Added May 18, 2021: Emblematic sign of the times: in the elections of Saturday May 15 and Sunday May 16, 2021, the Chilean people bury the barbaric neoliberal monetarism of Ludwig Mises and of the Chicago Boys. Notice is given to other peoples!

A ) El insomnio chileno, https://revistacrisis.com.ar/notas/el-insomnio-chileno?fbclid=IwAR2w09ZCK-XAAhzvnZc1v0i_8g8yB6JFQHNeYUEadlEy1rAlepQxzj4odFY v; in italiano: https://contropiano.org/news/internazionale-news/2021/05/18/insonnia-cilena-destra-strabattuta-0139074

B a) « ‘A new Chile’: political elite rejected in vote for constitutional assembly », Victories for leftist and independent candidates over rightwingers paves the way for a long-awaited progressive settlement, https://www.theguardian.com/world/2021/may/18/a-new-chile-political-elite-rejected-in-vote-for-constitutional-assembly

B b )Au Chili, les indépendants domineront l’Assemblée constituante, La droite sort vaincue du scrutin des 15 et 16 mai, chargé de désigner les personnes qui écriront la nouvelle Constitution du pays. Ses membres ont désormais un an, au maximum, pour rédiger le texte. Par Flora Genoux(Buenos Aires, correspondante) , https://www.lemonde.fr/international/article/2021/05/17/au-chili-les-independants-domineront-l-assemblee-constituante_6080454_3210.html

C ) Comrade singer-songwriter Victor Jara had already told the Right: “No es Chicha Ni Limoná”, https://www.youtube.com/watch?v=OTm6TymxJq0

D ) For the rest it is enough not to confuse the CPI which approximates the consumer basket and the Price/Earnings ratio of the stock market and speculative finance

xxx

Neoliberal monetarism claimed to replace dual economic and monetary management by monetarist management alone, based on deregulation and excessive privatization. The disruptions produced by this nonsense are there for all to see.

The fact remains that if a phenomenon is not a monetary phenomenon, not only will it be useless to treat it by intervention of the Central Bank, but such blind and ideological intervention will make things worse. Socio-economic contradictions require appropriate socio-economic interventions.

The current price hikes are transitory – raw materials, cereals, electronic chips. They are largely due to the health crisis. But decarbonization and its effects – administered prices, internal and border carbon taxes, artificially rising production costs – risk being permanent, while the dominant economic theory does not understand anything about it… This in the midst of a crisis restructuring leading to mass unemployment and not so creative destruction – mergers, robotization, AI, platforms etc. What a mess, eh ?

Almost everyone is now denouncing a resurgence of inflation (1) and (*) while we are dealing with shortages of raw materials, goods and electronic chips in a context of lockdowns and a vertiginous rise in unemployment, partial unemployment and poverty.

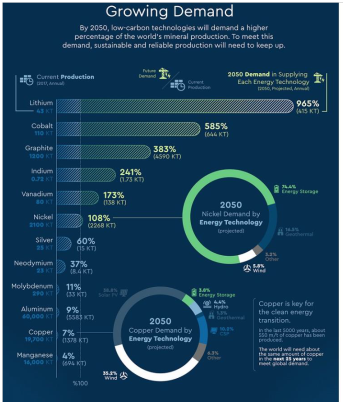

Historically, the demand for raw materials has known ups and downs according to cyclical or long capitalist crises, i.e. the so-called Kondratiev cycles, for which I have already pointed out that they correspond to the massification of successive technological waves. This was the case, for instance, with the driving and labor-intensive new or intermediate sectors after the Second World War – automobiles and transport, household appliances, culture and leisure, etc. Today, the new sectors and the new intermediate sectors are capital intensive. In addition, recycling plays a greater role. Therefore, although the world is not “finite” because of the power of successive increases in productivity and the scale of new discoveries – e.g. nodules in the seabed etc – a small secular rise in prices may materialize thanks to the economic take-off of certain emerging countries, but this takes place within the framework defined by these counter-trends.

The rest, as is being verified today, has to do with the evolution of the socio-economic and health crisis and its disruption of supply and delivery chains. This crisis can very quickly be aggravated by the eruption of a criminal New Cold War with its rehabilitated shackles, that is to say the new Cocom and the military-industrial and strategic complex of the Atlantic Alliance, now out of mandate because out of the regional zone – Ch. VIII, Art. 52 of the United Nations Charter. This alliance comes complete with its military Unified Command. However, this archaic alliance, contrary to the doctrine European defense and security independence and contrary to the doctrine of strictly defensive warfare – e.g. Art. 11 of the Italian Constitution – is subservient to crossed external interests, brutally exclusivist and contrary to our Constitutions, to the UN Charter and to the Universal Declaration of Rights of 1948. All these civilizational texts are the result of the alliance against fascism and Nazism.

We also know that the phenomenon of concentration and centralization of capital – mergers (2) – is on the rise again and that it will go hand in hand with the expected but underestimated effects of robotization, AI, uberization and the restructuring of platforms to the detriment of small and medium-sized businesses and small traders.

There is sometimes talk of “imported inflation” but this expression is often inaccurate because it does not necessarily refer to an essentially monetary phenomenon. This can be seen today in the prices of gasoline and oil, and to some extent in the prices of raw materials and foodstuffs. The statistics do not support this fear. There have been production problems due to the lockdowns, but above all we have had to deal with delivery difficulties, with many containers queuing up and experiencing long delays in unloading their cargo, for example on the West Coast of the USA.

We will see below that decarbonization is likely to lead to a sharp rise in prices, turning what was previously a temporary problem into a permanent one. The marginal and temporary increase in the price of new cars is due to lockdowns and the difficulty of sourcing electronic chips, which is somewhat less the case in the United States. (3)

It will be recalled that the hemispheric free trade agreement, later extended to Canada and Mexico with Nafta, promised “jobs, jobs, jobs” even though its designers knew that this choice would trigger the destruction of many jobs through the offshore relocation and outsourcing of the so-called soft and/or polluting sectors, as well as the soaring precariousness of the mass of workers. Since public transport is not as developed and accessible as it once was in Europe, they took care to provide for the mobility of precarious labor by artificially instituting a continental used car market. In the past, I denounced these Lemons Nobel Prizes. They are still at work, faithful to themselves and to their monetarist neoliberal nonsense, more destructive than creative. So this is how it stands, in the midst of a crisis, for evolution of new and used car prices.

Some advocates of the inflation rebound, stunned by the increase in prices, are looking for a monetary solution. For example, the $1.9 trillion support plan in the US, part of which was allocated to households. They also point to forced savings accumulated during the lockdowns that are now being released.

It has already been shown that these payments to households and unemployment insurance payments did not create much savings, except for the wealthier households, the others being too busy paying rent, credit cards or other debts, including the obscene student debts in an anti-democratic, privatized and unaffordable educational system. In the US, as in France and elsewhere in the West, the vast majority of these savings are held by the richest 20%, and especially the 10% and the highest percentile, or even its wealthiest fractions. So much so that J P Morgan had anticipated things, even creating a few stirs on the Repos. (4) ( Added on Mai 24 2021: We already said elsewhere that the Repos largely due to the fact that banks are now so vulnerable that they do not lend to one another on the inter-bank market. Hence the FED is obliged to intervene and will be obliged to do so increasingly as new speculative assets are added just to allow rotations. Lately, the fall of bitcoin probably explains the new rise. This adds to the chronic credit crunch. – On reverse repos see: http://rivincitasociale.altervista.org/a-quick-comment-on-inflation-qe-and-public-debt-rotations-repos-and-reverse-repos-may-27-2021/)

As I had already announced in March 1985 in my “The socio-economic consequences of MM Volcker-Reagan and Co” (5) at the very beginning of the monetarist neo-liberal cycle which is now in the process of sinking before our eyes, the poorly redistributed wealth goes to the richest who do not invest it in the productive economy because they no longer know how to remove the contradictions by sharing productivity gains and socially available work and by deepening the essential services offered by a strictly public Social Security. A highly emblematic epiphenomenon, the buybacks, the height of this speculative absurdity turning in on itself, are on the rise again. (6)

Poor Pigou thought he could criticize Keynes by anticipating Hicks’ and Solow’s nonsense about automatic economic equilibrium, provided that rigidities were eliminated in the markets, especially in the labor market. I have already shown how the pitre R. Solow had simply modified the variable L (labor) in his production function y = f (K,L). He did this by removing the Keynesian notion of control, the independent variable in the set of interdependent socio-economic variables, namely “full employment” which, at the time, could not be conceived of as anything other than full-time, apart from chosen part-time and frictional unemployment. His “razor hedge equilibrium” was based on this ineptitude, calculated on purpose. The 1956 article that won him the Nobel Prize is based on this well-rounded falsification – tondo, tondo come l’O di Giotto? It signals the will to “return” to the Marginalist pre-Keynesian foundations, a regressive return finally accomplished with the predominance of Ludwig Mises and the Chicago Boys under Reagan.

Pigou and Hicks did not take into account the income structure – let alone inflation. The monetarist neo-liberals have further aggravated this flaw and, as we have seen above, they repeat and propagate it like parrots. For them, the facts are always wrong: if they deviate from their authorized narratives, it is because markets are still too rigid and still need to be deregulated and made more flexible. Such arguments are not falsifiable, to put it with the neo-positivist pitre Karl Popper. It would be wrong to believe that the zany theory of “capital efficiency” is original. I have already shown, for example in my Methodological Introduction, in the Livres-Books section of my old website www.la-commune-paraclet.com , that no Marginalist and/or bourgeois theory is capable of differentiating between micro-economy and macro-economy and thus between real and speculative economy. Ontologically speaking, the crisis is not part of the “market” mechanism, and even worse, speculation, necessarily of a temporary nature according to Marginalists, should accelerate the return to equilibrium and to fair prices! The analysis of crises is relegated to historians – like John Galbraith initiating his analysis with the Dutch tulips – outside the paradigm that is incapable of integrating it.

Basically, all these bourgeois narrative edifices are based on the desire to conceal the dual form of all commodities – use value and exchange value – as well as the specific nature of the commodity “human labor power”, which alone is capable of creating economic exchange value. In short, what I have called the liquefaction of the factor of production labor power begins with J.B. Say manipulating Ricardo’s paper currency, a maneuver aimed at giving the factors of production, capital and labor, only in their liquid monetary form. The real worker with his needs and struggles disappeared from the equations.

It is true that in the US, government transfers now account for almost 20 to 30 per cent of household income, which today includes federal assistance and unemployment insurance payments. We have repeatedly noted that even as 18 million people were unemployed in the very midst of the crisis and the participation rate was down, American “median disposable income” had increased. No economist has ventured to comment on this significant phenomenon, which points to a rise in undeclared work and an extremely unequal structure of disposable household income that could produce such a median.

Add to this the fact that today there are cries in many American states against the presumed lack of labor. According to them, by receiving $ 300 per week for a little while longer, workers would become “couch potatoes”… It is the old puritanical philosophy of “means tested care” placing unemployed citizens under control. The same thing is done with the obscene Beveridge Curve: shipbuilding companies, for example, are no longer able to find plumbers! But as good followers of supply and demand, nobody among these people, dares to ask the question of the adequacy of the salary and of the working conditions…

For the “working poor” – Julius Wilson – who survive by working several jobs and other gig jobs in massacring weeks, the dose of physiologically necessary rest should be a sacred right … because it is also a matter of reconstituting the labor force. In short, sanctimonious people should take a look at the mechanical arms equipped with sensors capable of browning the fries while turning the slice of minced meat and soy on the grill, while a robot colleague will take care of the table service. The slice in question could soon come from an organic laboratory directly integrated into the fast food outlet.

In short, it is neither the real salary mass nor the social salary mass – the former plus the various aids accruing to the non-working labor force – that explain the price increase we are talking about today. For these two concepts, which make it possible to define structural inflation – the most important of the various forms of inflation – namely the social salary mass over the real salary mass, I refer the reader to my Synopsis of Marxist Political Economy, freely accessible in the Books section of my old site www.la-commune-paraclet.com

I will limit myself to giving here the simplest scheme allowing everyone to think for themselves. The scientific production function is written: c + v + pv = p. The first term « c » is « used-up » capital – to borrow from P Sweezy -, the second « v is variable capital which is paid a salary, the third « pv » is the surplus-value en « p » is generically the product of this production function. Let us take the Simple Reproduction Scheme – or stationary equilibrium – in the immediately coherent case where the rate of organic composition of capital (v/C where C = c + v) and the rate of exploitation (pv/v) are identical in the two Sectors, the SI Sector of the Means of Production (Mp ) and the SII Sector of the Means of Consumption (Cn). Everything is then immediately consistent both ex ante and post hoc.

I have shown, moreover, since the publication of my Tous ensemble (1998) that this coherence is not a special case; it remains as long as the Marxist law of productivity is demonstrated and integrated in a scientifically coherent fashion the Simple Reproduction (SR) and the Enlarged Reproduction (ER), which I alone was able to do by following Marx scientifically. We would have in a situation of full employment:

SI = c1 (80 MP/80 €) + v1(20Mp/20 € + pv1 (20Mp/20€) = 120 M1 (120Mp/120€)

SII = c2 (40Cn/40€) + v2(10 Cn/10€) + pv1(10Cn/10€) = 60M2 (60 Cn/60€)

= c + v + pv = M The macroeconomic function of total capital.

v= 30 hours of work = 30€.

Here v/C and pv/v being identical in SI and SII, 1Mp =1Cn =1€.

Let us introduce the productivity that would have deepened by 1/4 in SI; we would have:

SI = c1 (105 MP/84 €) + v1(20Mp/16 € + pv1 (25Mp/20€) = 120 M1 (150Mp/120€)

SII = c2 (36Cn/36€) + v2(9Cn/9) + pv1(9Cn/9€) = 54M2 (54Cn/54€)

= c + v + pv = M The macroeconomic function of total capital.

v = 25 hours of work = 25 €.

Here 1Mp = 0.8 € and 1 Cn = 1€. This reflects the difference in productivity.

But now there are 5 hours of “freed” labor that constitute the Proletarian Reserve Army or RA. Let’s assume that RA is paid ½ of the active labor force, with the Central Bank printing the missing amount. We will have:

RA = €2.5 . Real salary mass = €25. Social salary mass (the former + RR in €) = 27.5€.

The structural inflation rate will therefore be 27.5 / 25 = 1.1%.

This inflation will be reflected in all the price expressions of the system via the exchanges mediated by the monetary salary masses which are sufficient and necessary to do so. To obtain the new “value-price” expression scheme, we simply multiply the exchange value terms by the inflation rate. All other parameters, in particular v/C and pv/v, remain unchanged.

Marx’s Schemes, by me re-established thanks to the demonstration of the law of productivity reintegrated in a coherent fashion the SR-ER Equations, are able to give simultaneously all the terms, be they quantitative, exchange values – and prices – by introducing the inflations and even are even able to do so in hours terms, if we want to. It can be verified easily by giving the terms in hours rather than in € in our schemes , e.g. 20 hrs = 20€ . This coherence of the economic calculation no other theory is capable of even approaching it. The demonstration of the Marxist law of productivity sweeps away all the falsification known as “the problem of the transformation of values into production prices”. I have shown in my Tous ensemble – and in English in my bilingual Book III Keynesianism, Marxism, Economic Stability and Growth (2005)- that this false problem is a falsification which is due in particular to Böhm-Bawerk; my demonstration is complete and definitive since it concerns both the logical argument and its historical genesis.

I recall that in the study of Sismondi’s Annual Income and Quesnay’s Tableau etc., i.e. in the study of Simple and Enlarged Reproduction, what opened the way for Marx was his realization that equilibrium – whether stationary or dynamic – should materialize a socio-economic reproduction both in quantitative terms – Mp and Cn – and in qualitative terms – exchange value and price. The production function contains the seeds of reproduction since constant capital “c” refers to Mp and variable capital “v” refers to Cn. This is why two large Sectors suffice, all the sub-sectors, branches and industries can be subsumed under these two. The “invisible hand” imposes an equilibrium in monetary terms – confusing money and credit – which imposes an underlying equilibrium in Mp and Cn that is completely random and post hoc, not responding to any social or socio-economic logic, but only to the logic of the accumulation of capital for the benefit of the largest actors – the laws of motion of capital including the centralization and concentration of capital

The variable “v” of total capital represents the real salary mass, here in a situation of full employment, so that the SR scheme is strictly an exchange value scheme. There is no inflation of any kind. The magnitude of “v” is sufficient and necessary to ensure all the exchanges allowing the reproduction of SR – quantitative and qualitative, hence in exchange value. (See the rotations that formalize the exchanges in Tous ensemble freely available in the Livres-Books section of my old site www.la-commune-paraclet.com )

Why does the real salary mass necessarily have to correspond to “v”? Rather than depending on the whim of the Central Bank? For the simple reason explained in Tous ensemble, that social life, and therefore the social division of labor, and therefore socio-economic reproduction, would not be comprehensible without the worker’s prior advance of his living labor, which the owner of the Means of Production only pays for with the wage once the work is done, but only in part. In a 7-hour day, if 3 hours of living labor spent in the production process are sufficient to renew the wage, the other 4 hours of surplus labor are pocketed by the owner of the Means of Production because s/he is legally entitled to do so due to his private ownership of these Mp.

If you now introduce productivity in a sector, this sector will produce more products in the same working time but with v/C and pv/v ratios deepened by the new productivity. The unit price of the products will fall accordingly. The labor power evaluated in terms of the goods necessary to reproduce it will remain the same since productivity is a structural intensification of work. But it will imply proportionally less physical workers since capitalist productivity “liberates” a part of the labor force, reducing it to unemployment.

This portion of the labor force made inactive was formerly taken into account by the return to the countryside and or within the extended family. The assistance was a charitable assistance and in any case always subject to social opprobrium and “means tested”, something which comes back in fashion today. Yet everyone knows that this creates poverty traps from which it is almost impossible to escape. Rather than talking about “inheritance for all” – Raymond Devos to the rescue: inheriting from someone who has nothing, would amount to twice nothing? Or, in any case, not much… – Within the framework of the Reduction of the Working Week – RWW- and a portion of chosen part-time work, let’s start by substituting a weekly Smic to the disastrous hourly Smic because it leads to endemic precariousness; let’s equally suppress the conditions of resources, which lead to ignoble real poverty traps calculated as such, and which flies in the face of the Constitution which did not foresee the right and the duty to work without dignity, that is work that would not ensure a « livelihood » – Polany’s terms – worthy of a citizen. This is the reason why our newly philo-Semite Nietzschean elites are slashing social insurance, seen as a fundamental social constitutional right, in order to illegally return to this social assistance, which is more and more often charitable and always subject to income and asset conditions.

It remains to understand the mechanism of this social assistance. When labor income is limited to the individual wage, this assistance does not correspond to a value created by labor. Where does it come from? It comes from the sum always stingily paid by the authorities, which brings us back to the financing by the Central Bank. The active population is therefore left with its salary and the inactive population with this social assistance. The two form the social salary mass. The ratio of the social salary mass to the real salary mass gives the rate of structural inflation, the major form of inflation, because there are several others.

On the one hand you have the real exchange values produced in the SR. On the other, the social salary mass, part of which is a monetary creation ex nihilo. But money is legal tender. The active population and the inactive population buy in the same stores, so that the mechanics of exchange propagate and give rise to structural inflation.

The entire proletariat – all those who work or are deprived of work – pays the price. The wage is eaten up by inflation. This is the reason why the workers’ struggles have taken various forms throughout history:

The first instinctive form was to protest against the effect of inflation on the standard of living by demanding wage increases or even the indexation of wages to “inflation” or CPI.

The second, more informed, aim was to institutionally protect workers against periods of inactivity. This eventually led to the institutionalization of some savings, in particular through the creation of public Social Security based on what I have called “net global income” of households. It includes the individual net salary, the deferred salary – social contributions financing notably pensions, unemployment insurance, health insurance, etc. – as well as what returns to citizens in the form of guaranteed universal access to public services and public infrastructures, precisely what the Marginalist “disposable income” excludes from its scope! When the other two components of the “net global income” of households are solidly institutionalized, the net individual wage goes further, alleviating “the fear of tomorrow”, which opens up what was nicely called “the happy days”.

The three components of “net global income” of households implement virtuous circuits of capital which equally play the role of socio-economic stabilizers, as Beveridge and Keynes perfectly understood.

Whereas the net wage corresponds to a classical liberal « Censitarian » capitalism which reduces the share of “v” in the total production function c +v + pv = p to its strictest expression of survival, the “net global income” of households represents a new epoch of redistribution of the Capitalist Mode of Production – CMP – whose popular conquests correspond to what we commonly call the Welfare State or, better still, the Social State. Whereas all the “pv” or profit went to the owner of the Means of Production, with the Welfare State it is recognized that the worker, being a member of a sexually reproducing species, must not only reproduce individually in order to return to work the next day, s/he must also reproduce as a species within a household.

A new phase of the class struggle opens, aiming at a better sharing of surplus value. It is now increasingly conceived as social surplus value, which in principle belongs equally to all those who participate in its creation and which a society on its way to an ever more accomplished democracy will share more and more equitably until the establishment of socialism, which will ratify “social surplus value” as such within socialist democracy based on interactive citizen planning.

Today the philo-Semite Nietzschean leaders are trying to reverse this trend by dismantling the Social state. This reversal is incompatible with the logic of capital accumulation, which requires an appropriate social demand within the framework of sustained dynamic reproduction. The CMP is constantly confronted with its main contradiction opposing overproduction and underconsumption, a contradiction that is increasingly being undermined by foreign trade. So this attempt seems doomed to failure unless it is able to impose a newly philo-Semite Nietzschean “return” to a society of new domesticity and new slavery. The corporatist dictatorship will then attempt to substitute the defense of private property for formal capitalist unequal democracy. This is happening today before our eyes.

The third form of workers’ resistance to the erosion of their standard of living is to go to the root of the problem to re-impose full time employment through recurrent cycles of RWW – according to the possibilities offered by micro-economic productivity and macro-economic competitiveness of the Social Formation. No country can sustainably live beyond its means, although this does not prejudge the equality of the internal redistribution system.

Of course, there will remain a frictional unemployment rate – seasonal or transitory when it is due to restructuring – as well as periods of inactivity beyond the citizens’ control. – retirement, illness, unemployment. This is why in Tous ensemble we have spoken of “civilizational inflation” since it implements the conscious solidarity between the active and inactive population as well as a “value-price equilibrium”. In periods of full employment, the exchange value and the price coincide; with structural inflation, via the exchange that imposes it on the whole system, the exchange value and the price differ according to the rate of this inflation. But this is then scientifically apprehended and integrated into planning via two mechanisms: full employment, structurally reducing the problem to a minimum, and the Marxist recovery of the Fisher Chain.

This last recovery is all the more controlled by the socialist Central Bank and by planning since we now have, following my scientific contributions, a series of vital scientific distinctions. Namely, between money and credit, between classical credit and speculative credit, between classical interest rate and speculative interest rate. The latter is today disguised as a profit rate, legally legitimized, which allows the speculative economy to swallow up the real economy via the Roe etc. We also know that the socialist Central Bank in the service of planning will leave behind the ineptitude of its blissfully uniform central interest rates and replace them with modulations of the prudential rate, and thus of the volumes of credit available, via offices specifically attached to the different sectors and branches included in the SR-ER.

The transition from classical liberal capitalism gravitating around the individual wage alone to advanced capitalism – the Welfare State or European Social state – based on the logic of the “net global income” of households is essential to understanding socio-economic and therefore inflationary dynamics. In particular, the conscious deconstruction embodied by the barbaric “return” to the individual wage set in global competition by the current definition of anti-dumping inscribed in the functioning of the WTO and all the free trade treaties.

In a system based on “net global income” of households and on full employment as the norm – especially if it is based on public credit issued by the public central bank and on indicative and incentive planning – inflations, apart from imported inflation, are negligible. This was the case in France and Italy until the late 1960s. Then inflation began to rise with the rise in unemployment, without RWW to mediate productivity increases. The end of the GATT, i.e. of the external parameters, made things even worse in the context of a “mature society” according to the expression of François Perroux and Maurice Allais’ Fracture of ’74, which I analyzed in Note ** of my Book III, see my old site.

The dismantling of GATT had begun with the Dillon or Kennedy Round. It explains in part the reluctance of bourgeoisies to return to full employment with the RWW, because the latter imposes either a greater economic competitiveness than that of competitors – which is possible when social security is entirely public, thus structurally reducing production costs – or a form of tariff protection. The latter could take the form of Mr. Allais’ Community Preferences or, taking globalization for granted and transforming it into Fair Trade thus replacing the neo-liberal monetarist Free Trade, my proposal for a small import surtax to compensate for the loss of income for the Social Security caused by the current anti-dumping impact on social contributions. As this surcharge is not discriminatory and falls under the exclusive national competence of EU member states, there is no obstacle to its implementation, pending the negotiation – unanimously at the WTO – of a new definition of anti-dumping based on the three components of the “net global income” of households at the WTO. It is a question of political will and of the constellation of power relations.

With the gains in productivity, not redistributed by the RWW, which would have made it possible on the contrary to reabsorb unemployment, the defensive cycle of wage indexation was set in motion in the 1960s and 1970s. The bourgeoisie cynically applied it by revisiting Schacht, or Léon Blum and his Atlantic advisors after the Grenelle Agreements, or Pompidou after 1968! For example, in the USA, collective agreements were established in large companies taking into account the Cola Clause – cost of living allowance. Then they were generalized, but through inflation one took back with one hand what had been given by the other hand. This led to what was called stagflation, a system combining structural inflation and a high unemployment rate corresponding to an increasing dualisation of the labour force, which opened the way to the current rampant precariousness with its joblessness, undeclared work and so on.

In 1979 Volcker was appointed head of the Fed and in 1981 Reagan became President, while Thatcher had been at 10 Downing Street since 1979. The neo-liberal monetarist counter-reform was set in motion by the brutal suppression of the unions, which until then were conceived as a necessary counterweight to the exorbitant power of big business. (See Note 15 on John Galbraith in my Book III.) This was followed by the growth of precariousness, the reduction of wages without real indexation and the passage to socio-economic and financial anomie, in particular with the emergence of private credit and the monetization of public debt on the international financial market. All this with the dismantling of the Social state and the virtuous circuits of social security, as well as the forced return to the individual wage alone, supported at the margin by a reduced social insurance and a social assistance that is more and more charitable, even confessional, and subject to means testing and to a Reagan-style workfare.

One might therefore object that since the social salary mass would rise with unemployment, structural inflation should be more present today.

This would be true:

a ) If productivity gains were shared, but they are no longer shared in the EU, nor have they been for a longer period in the USA; already in the mid-1990s, in support of the RWW, several of us pointed out that over the last 20 years more than 8 to 9 % of GDP had been transferred from labor to capital without any compensation, except increased precariousness and poverty.

b) If public social security covered the essential needs, which it does not in the USA – health, pension, etc. – and, less and less in the EU, it would then be more efficient because public social security corresponds to institutionalized savings, materializing the passage from classical liberal capitalism to advanced capitalism. The class struggle and the social modernization that followed made people aware that labor power was embodied in a human being who was a member of a sexually reproducing species that had to reproduce itself as labor power but also as a human being within a household. The three components of “net global income” replaced the worker’s individual wage. In the second chapter of my Book III I analyzed this transformation of the “structure of v“. It affects the division of the sum (v + pv ) between labor and capital and consequently the rate of profit, i.e. v/(c+v). The surplus-value is more and more considered as “social surplus-value“.

c) If the increasing precariousness and the regressive “rehabilitation” of the role of the family as a social stabilizer were not used to absorb the distortions. This relieves the State of part of the cost of financing social assistance. The entire Reagan monetarist neoliberal ignominy – from the sacking of striking airmen to the attack on collective agreements – is that wage deflation was imposed with increased precariousness, while social security payments were reduced to a minimum and often made temporary. The same was true of Trump’s and then Biden’s temporary federal aid to alleviate the effects of the health crisis. I note that Trump lost his election the moment he cut federal aid to the unemployed in half while continuing his giveaways to the wealthy; he thus lost the few needed votes in industrial and mining states that he had won in his presidential election.

By regressing from ” net global income » of the household to a “wage structure” increasingly reduced to individual wages, and by replacing the institutional but temporary support in a full-employment system for the idle labor force with the precariousness imposed by workfare, no one will be surprised to find that the Volcker-Reagan couple slayed the inflationary dragon. In the same way, remaining logical, no one will be surprised to see that this method led to the increasing impoverishment of workers. We revealed this logic in our March 1985 essay cited above (see below Note (5)) entitled “The socio-economic consequences of Volcker-Reagan and Co’’. We only need to add the increasingly unbridled development of international financial and speculative capital, the main stages of which are described in my Book III and in the articles available in the International Political Economy section of my old site, including “Credit without collateral“, “The Treasury and the FED” and “The Fed dilemma“.

On the other hand, it should come as no surprise to anyone that under this new “structure of v”, the precarious workfare and the hyper-inegalitarian income structure, it is impossible to revive structural inflation even to the modest level of 2 per cent. However, given the real unemployment figures, this percentage would still be far from what we have called “civilizational inflation”.

Added to this is the confusion between money and credit, which originates in Irving Fisher’s consciously falsifying concept of the “income stream“. This emulator of Böhm-Bawerk wanted to erase the distinction that Marx proposed in Book III of Capital between wage, profit and rent, since these three forms of income were presented as the objective basis for the division of capitalist society into three great classes, workers, landowners and capitalists. (See my Methodological Introduction in my old site). This shapeless magma, designed to erase the class struggle, led Fisher to develop all sorts of indexes allowing him to keep a semblance of control over the moving economic reality, among which the inflationary indexes that would become the CPI and the PPI. Today, everyone happily confuses these indexes of the purchasing power of “money” with markers of the standard of living provided by the “net global income” of households. (see: PURCHASING POWER, STANDARD OF LIVING, SOCIALLY NECESSARY WORKING TIME AND “GLOBAL NET INCOME” OF THE HOUSEHOLDS, 2-31 Dec. 2018 | Blog di rivincita sociale )

In addition to the Fisher indexes, monetary aggregates were developed, always on the basis of the confused magma of the “income stream” in the hope of keeping control over monetary policy and economic growth. The confusion between money and credit became irremediable. The situation became even worse with the development of speculative credit, since this form of credit and the recurrent bailouts by the central bank distorted the feedback and therefore control mechanism based on the fractional system. With this system, the prudential ratio must be respected, so that the supply of credit by the banks evolves with the state of the economy. In times of growth, credit is more affordable, while in times of crisis, banks have to cut back to protect themselves by respecting the ratio.

Speculative credit and its recurrent bailouts have destroyed this mechanism, and that is why I spoke of “credit without collateral”, the only de facto ratio that remains is central bank liquidity, which is now in continuous flow. The evolution is so unnatural that the aggregates are almost useless. In fact, the Fed no longer calculates M3 and the other central banks that continue to do so take no account of the gigantic shadow banking, black pools and OTCs. At best, we can say that, apart from metallic money, M1 plus a part of M2 corresponding to individual savings and household investments, correspond roughly to the salary mass…

It is easy to see that this Fischerian confusion, which is an integral part of the dominant paradigm, distorts everything by confusing money and credit. The simplest example is that of the tides of liquidity poured out by the Central Banks: far from causing inflation – in the singular!!! – they cause a chronic “credit crunch” and increased poverty since speculation cannibalises the real economy. ( see : The Fed finally admits: it does not know what inflation is, Sept-21-2017, in http://rivincitasociale.altervista.org/the-fed-finally-admits-it-does-not-know-what-inflation-is-sept-21-2017/ )

This explains why :

a ) No US economic recovery after the subprime crisis broke out produced real inflation, in the official CPI sense – for shadowstats, it’s a different story, see my essay on GDP. In fact, they were always “jobless” or “jobs shedding” recoveries encouraging at best the race to shitty or gig jobs;

b ) QE and other liquidity – going to speculation – did not produce inflation; Mrs Janet Yellen is a witness to this (7) ;

c ) Federal aid from Covid, which partly reflects income inequality, does not create any monetary inflation, except for a marginal and transitory one, currently hovering around 0.4 %. But it does create more potential speculation, which is already being captured by JP Morgan and others. In the meantime, Congress has refused to raise the – hourly – minimum wage to 15 dollars (more or less 12 euros)

A good question for the capitalist central banks would be to ask themselves, in view of the formalization of the “structure of v” in of more or less developed “net global income” of households, how much would it be necessary to increase this “structure of v” to obtain a real structural inflation? According to what was said above, the answer is :

A ) Under full employment, provided that productivity gains are shared – thus conforming to the underlying exchange value terms – structural inflation will only concern frictional unemployment, as is the case in our diagram above, if the payment of RA is ensured by additional monetary issuance by the Central Bank. We know that today, in the framework of the gigantic tax expenditures corresponding to the monetarist neo-liberal public policy, contributions are scuttled under the pretext of reducing the cost of labor – blithely confused with the cost of production, which alone matters for exports -, the transfer of responsibility being made to an evanescent general fiscal revenues.

B ) In this same scenario, if the five branches of social security – retirement, health, unemployment insurance, work accidents, old age – were financed by social contributions or deferred salaries, there would be no structural inflation, as long as the gains in productivity were shared out in accordance with the underlying terms of exchange. In fact, contributions that fall within the framework of the sharing of value between capital and labor eliminate the need to resort to additional monetary emission without value support. Of course, management will be simpler if full employment is respected.

B a ) This will continue to be the case for the third component of “net global income” of households financed by taxes. Here again, there will be no need for ex nihilo money creation. Moreover, and this is the case today in France and elsewhere, even if almost half of the workers earn too little to pay income taxes, the problem is solved by social equalization: for example, a highway that is built can be used by all. Of course, this will be more obvious when public infrastructure and services are still offered by the public sector to the citizens who use them – and not to clients who will have access only if they can pay the tariffs.

C ) As we can see, problems emerge when money – real and social salary masses – are confused with credit, and even worse with speculative credit. In this case, structural inflation will correspond to the part of monetary emission without value support, including deferred salaries and taxes, part that will enter the social salary mass. For example, Biden’s $1.9 trillion in debt-financed aid package went partly to households but in a very unequal way, causing more speculation than transitory monetary inflation, which merely hovered around 0.4%. – (Speculative bubbles – financial derivatives etc. – do not count as inflation in the more or less correct sense of CPI or “consumption basket” of households approaching the salary mass. )

C a ) Irving Fisher transformed money and credit into a shapeless magma, the “income stream”, in order to make the three sources of income on which the three great classes explaining the class struggle in Book 3 of Capital were built disappear: wages, profit and rent. All of them, whether capitalists, workers, peasants, housewives, unemployed or retired, are conceived according to the Marginalist psychological absurdity that attributes an “acquisitive mentality” to all at all times and in all places, including in societies that respect the potlatch. All are supposed to maximize their personal gains by calculating the profitability or the risk of their investments as well as their temporalities. The dismantling of the Welfare State and of the more developed European Social State dangerously reduces the “net global income” of households to a Marginalist “disposable income” that excludes precisely what is most important for the standard of living, namely universal citizen access to social services and public infrastructure. In short, social contributions are increasingly replaced by financial investment by households. This is done in a particularly unequal way, given the precariousness of labor as well as the tax credits and other tax expenditures.

If on average 20% or 30% of the income of American households – the better off portion – comes from investments that are now speculative, then the question arises of the amount of structural inflation thus created. This comes from the fact that credit is a monetary creation anticipating investments. In the capitalist regime, this anticipation is mediated by the fractional banking system with its prudential ratio. This is the only cybernetic self-control mechanism of the capitalist system: it imposes on banking and financial capital to open or tighten the credit valves according to economic evolution, thus giving the central banks a certain control of the situation by managing central interest rates.

Within the framework of the “invisible hand” driven by individual profit, the allocation of available resources – reinvestment and credit – is done without taking into account essential social needs, nor the quantitative balance – in Mp and Cn – necessary for the harmonious reproduction of the system. This creates an expansion in some sectors that goes hand in hand with a contraction in others, namely the cyclical crises of the MPC or trade cycles. Longer cycles – the so-called Kondratiev cycles – concern the introduction and then the exhaustion of successive waves of massive technologies. Unlike the situation after 1945 – cars and transport, household appliances, etc. – these sectors are now very capital-intensive. The “déversement” – A Sauvy – of freed labor from one industry to another is becoming increasingly difficult.

In the era of unequal redistribution corresponding to hegemonic speculative capital, the speculative interest rate – always deducted from profit like any interest rate – is legally imposed as a legitimate rate of profit. This deception initiated with Volcker-Reagan found its legal completion with the repeal in 1999 of the New Dealers Glass Steagall Act of 1933. This abrogation removed the salutary compartmentalization between the 4 pillars of finance, namely depository banking, commercial banking, insurance and credit unions. This led to the de facto disappearance of the prudential ratio inherent to the fractional system, thus laying the lax foundations on which the subprime crisis and its perennial aftermath developed. This speculative fraction of capital then enjoys an enormous advantage since its organic composition requires less fixed capital. Thus speculation cannibalises the real economy with its unsustainable Roe. Moreover, let us repeat, the constant flow of liquidity – QE, LTRO, TLTO, PEPP, etc. – issued by the Central Bank replaces de facto the prudential ratio and its self-control action. The speculative economy is freewheeling and disconnecting itself more and more from the real economy, a process perfectly illustrated by the current economic contraction and the booming stock market.

Thus, part of the income of the wealthiest households will correspond to the ex nihilo issue of the Central Bank. However, the share corresponding to the “consumption basket” or CPI is very small. I refer again to JP Morgan’s speculative expectations for the portion of the $1.9 trillion in aid from the Biden administration going to the wealthiest households and thus speculatively reinvested. (See note 4 below.)

Imported inflation can also be a monetary phenomenon. It must therefore be taken care of by the exchange rate of the currency. In theory, it should correspond to the macroeconomic competitiveness rate of the Social Formation, as explained in Tous ensemble.

It would be wrong to believe that floating exchange rate regimes can solve this problem. These regimes emerged from the end of the convertibility of the US dollar into gold, which was decreed by Connally-Nixon on August 15, 1971 and then ratified at the official burial of Bretton Woods at the Jamaica Summit in 1976. They are based on the theoretical illusions of the monetarist neo-liberals who claimed that global competition in the global market for capital – and goods via free trade treaties – would quickly lead to equilibrium, and thus to the right exchange rate and international price stability. This was another monumental ineptitude which in fact produced much more instability, the Plazza Agreement, Tech Bubbles, the Baht crisis, the Ruble crisis, the Doha Agreement and then the Dubai Agreement, etc., seeking to stabilize the level of the main currencies according to the model of the Plazza Agreement, which Volcker-Reagan had to concede to Thatcher and the EU. The international turmoil of the subprime crisis and the current endless series of permanent bailouts via QEs etc, testify to the real instability absent from Marginalist and monetarist equations. This was foreseen as early as my “The socio-economic consequences of Volcker-Reagan and Co” March 1985 (see note 5 below)

The problem is possibly more serious in a single currency area like the Eurozone – or when we have to deal with a rigid peg to the US dollar or another foreign currency. In Tous ensemble, I had called for two things from the ECB:

a ) National Cooke Ratios coordinated by the ECB within a fluctuation band; this would have allowed the necessary flexibility for monetary management within each member State. One week after the publication of my Tous ensemble, according to the old rabbinical-Nietzschean method of confusing the issue in order to maintain control, these ratios were renamed McDonough ratios … Of course, my prudential ratios were not retained and they preferred to adopt the hyper-centralized vision of the pitre Mundell – even though this pitre was stating a fatal triangle – v, https://fr.wikipedia.org/wiki/Triangle_d%27incompatibilit%C3%A9 – that can only be solved by either destroying the Euro, the rival reserve currency of the US dollar, or by creating a hyper-centralized European federalism subject to the hegemony of both Berlin and NATO, and therefore of Washington and the Mossad.

All the current problems of the Euro would have been reduced by the adoption of my national Cooke ratios. Moreover, as long as CDS were not commonplace on public debt – a total nonsense since public debt is guaranteed by the State as much as the legal tender of the currency in which it is denominated – speculative financial capital had no leverage to weigh on the Euro. In fact, the Euro protected the “gauche plurielle” and its RTT against a speculative attack identical to that of July-August 1947, which broke the pound sterling and the UK’s desire for independence. When the Cypriot and Greek crises brought to light the role of speculation through CDSs affecting the spread and the systemic risks incurred in the event of a break in the CDS chain, Chancellor Meckel re-launched the proposal to ban naked sales, but Hollande and the Italian leaders refused. Today, these proposals should be put back on the table with urgency.

b ) The “circuit brakers” aimed at suspending transactions in the event of a speculative attack in order to calm the markets – sheep-like by nature – and prepare the response. This maneuver had been brilliantly used by the Swedish Central Bank and therefore deserved to be studied. The excellent first president of the ECB, Mr. Duisenberg, was perfectly aware of this possibility.

The fact remains that in the years following the entry of Italy and Greece into the Euro, we were treated to a real textbook case that deserves to be studied. It gave me the opportunity to discharge my role as an organic intellectual of the authentic Left by writing my Book III. I recall that it aimed to show that, in spite of the three main criteria of the Maastricht Treaty, or rather paradoxically thanks to them, neoliberal austerity could be replaced by economic rigor using public credit, RWW and parity, etc. Inflation could no longer be used as an excuse in impose continuous economic austerity. With inflation no longer a pretext, the emphasis could be placed on rehabilitating the “net global income” of households, and in particular on deferred salaires, by adding the use, at least in part, of public credit.

The book is entitled Keynesianism, Marxism, Economic Stability and Growth – 2005. It is the only book that predicted the subprime crisis by denouncing with precision the financial decompartmentalization for finance and the “montages ” of financial products of which nobody, neither central banks nor BIS, knew the extent. This is still the case today. In fact, after the 2007-2008 crisis, G. Cecchetti at the BIS proposed to systemic banks and financial institutions to give at least 2 to 3 weeks before triggering the CDS chain to prepare a response and thus avoid a general collapse. That said, the Italian left, besides the deplorable and very ignorant Prodi – of whom Schröder said that he spoke first and thought later, in short a pure product of the Italian elites since the death of Luigi Longo. He had also privatized IRI the strategic industrial heart of the country – had a frightening number of renegades who were not very presentable, including at the head of the Partito della Rifondazione Comunista. My minimum program, based on a scientific contribution of the first order – i.e., the “structure of v”; the “social surplus value” etc. – summarized in Chapter II of the book of the same name had no audience and was carefully hidden. Italy and the Left – as well as the EU – are paying the price for this today, to be said modestly.

A bizarre but emblematic situation developed. While Ireland was doing the Modigliani thing, letting its inflation run away like the UK at 6% and 7%, while building up its high-tech sectors – pharmaceuticals, the English-speaking cultural sector and the Internet, etc. – the poor servant Prodi had budgetary discipline imposed on him without complaint – in fact, by been thankful, which insured his servo in camera career in the EU. In fact, he was thanked for it, by the imposition of a budgetary and economic discipline that was more rigorous than the Maastricht criteria, especially with regard to the budget deficit and inflation, all on the pretext that the Italian debt was higher than the 60% of GDP allowed under Maastricht. This imposed what would later become the path of fiscal consolidation under the Fiscal Compact and the Two and Six Pack. The tourniquet was further tightened when the Trichet-Draghi couple sent their letter of August 5, 2011 to the President of the Council Mr. Monti – see https://www.challenges.fr/economie/l-incroyable-diktat-de-trichet-a-berlusconi_301344 and compare it with the program of the Logge P2, worthy felonious successor of Gladio and its stay-behind: https://fr.wikipedia.org/wiki/Propaganda_Due )

It is important to underline that Mr. Monti was the typical Italian pitre who took anti-trust seriously within the Commission in order to deregulate and privatize everything in the Peninsula, while the other big countries used it to create “national champions”… It is in this context that, while the Maastricht Treaty was pointing to an inflation rate of 3% and my Tous ensemble had exposed the rational logic of the “civilizational inflation rate” that the famous inflation rate of 2% was imposed as the objective to aim at. In fact, the EU Commission used to demand an even lower rate from Italy.

In both cases, imported inter-zone inflation – Ireland – or, conversely, asphyxiation by imported monetary rigor, we are dealing with harmful phenomena that affect the entire internal price structure, which is perfectly impossible to correct within the framework of the dominant paradigm. The fiscal compact imposes criteria levels that are appropriate for the Center of the Eurozone but not for its peripheries. I refer again to the exposition in my Live III.

Other legitimate types of inflation. One of the most insidious is the one I called “organic inflation” in my Synopsis of Marxist Political Economy. Leaving the analytical framework of SR-ER, which can correspond to scientific Marxist planning, and therefore to schemes in ex ante exchange values, the price expressions being clear thanks to the distinction between money and credit, we wanted to show that the epiphenomenal motor of capitalism being competition, which rests above all on the search for the most developed productivity, it was necessary to integrate this competition into SR-ER schemes in a coherent way. Marx had already glimpsed the solution in his Parisian Manuscripts of 1844 by noting two primordial facts:

1 ) Price competition eventually cancels itself out in the medium and long term, so that, says Marx, the logic of the system must be based on something other than price epiphenomena; it is based on the exchange value of labor power and on the extraction of surplus value, the only rational explanation that makes it possible to understand the genesis of profit and to make possible the commensurability of all commodities among themselves by a common standard of measurement. Basically, the logically flawed supply and demand curves say the same thing since their respective ex ante price scales (!!!) finally lead to the ex post market price, after much trial and error along these curves… (Note that if you take the curves in quantitative terms, you end up with the technical composition of capital of Pareto or economy of scale. Drowning out the use of F. Taylor’s chronometer, etc. Except that neither you nor Pareto would be able to give the solution both in quantities and in exchange value or price).

2 ) Since the system must reproduce itself by social necessity, social demand over-determines the resolution of both micro and macroeconomic equations. (Tougan-Baranovsky, and later all the neo-Ricardian emulators, including Sraffa, of the “simultaneous resolution” started from this social demand that they formalized in their matrix; but not having a scientific theory of productivity, they all failed.)

It was therefore possible to demonstrate that the SR-ER schemes in values underlie the structure of prices in a competitive regime. This is no small thing.

It remains that this competitive framework is subject to the “invisible hand” of the market, i.e., to the random allocation of resources according to the sole search for individual profit, and to capitalist credit, and therefore also to mediation by foreign trade and by the revaluation of stocks. Deviations from the exchange value will emerge. We would have roughly two typical situations: The first is that production is brought to the market as it is produced. The second is that it is brought to market in batches. If a company produces more in one industry, it will sell its output at a better price, which in turn will allow it to dominate the market by eliminating the competition. If conditions elsewhere in the SR-ER System remain the same, demand for this supply will be over-determined by the SR-ER Equations. Conversely, underproduction will lead to a price increase or organic inflation that can only be absorbed by restoring production or by adjusting the SR-RE parameters. The social demand glimpsed in the Parisian Manuscripts of 1844 was fully elaborated in the SR-ER Equations of Book II of Capital . It will impose itself in an underlying manner, but by ratifying these deviations, which thus cause organic deflation or inflation, which will then have to be corrected by recourse to constant prices. I refer you to my Synopsis.

The problem of imported price increases when they are not due to monetary effects should also be questioned, especially when the exchange rate, even if it is floating, is influenced by the role of certain currencies playing a role of reserve currency – e.g., the US dollar and to a lesser extent the Euro.

The very pronounced external exposure of the U.S. dollar, which still covers nearly two-thirds of international trade denominated in this currency, makes it more difficult for the FED to adjust its exchange rate. The possession of a strong reserve currency may seem to some like a godsend because it confers an exorbitant privilege attached to monetary suzerainty: the imperial impression emerges from the fact that it is enough to print money to pay for the expansion of one’s own multinationals and the many military bases needed to protect access to raw materials and foreign markets. This analysis of the imperial burden for Britain and then for the United States was well exposed, in particular by the great American Marxist Harry Magdoff. Add to this Triffin’s paradox: “Triffin’s dilemma or Triffin’s paradox has its origins in the Bretton Woods system, which made it necessary for the United States to run a current account deficit in order to supply the world with international means of payment. This situation contributes to a progressive weakening of the confidence of foreign economic agents in the reference currency. The world economy’s great need for a reliable currency thus paradoxically leads to a loss of confidence in that currency.” (See https://fr.wikipedia.org/wiki/Dilemme_de_Triffin )

Immediately after the establishment of the Bretton Woods System – IMF and World Bank, soon followed by GATT – the great American financial-commercial outward expansion was the Marshall Plan. It followed the reintroduction of the mark in 1946 by General Lucius Clay in the German Western zone without any consultation with the Allies, Western or Soviet. This signaled the unilateral rearmament of West Germany as part of the launch of the Cold War by the snarling loser speech Churchill made in Fulton, Missouri when he announced the descent of an Iron curtain from Stettin to Trieste … purposely mistaking the political geography agreed upon at Yalta!

In addition to the rearmament of Europe against the USSR, it was also a question for the USA, which had just reconverted their industrial assembly lines into peacetime industries, of finding other outlets that could complement the internal demand coming from the liberation of the forced savings into the Victory Bonds. In order to receive US aid, it was necessary to integrate the country into the logic of American trade and therefore to give the imperial aid manager all the necessary macroeconomic information – which Stalin was obliged to refuse in view of this cynical offer made by Baruch … US aid for Western countries reconstruction came back in the form of purchases of products made in the USA. A little later, the US went so far as to pay interest on the dollars, then convertible into gold, held as reserve currency by the other central banks. Gold had become less available to them since Fort Knox held more than ¾ of the World’s reserves. This was followed by the expansion of American multinationals and banks, with the cry “The World is our Oyster! “Then, with the end of Bretton Woods, came the floating exchange rate system mediated by petrodollars.

In such a context, the possible contradictions are quite obvious. We will mention the three main ones:

a ) Trade in raw materials is denominated in US dollars, so that price swings due to cyclical crises or wars are immediately reflected in the dollar zone;

b ) The internal action of the FED is constrained by the external exposure of the dollar. For example, when Volcker decided to launch what was called within the FED “the roller coaster” of the vertiginous rise in double-digit interest rates, there was a massive influx of dollars into the United States, but it mainly fed speculative investments. It ruined the emerging countries of South America and Africa most exposed to the dollar, as well as the Eastern Bloc countries that had committed the folly of indebting themselves in dollars to assert their independence within their Bloc, including Poland, Romania and Yugoslavia. The sudden and drastic rise in interest rates made the financing unsustainable, leading to their self-destruction.

In 1982, Mexico, into which the American banks had recycled their excess liquidity, was on the verge of bankruptcy, which would have led to the collapse of the major American banks. Bankers like Mellon had defended their “largesse” by pointing out that, if necessary, Mexico could always pay with Pemex, which turned out to be true for the most part. In 1982, Volcker was forced to carry out his first major external bailout, setting in motion a dynamic of subordination from which Mexico has not yet been able to extricate itself. The same was true for other countries. Mitterrand decreed that “Africa was a continent lost to development’’ In my 1985 article, I had asked for the remission of debts for the worst off African countries, while at the same time eliminating tied aid in order to promote indigenous development. What was practiced, for example by France, was debt forgiveness calculated as closely as possible to allow for continued repayment, thus avoiding the need for the banks and States involved to record losses in their balance sheets.

Argentina, on the other hand, is an interesting case, since the problem of debt repayment, made worse by Volkerian interest rates and capital flight, led to politically motivated wage increases to keep the allegiance of some unions and the middle classes. Many theorists of Latin American “populism” ignore this. However, this increase, made possible by the printing of money, was quickly taken back by inflation, in a vicious circle that hindered any attempt at re-industrialization that could restore a favorable rate of competitiveness. Thus, before Nestor Kirchner came to power and put his house in order, the assets held by Argentines in the United States exceeded the amount of the Argentine public debt.

In the United States itself, a series of bankruptcies broke out, including the famous Orange County bankruptcy and the phenomenal Savings and Loan bankruptcy of over $400 billion. This situation was further aggravated by the reduction of federal transfers to state and local governments and the prohibition on their taking on debt. The rescue of these S & Ls informed those that followed, particularly those arising from the subprime crisis. In essence, the liquidity created ex nihilo by the printing press increasingly replaced the prudential ratio emanating from a fractional system organically linked to the real economy. The peak was reached in March 2008 when the Treasury under Paulson imposed as a remedy to the subprime crisis its March 2007 Report which abounded in the direction of the all-out deregulation that led to the crisis! (See “Credit without collateral” and “The Treasury and the FED” in the International Political Economy section of my old website www.la-commune-paracelt.com ) In the end, the federal debt soared and continues to soar. It exceeds $27 trillion today. (“The largest government debt refinancing will be in the US, with $7.7 trillion of debt coming due, followed by Japan with $2.9 trillion. China has $577 billion coming due, Italy has $433 billion, followed by France’s $348 billion. Germany has $325 billion. ” in “World’s Top Economies Brace For $13 Trillion Debt Maturity Vortex”, by Tyler Durden, Thursday, Jan 07, 2021 – 4:15, https://www.zerohedge.com/markets/worlds-biggest-economies-prepare-13-trillion-debt-maturity-wall . Add to this the fact that the African situation is getting worse again).

It is therefore understandable that the fear of carry trades or reverse carry trades is permanent at the FED as well as in the affiliated Central Banks.

c) The transition from multinationals to transnationals firms within the framework of triumphant free trade, with its debilitating definition of anti-dumping, within a WTO born of the Uruguay Round, the country risk that is strongly linked to the monetization of public and private debt on the international financial markets. It takes on the appearance of the systemic risk of large global banks and quasi-banks. The failure of a systemic bank now puts the entire dollar zone and associated countries at risk. The same goes for the EU and its fear concerning the Italian situation and that of the other South European countries, not to mention the Deutsche Bank.

In my Book III I linked these processes to the development of particular forms of capitalist credit, consequently of the dominant fractions of capital that define “epochs of redistribution” within the same Capitalist Mode of Production. The overdevelopment of credit pushes the dominant centers to privilege financial and banking intermediation and services to the detriment of the real economy, leading inexorably to the passing of the baton. Thus Florence was challenged by certain German centers, but above all by Holland, which then gave way to the United Kingdom, which tried to delay the decline of its empire by creating the Commonwealth, only to be forced to recognize that North American continental trade had taken over from its system of imperial preferences in 1939. British pretenses to independence were finally shattered with the speculative attack on the pound sterling in 1947, thus imposing GATT on the United Kingdom along with the rest of the Bretton Woods system.

Always toward the West, said Hegel! A cardboard Western, added Léo Ferré. But eventually, according to the same logic, the United States itself had to impose a surtax on imports and suspend the convertibility of the dollar into gold on August 15, 1971, because it had become incapable of managing its external deficits except by printing money. The end of the Dollar-Gold Standard signaled the end of Bretton Woods and implied the attempt to replace it by the “petrodollar” system. Kissinger set up this new system after the 1973 Arab-Israeli war, which led OPEC to raise the price of oil in retaliation for its unilateral support for Israel. The recycling of profits organized by the US led to the petrodollar regime which is in an accelerated phase of decay today.

In short, by confusing money and credit; by being unable to distinguish between classic interest deduced from profit and speculative interest irrationally but legally established as a legitimate rate of profit with its fake rate of productivity that imposes its law on the real economy; by substituting de facto the prudential ratio of the fractional system and its cybernetic control link with the real economy by the QEs and other liquidities created ex nihilo by the Central Bank for the benefit of hegemonic speculation, the Central Bank only manages economic epiphenomena, namely central interest rates strongly influenced by stock market prices, with its empty rotations and buybacks, and speculative bubbles always ready to burst, which impose the permanent bailouts with the liquidities issued by the Central Banks

Any residual claim to manage the evolution of the economy disappears as soon as one realizes the phenomenal scale of the speculative economy in national accounts. This drift was further aggravated by the inclusion in 2013 in the US and in 2014 in the EU of part of tax evasion, drugs, prostitution and certain intellectual property rights linked to the new Internet economy, the so-called immaterial economy. This Marginalist national accounting chooses to calculate only what has a market price. This ideological choice amounts to counting infrastructures and public services only as costs – their salary mass and administration costs – whereas fiscal, or better still, budgetary expenditures in these areas trigger a much more important Multiplier while reinforcing the macro-economic competitiveness of the Social Formation, which in turn systemically increases micro-economic productivity. ( On GDP see: http://rivincitasociale.altervista.org/gdp-marginalist-narration-tool-against-the-welfare-of-peoples-and-the-prosperity-of-nation-states-may-24-2020/ ) As we can see, the fact that neither the capitalist Central Banks nor the BIS know what inflation – or better, inflations – really is, is only the tip of the iceberg.

The disconnection between the real and speculative economies is now complete. A few very tenuous threads still unite them, namely the inept financing of public debt on the global speculative financial market. This involves the possibility afforded by government taxation rather than its relative weight in GDP, as well as private debt increased by the banking vulnerability now combining Non-Performing Loans – NPLs – with the chronic credit crunch and with the rising destructive force of zombie companies that are kept artificially alive by banks seeking to avoid the degradation of their balance sheets. This rise is strongly supported by the welfare management of the economic-sanitary crisis, as shown by the hundreds of billions of loans and State guarantees that will never be paid back for the most part.

For a Marxist or for any person of good will who hates the State within the State – that good Philip le Bel with his Legists – this disconnection is excellent news. By consolidating it, it allows the real economy to be freed. To do this, it is necessary to understand that, by virtue of its mandate, to the ECB is conferred the management money but not credit. Even so, it must manage money according to the major criterion of “inflation” – in the singular – the definition of which depends on science and therefore on the Regalian power in the matter, just like part of the fixing of the exchange rate, which is a joint competence. There is no need to ask the ECB to freeze or erase the part of the public debt of the member States that it holds. Of course, Mr. Mélenchon is perfectly right to say that nothing would prevent this in practice. But, without a public bank, this would risk being done within the same parameters, confusing money and credit; it would simply allow the ECB to continue its policy of liquidity created ex nihilo for the greater profit of speculative finance, but without the slightest advantage for the States, especially in the current situation with prevailing low interest rates. And without the slightest advantage for the tax revenues either, given the loss of the annual ECB rebate. The destructive logic of the Fiscal compact would not be changed in the least, even though the States have obliged themselves to it again by accepting the Recovery Fund, the Sure, the health ESM and the main ESM as such. Mr. Mélencon had rightly pointed out that since the Fiscal compact had not been transcribed into law at the end of December 2018, it was null and void since January 1, 2019.

The State must therefore take back at least part of the public credit in order to buy and erase, year after year, the public debt. This without even nationalizing the banking sector, simply by taking back public control of the Caisse des Dépôts and the Banque d’investissement publique – handed over to the Lazard Brothers by Hollande … – and by creating another national public bank. A budgetary allocation of 2 billion euros would be reserved each year for its own capital funds. Its initial prudential ratio would be equal to the average for the banking sector, excluding the huge shadow banking sector, say 40:1. This bank will therefore immediately have a little less than 80 billion to buy part of the public and para-public debt in order to write it off. This is because it only has to cover the costs of its administration and the usual provisioning for debt. Let’s remember that the Banque de France, public until 1973, maintained the public debt around 20-25% of GDP during a period of accelerated reconstruction, while coexisting with private capital, carefully divided into four distinct pillars. It is simply necessary to organize a coexistence adapted to the new conditions by ratifying the disconnection between the real economy and the speculative economy in order to protect the former from the destructive effects of the latter.

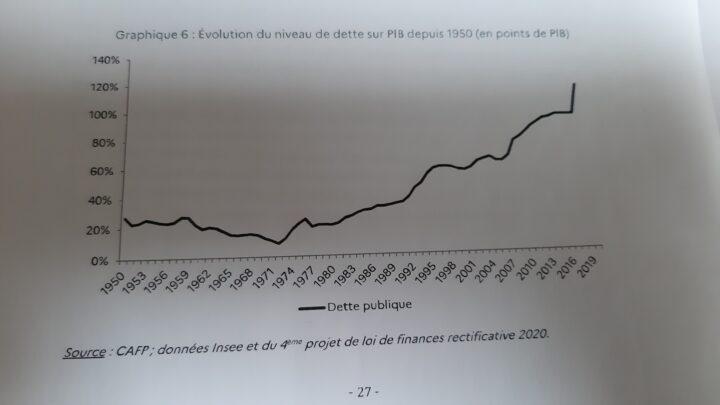

Look at the increase in public debt as a percentage of GDP after the privatization of the Bank of France by the Pompidou-Giscard-Rothschild law of 1973, it is worth a whole poem:

The financing of the current French public debt costs around 35 billion. All new issues could therefore be bought back, but for the time being, it would be preferable to buy back the highest interest rate debt on the secondary market in order to write it off. The budgetary margin thus gained will be very useful for improving social security and intervening in the productive economy. This deletion will mean a transfer of funds to creditors. At the same time, it will be necessary to provide for laws to regulate the share of ownership by investors in the national enterprises of the real economy to be held by the private sector. In so doing they will invest in the stock market and in the speculative economy. In the meantime, this public bank will also make it possible to regain control of strategic enterprises that need to be renationalized and inserted into a good indicative and incentive planning, the so-called French-type of planning.