therefore be “fixed” in this precise sense. It is therefore not susceptible to modification or attack by internal or global speculation. It is therefore imposed by its scientific and objective nature.

If we refer to the Scheme of Equations of Simple Reproduction – see above – we understand, if only intuitively, the importance of a good definition of anti-dumping. Indeed, the Epochs of redistribution of the Modes of Production depend on what I called the “structure of v” in the second part of my Book 3 Keynesianism, Marxism, Economic Stability and Growth – 2005, idem – or the distribution of the “social surplus-value” according to the choice of the relative share of the three components of the “net global income” of households, i.e. the net wage, the deferred wage – Social Security – and the share of taxes that comes back to households, for example in the form of universal access to public infrastructures and services.

This definition of anti-dumping cannot be left at the WTO in the form it takes today. The current definition automatically excludes any reference to labor rights and to the most minimal environmental criteria, a free-trade choice which imposes global competition that favors the lowest bidder. This is particularly the case for the “cost of labor” substituted for the “cost of production” according to R. Solow’s Malthusian conception of the physiological threshold, the threshold at which presumably unfettered competition would make it possible to achieve “full employment”. However, there is no human physiological threshold other than the one ratified by the cemeteries, as can be seen from the average longevity of 40-42 years imposed on ½ billion fellow Dalits in India.

On the contrary, the macroeconomic development of public infrastructure and social services – deferred wages and a large share of tax revenues – form the common base on which the microeconomic productivity of public and private enterprises can flourish. One needs only look at the socio-economic, cultural and environmental location factors of firms to grasp this. A well-planned SF will therefore aim at a rate of macroeconomic competitiveness that takes into account the optimal weight to be given to the “net global income” of households; if necessary, it will be able to resort to a small import surtax beyond the current WTO-approved anti-dumping in order to allow for its financing without damaging the global competitiveness of the SF. In essence, this small surtax will supplement the necessary deferred wage. It will thus provide a national protection that, together with planning and public credit, will put an end to any undesirable relocation and outsourcing, thus preserving the optimal productive coherence of the SF.

Bilateral credit line swaps will be based on the exchange rate of the two currencies involved, taking into account the adjustment mechanisms included in the short, medium, or long-term contracts. The optimal solution is to negotiate import-export agreements outside the wholesale, medium and short-term markets, while eliminating unnecessary financial arbitrage. This will amount to granting each other a strong competitive advantage. In the case of energy, this advantage will be reflected at all stages of the production process, transportation and sale of products, which will ultimately be considerable. We know the cost of production of our own products, as well as the national average profit rate – not to be confused with profit volumes – at the national level; we also know the average final unit price on the markets, which in turn includes almost 25% of financial-speculation free riding. We know the cost of insurance, and indeed insurance should be removed all together from the market by creating public insurance agencies that are much less expensive, since they will be able to offer non-speculative contracts; these insurances, offered without superfluous intermediaries, will only have to provide for replacement in currency in the event of loss or damage to products and cargoes, but they may also provide for substitution in kind when this can be agreed by both parties and when the production timeframe allows it. In this way, necessary adjustments, in addition to insurance, will be limited to basic hedging mechanisms on exchange rates, but without the slightest speculation since these rates will henceforth be “fixed”. The long time frame needed for planning will thus be optimized.

Rigor and flexibility of bilateral credit line swaps.

To begin with, we have the negotiation of import-export agreements in quantities of concrete products, which will allow us to deduce the amount of credit lines necessary to mediate these exchanges. We have already said that these agreements will be made according to the need felt without calling into question all the bilateral trade between the two partners concerned, although the cumulative logic of such agreements will tend to invest in due time the entire bilateral trade balance. These agreements allow us to move quickly and in a virtuous manner, since they aim by construction at a equilibrium in trade value.

They will therefore be symmetrical in their value form, so that simple writing games ( « jeux d’écriture » ) will make it possible to cover the necessary bilateral credit lines. However, if a country imports more oil and gas than it will be able to compensate for through its own exports, these « jeux d’écriture » will only cover the symmetrical part of the agreements, the remainder being settled by recourse to another mutually agreed general equivalent, such as gold, silver, but above all another currency or a basket of currencies. However, there is nothing to prevent the difference from being the subject of a conventional albeit temporary deficit – or symmetrically a surplus – in the trade balance. The latter would then have to be rebalanced as soon as possible.

This is why, with regard to the most rigorous and flexible management possible of the various bilateral import-export agreements, a multinational platform operating as a clearing and adjustment chamber should be created. All bilateral agreements will be represented, both those that were negotiated according to a equilibrium in the value of import-export exchange – which, as mentioned above, can be maintained in this form of equality by adjusting annually the quantity of products exchanged and therefore the corresponding credit lines – or according to a balance in value. In this case, a country will ask for more products than it can compensate for in return, so that the credit lines will be granted for the balanced import-export share, while the difference will be settled using a third currency agreed by both parties. The fixity of exchange rates will facilitate this. Indeed, bilateral import-export agreements can change due to the production logic of one or the other partner. This is to be expected but it will not create insoluble problems because of the possible recurrent adjustments, either by readjusting the quantitative agreements, or by resorting to a third currency, or to an assumed deficit.

The fact remains that it is also a question of making the international exchanges resulting from this type of agreement more fluid – which, in due time, could well represent all the World’s exchanges, which would then result in the stabilization of the entire International Division of Labor. The Clearing and Adjustment Chamber makes this fluidity possible. When a partner wants to rebalance its import-export agreements, either in quantity or in value, this platform will give it more room to maneuver according to the balances available on the platform. These balances will thus indirectly but surely guarantee the best global exchange terms, especially if the bilateral agreements are based on the fixed exchange rate and its adjustments that we proposed above.

The productive advantage of bilateral import-export agreements.

If they are based on a macro-economically sound fixed exchange rate, all speculative financial interference will be eliminated, as well as the turbulence that comes with it. Furthermore, and this is crucial, with the exchange value of the products fixed outside of market interference, the prices offered will be structurally discounted by at least 20-25% if not more. Imagine that you have negotiated such agreements for gas, oil, nickel, wheat, sunflower oil etc. with the Russian Federation, then your own microeconomic productivity rate and your own macroeconomic competitiveness rate will be unbeatable. In the case of oil, gas or coal, basically energy, this is even more crucial. As every economic process involves transformations requiring energy expenditure – the electronic and information economy is even more energy-intensive than conventional industry – all stages of production, transport and sale will be affected. Competitiveness will be magnified, and this will be more the case if less philo-Zionist Nietzschean countries take note of the fact that CO2 is beneficial to vegetation and crops – indeed, life is carbon-based – while its level follows and does not precede climate change – In reality, ppm today is given according to the measurement made on Mauna Loa, one of the 16 most active volcanoes on the Planet … see the Category “Ecomarxism” in this same site.

We see that it is necessary to abandon the exclusivist and Malthusian choice of the IPCC prevalent in the USA and the EU, as well as the obscene carbon taxonomies and the even more obscene Green Bonds and pollution certificates, to the putative empire that has now come to believe in its own asinine nonsense originally forged to deceive the masses and the emerging countries despite Nietzsche’s warning in Thus Spoke Zarathustra – hi-han!

Import-export, import substitution, joint ventures and intra-firm trade.

The benefits of this facilitated import-export system should be maximized by acting upstream to adapt the international division of labor as well as possible. Planning makes it possible to foresee Enlarged Reproduction and the necessary public credit in the medium and long term, with recurrent revisions. Import-export agreements with their bilateral credit line swaps make it possible to secure the necessary supply without additional monetary – and political – costs, since these credit lines are mere “jeux d’écriture ” that offer the extreme advantage of not having to accumulate foreign currencies, especially USD or EUR or even the national currencies of trading partners, prior to trade. To complete this scheme, the SFs concerned will adopt a small surtax on imports to pre-empt the long overdue reform of the current WTO definition of anti-dumping, which imposes a global race to the bottom in terms of labor rights and environmental criteria. It will serve to maintain the “net global income” and in particular the “deferred wage” of households at its optimal level calculated to maximize the macroeconomic competitiveness of the SF and therefore its exchange rate. Indeed, no SF can live above this rate of competitiveness for long without incurring permanent external deficits and consequently a prohibitive debt.

Eventually, the definition of anti-dumping will have to be changed, but this is a laborious process since it requires unanimity among all WTO members. The small surcharge on imports will be painless, especially if the import-export agreements discussed here are made away from the deleterious drain operated by speculative markets. On the other hand, it will prevent relocations in the name of lowering the “cost of labor”. This will amounts to preventive import substitution, while acting as an incentive for quality foreign investment. The latter will involve technology transfers without undermining the national coherence maintained through public control, public credit and planning. It remains to add joint ventures, or former EU-type « enhanced cooperation » particularly among State companies, because they not only accelerate the industrial and technical development of the SFs concerned, but they also permanently modify the international division of labor while creating a stable and highly adaptable intra-firm trade over time.

Bilateral credit line swaps, non-interference and repudiation of all extraterritoriality.

The project must aim at an open and equitable multilateral world. It must be compatible with the plurality of regimes, relying on peace and economic development to help them converge, at their own pace, towards the most developed human emancipation possible. Too many crimes have been committed in the name of the otherwise illegal principle of “humanitarian interference” applied à la carte according to the imperial or neo-colonial interests that are thus opportunely concealed. It will necessarily have to put on its pediment the Article 2 of the United Nations Charter, namely the principle of non-interference in the internal affairs of sovereign States, which implies the official and unwavering repudiation of any extraterritoriality. In matters of human rights, one should always distinguish what pertains to civil society as opposed to political society. Global stability and ultimately the progress of general emancipation must be based on the principle of political non-interference. International Law, like the UN Charter and the Universal Declaration of Fundamental Social and Individual Rights, remains the materialization of Natural Law – G. Vico’s “diritto delle genti” – a long and still ongoing historical process.

Generically speaking, this new multilateral order will include an alternative and parallel payment transfer system to the SWIFT system, the basis of which will be composed of the merger of the Chinese and Russian systems, immediately extended to the BRICS, ALBA, the so-called Group of 77, as well as to all the other countries that wish to participate in order to protect themselves from imperial and Western piracy and from debilitating sanctions, which are nevertheless unacceptable and illegal.

There is much talk of sanctions these days. However, it must be emphasized that global speculative finance – dominated by the 4 New York banks – exerts daily pressure on investment and socio-economic choices through the rating agencies that are closely linked to the large US private primary banks. Their judgments are subjective and displayed as such as a defensive legal precaution. However, all institutional actors are required de facto to take them into account. When these opinions relate to non-US companies or funds, or even to the “country risk” of Nations-States, this is beyond comprehension. It is therefore necessary for each major sovereign State to have its own public rating agency.

Paul De Marco

NB: In order to override the sanctions – without losing access to other markets – in addition to the use of the bilateral credit line swaps discussed above, it will be necessary to create national companies and cooperatives that will not be exposed to the countries imposing the sanctions. On the other hand, in the medium term, it is necessary to go collectively or individually to the International Court of Justice and the WTO to demand that extraterritoriality be outlawed once and for all as an abuse of the UN Charter in order to obtain justice, especially when a country has to resort to trade countermeasures. This strategy has already been discussed. I therefore refer to : “Extraterritorialità et legalità: necessarie contro-misure”, maggio-giugno-2018, in http://rivincitasociale.altervista.org/extraterritorialita-legalita-necessarie-misure-maggio-giugno-2018/ (One can use an online translator e.g., www.deepl.com )

Here are some additional protective measures. It is obvious that the abandonment of the national currency on the free-float exchange rate global regime is tantamount to accepting total servility to the World of philo-Zionist Nietzschean and stateless finance. In case of deviation from the new law of the temple of the new merchants of the temple, speculative attacks will be added to the sanctions. Given the phenomenal amount of liquidity in USD around the World, they can bring a country to its knees in a few hours and push them to default, which amounts to making their access to international capital markets more expensive, if not impossible. It is therefore necessary to set up rigorous circuits-breakers that can stop these attacks and immediately impose strict capital controls so as not to waste national reserves in a futile defense of the national currency’s exchange rate. Above all, it is necessary to be able to rely on public credit. Of course, national reserves must always be held within the national space, or at least within national banks or those of friendly nations, in order to prevent them from being frozen. These acts of imperial exclusivist piracy have been going on for a long time, but with a strong and bellicose acceleration since the proclamation of the illegal and criminal “doctrine of preventive war” and the “war – sic! – against terrorism”, this last word not being defined. According to International Law and the UN Charter, sanctions cannot have an extraterritorial scope; likewise, the freezing of a country’s assets constitutes piracy and plain theft of other people’s property, both public or private. It is therefore appropriate to bring the case before the courts of the guilty countries as well as before the International Court of Justice in The Hague to demand the immediate restitution and payment of the damages incurred. Otherwise, International Law does allow for proportional countermeasures.

Moreover, in the context of the multilateral world advocated here, Nations-States with large reserves of USD – or EUR – could put them to good use by killing two birds with one stone; they can reduce their dependency while pursuing their own national interests by accelerating the establishment of a new international division of labor. It is possible to sell these currencies to buy gold, but this valid strategy requires a certain slowness so as not to push the price of the currency in question downwards, which would amount to shooting oneself in the foot. On the other hand, many emerging countries do not yet enjoy the benefit of the bilateral credit lines proposed above. They are therefore heavily indebted to the big American or European banks and to Washington’s two twins, the IMF and the World Bank. This applies to some of their enterprises. One can therefore use some of these dangerous reserves, especially in USD, to buy up all or part of the debts of the most indebted countries and restructure them – say in rubles or renminbi etc. – over the long term in order to reduce their debt. This would be done in exchange for negotiations on medium and long-term import-export agreements together with their corresponding bilateral credit lines, or, in the case of companies, by proposing joint-ventures, especially between State-owned companies enjoying the strong financial-economic leverage offered by public credit. The World would then truly change its foundation and move towards a new order of peace and socio-economic and cultural emulation and cooperation.