(Given the importance of the distinction between purchasing power and standard of living I make this essay available in English although it still needs some editing for typos and other errors.

The individual net pay without social contributions for public social safety nets is a monstrous rip off implemented by the philo-Semite Nietzscheans since the counter-revolution launched by Volcker-Reagan in 1979-1981. This destructive cycle is now reaching its miserable end everywhere in the World, including in the USA and in Chile …)

Tribute to the Gilets jaunes who had the republican courage to refuse voluntary servitude.

(Woody Guthrie- This Land Is Your Land, in https://www.youtube.com/watch?v=wxiMrvDbq3s

Working Class Hero – John Lennon/Plastic Ono Band, in https://www.youtube.com/watch?v=iMewtlmkV6c

Imagine – John Lennon & The Plastic Ono Band (w The Flux Fiddlers) (Ultimate Mix 2018) – 4K REMASTER, in https://www.youtube.com/watch?v=VOgFZfRVaww)

(Jean Ferrat, La Commune, https://www.youtube.com/watch?v=S4LGwWmge3U

Jean Ferrat, Les cerisiers, https://www.youtube.com/watch?v=t0UW-kNo1G8

Jean Ferrat, Ma France, https://www.youtube.com/watch?v=XAbbzXe8NwM

La Canaille – Chansons Populaires, https://www.youtube.com/watch?v=811-eXgctSc )

Content

Introduction

The purchasing power of money and the measure of “inflation”.

The consumption basket according to INSEE.

The consumer basket according to Herlin.

The purchasing power of money according to the quantitative scientific – Marxist – theory of money.

The socially necessary working time per unit of product is the universal standard of measurement of relative prices, not the work of the laborer or the SMIC.

“Structure of v”, “global net income” of the households and labor contract.

Notes.

Some quantified articles on the standard of living

xxx

(Added May 28, 2023. A word of synthesis. Talking about the “purchasing power” of money doesn’t make much sense, since it’s a general equivalent that makes it possible to define the commensurability of all commodities with each other, but which itself needs to be evaluated as a commodity on the basis of a universal equivalent serving as a standard of measurement, namely the exchange value of labor power.

We could speak of the “purchasing power of wages”, but only if we bear in mind that individual wages are just one of the three components of the “global net income” of households, which includes the net individual salary, the deferred salary – pension and social security contributions – and the share of taxation that accrues to households in the form of universal citizen access to public infrastructures and services.

We need to talk more precisely about the “standard of living” embodied in the “net global income” of households. We can see that this differs considerably from the Marginalist “disposable income”, which includes only the net individual wage, plus any financial income from household savings.

Inflation corresponds to a gap between the monetary expression of exchange value – prices – and exchange value itself. The main form of inflation, structural inflation, arises from the ratio of the social salary mass to the real salary mass, when the difference between the two emanates from a monetary issue with no counterpart in exchange value. When this difference is organically financed by deferred wages, there is no structural inflation. We must therefore look elsewhere to understand price hikes: imported inflation or organic inflation. The latter, when it persists, is naturally becomes part of the relative price structure of the Social Formation in which the exchange value is formed, i.e., without inflation, but it will affect from within the microeconomic productivity and the macroeconomic competitiveness, i.e., the exchange rate of the national currency.)

xxx

Introduction

The next social disaster, already announced, will unfold with the reform of public pensions calculated on the basis of retirement points. The current ending of the indexing of wages and social payments on inflation is just an introduction. With the growing employment precariousness and the huge tax expenditures and tax credits in favor of the employers – CICE plus about 90 billion euros in annual exonerations – it will be quite something! Especially since the general tax revenues will not follow suite for the same reasons. One of the slogans for the new year 2019 should be “Do not touch my retirement! Restore the “total net income” of households by creating RTT jobs! “.

(Note that Social Affairs are an exclusive national jurisdiction under the EU’s Functioning Treaty which implies, at the very least, that the Fiscal Compact must be modified to take account of it.) Similarly, without the recourse to public credit the financing of the public debt will remain too expensive in socio-economic terms See: http://rivincitasociale.altervista.org/private-or-public-central-banks-to-defeat-speculative-and-economic-attacks-september-21-2018/ ) One needs to be concrete because “purchasing power” is a vague concept, used most often out of context. As a first step, the next general Reduction of the Working Week – RWW -could take the form of the general lowering of the retirement age, without any pension cut. This would help support domestic demand while allowing the massive hiring of young and less-young people, who are now struggling for nearly a decade on average, to obtain a truly stable job on the basis of which to plan for the future. After the first year of transition this social policy would be largely self-financing without even mentioning the 20 billion euros annually wasted with CICE program now transformed into a permanent exoneration for the employers, without any real counterparts for the employees!

The pretext for this essay was my recent reading of Philippe Herlin’s book, Pouvoir d’achat : le grand mensonge, Ed Eyrolles, September 10, 2018. It had been preceded by a short note that I published in support of the Gilets jaunes movement. (This note is available at this http://rivincitasociale.altervista.org/pouvoir-dachat-mobilite-budget-mal-ficele-et-volonte-de-rattacher-les-nouveaux-serfs-la-glebe-27-11-2018/. See also the additional notes in French in the “Ecomarxismo” category of the same site, especially those concerning the misleading narratives of the IPCC threatening the end of the world in order to legitimise a new attack on the end of the month … The measurement of the CO2 used by the IPCC to scare the poor population of citizens comes from the observatory of Mauna Loa in Hawaii, one of the 16 most active volcanoes of the Planet, which speaks for itself …)

This book by Ph. Herlin arrived at the right time, as testified by the citizens’ protest spearheaded by the “Yellow Vests”. One of the key elements of this useful book is to recall the contribution of Jean Fourastié, particularly with regard to the concept of “purchasing power” and more precisely that of “standard of living”. I make abstraction of his discourse, which I find confusing, but which Herlin probably believes to be of importance, about the role of competition as an effective socio-economic regulator. At the time of triumphant neoliberal monetarism, which now reaches the end of its historical cycle with its disastrous litanies of privatizations and its most disastrous definition of anti-dumping enshrined in the WTO, it appears little convincing, to say the least.

In fact, Herlin sees it as a means of promoting productivity by breaking the benefits conferred by monopoly and oligopolistic practices. Nonetheless, he recognizes that this is not always the case. In fact, behind this balancing act lies his incapacity and that of his theoretical referents, including Fourastié and Pareto, to combine the technical composition of capital with the exchange value composition of capital. The bankruptcy of this combination is lethal. On the basis of Marx’s law of value, I am the only one who can accomplish it. To do this, I first had to develop the Marxist theory of productivity by integrating it in a fully coherent fashion into the function of immediate production – micro-economic – and in the Equations of Simple and Enlarged Reproduction – macroeconomic – or general stationary or dynamic equilibrium.

Jean Fourastié failed to offer a coherent theory of productivity. Following historians, prevalently French, and granting priority to the economy, he strove to define reliable statistical series to better understand the evolution of societies. He fell back on the “simple work” of Adam Smith. For the latter, the “pin factory” decomposed trades into simple tasks in a vast movement driven by industrialization and machinery. By defining “simple work”, trades or complex jobs could be evaluated in a simple sum of specific work and thus on a salary scale.

Fourastié followed this path peculiar to the classical political economy prevailing before Marx. He took the « work of the laborer » as a concrete indicator of “simple work”. He thought to hold with it an invariable standard of measurement valid diachronically and synchronically. Already in the early eighties, I had shown that this was false, an error that Marx had already demonstrated. The first complete published form of my demonstration is to be found in my essay Tous ensemble of 1998. (Books-Books section of my old Jurassic site www.la-commune-paraclet.com .) Smithian « simple work » does not make it possible to understand the micro-economic productivity and the macroeconomic competitiveness. As we will see below, the operative concept is abstract work, which concretely takes the form of the work socially necessary to produce such and such a commodity.

Herlin rightly criticizes the definition and evaluation of purchasing power by the INSEE – Anglophones already know the shadowstats that give the actual “inflation” currently around 9% in the US. He summarizes the issues: the components that enter at a particular moment into the average consumption basket used to gauge real purchasing power – in fact, as we shall see, to gauge “inflation”; the weighting effects caused, for example, by the fact that several products are given a specific elasticity; and finally, Herlin is right to point out, the quality effect of the components of the basket, which is a very Marginalist way to take into account productivity …

Herlin rightly insists that the consumption basket does not include social security contributions or the share going to taxation. Let us repeat that the purchasing power is used to evaluate the impact of “inflation”, its initial vocation was not to evaluate the standard of living. Herlin shows the incongruity of the evaluation of some products by recourse to the quality effect, for instance, the electronic products, but he specially insists on the undervaluation of the real weight conferred to housing. Through a supposed equivalent of rent, the share of housing in the consumption basket is given at only 6%!

He therefore proposes to repeat Fourastié’s approach with a nuance, namely the substitution of the work of the laborer with the SMIC. This is to provide a means of assessing more accurately the specific weight of the main components of the average consumption basket given in fractions of the SMIC. This is a first approximation. However, it remains circular, the SMIC being subject to “inflation” just like the other goods and services it claims to measure in its own terms. This circularity is aggravated by the fact that the SMIC is an hourly minimum wage that reflects today’s the excessive precariousness of the workforce, including in its most atypical forms, something which distorts the whole structure of “real” (?) prices that one would claim to arrive at on this “objective” basis. I repeat that, for bourgeois economists, the consumption basket was used initially to evaluate “inflation” and not the purchasing power of wages.

The purchasing power of money and the measure of “inflation”.

To apprehend the subject scientifically we must take into account its genesis. We will try to show that the marginal concept of purchasing power is circular and that what is commonly called “standard of living” technically refers to the “structure of v” , that is to the structure of « variable capital » (i.e the force of labor), both for the microeconomic production function and for the macroeconomic production function corresponding to social capital, i.e, to the sum of Sector I of the Means of production and of Sector II of the Means of consumption. Every economic system must reproduce itself preferably in a positively dynamic way. Similarly, any reproduction system will be all the more economically viable and consistent, as its « structure of v » will reflect as faithfully as possible the systemic components related to household consumption.

Why cannot we just express a person’s standard of living in strictly monetary terms? Of course, because money is a only general equivalent which must itself be evaluated according to a universal equivalent, namely the exchange value of the labor force, the only universal equivalent that exists in the economic world of goods, the world of exchange values.

Bourgeois economists have tried to hide this reality. In this area, Irving Fisher is the greatest falsifier. He was a disciple of Böhm-Bawerk, the first great falsifier of Karl Marx’s scientific critique of political economy. He fabricated the so-called “problem of transforming value into price of production”. (1) Irving Fisher wanted to be a disciple and a follower. Böhm-Bawerk had thought to falsify the law of the value exposed in Book I of Capital. Fisher attempted to falsify Book III, which Marx devoted to the class struggle by which the Equations of Simple and Enlarged Reproduction, analyzed in Book II, was reformulated by the political redistribution of Community resources, in theory at least, in favor of of the Community, but within the CPM and thus according to a clear unequal class logic. (2)

The Book III of Capital, the publication of which came after the death of Marx, is a collection of manuscripts of various epochs. The exposition of this Book III would have been very different on many essential points if Marx had had time to take care of it himself. Be it as it may, its main idea remains brilliant, namely the class struggle as the driving force of the redistribution of wealth created within the parameters defined by the Equations of Simple and Enlarged Reproduction set out in Book II. The two great and unrivaled contributions of Karl Marx are the critique of exclusivism and the law of value. With them was finally elucidated and scientifically established the understanding of human History, that of class struggles, which Giambattista Vico had discovered in his Scienza Nuova.

For Marx, the foundations of the class struggle lie in the three sources of income defining three broad social classes, namely the wage for the proletarians, the rent for the “landowners” and the profit for the capitalists. Marx was not unaware of the differences between absolute rent and differential rent. I refer to my Tous ensemble for the details of this question or, in English, to my Keynesianism, Marxism, Economic Stability and Growth, freely accessible in the Livres-Books section of my old Jurassic site www.la-commune-paraclet.com . I also dealt with the question of the false problem of the transformation of values into prices production, a false problem dissipated by the Marxist theory of productivity that I was the only one to demonstrate by following the logic of Marx. It remains that the transition from agricultural feudalism to agricultural capitalism has been slow, raising the difficult question of the coexistence under dominance of several modes of production and therefore of the strategic alliance between proletarians and peasants.

Irving Fisher, although an American, did not concern himself with the question of the difference between absolute and differential rent that had so preoccupied Adam Smith and Ricardo and Torrens, as well as Marx … and Pierre-Philippe Rey in the wake of the great Louis Althusser. What mattered to him was to suppress the scientific understanding of the class struggle. His job was to imagine a generic « income stream » applying to all indistinctly, boss, landowner, farmer, worker, housewife etc. By removing the dialectical relationship explaining the genesis of these three incomes according to Marx, it was enough to establish some simple behavioral rules applicable to all – according to the presupposition of a perennial « human nature » – plausible rules that were supposed to govern this flow of income (income stream). These rules consist in preference for investments – risk assessment – according to a temporal choice or time preference, assuming an anticipation of returns on the short, medium and long terms.

If, as Marx demonstrates, interest – classical interest – is deducted from profit (3) and if profit corresponds to the overwork imposed by the boss to his workers, over and above the amount of work necessary to earn the salary, then the dominant logic will be that of exploitation, thus that of class struggle. If that is the case, then the general logic induced by the behavioral falsification of the “income stream” will have no meaning whatsoever. In fact, not only as Keynes argued, a State does not manage its budget like a Victorian family, but, moreover, ancient thinkers had already made a clear distinction between the family economy called economy and the economy in the modern sense of the word, formerly called chrematistics.

In his falsification Fisher followed the path traced by Jean-Baptiste Say on the basis of his mystifying reinterpretation of Ricardo’s monetary theory, culminating in the paper currency. It consisted in disguising the origin of the exchange value – and hence of profit – nested in the specificity of the dual nature of the commodity known as « human labor force ». Only the use value of the labor force is capable of creating exchange values by shaping their use value supporting vector. This original falsification of J. B. Say brought to the Marginalist concept, one which is both reductive and one-sided, namely utility, expressed solely in monetary terms. In doing so, the factor of production human labor became a factor of production like any other and could be expressed and exchanged in monetary form – of course by disregarding its human character and, in particular, the fact that the worker is a member of a sexually reproducing species. This implies that the reproduction of the worker must also take into account his human reproduction in a household whose size is variable.

It was necessary to move away from classical liberalism closely linked to Censitarian democracy, i.e., to the capacity to pay taxes, and to move towards a political pluralism implemented by bourgeois representative democracy – universal and secret suffrage – to begin to conceive the three components of the « global net income » of households, whose capitalist individual salary – the net salary on the pay slip – is only one component, the other two being the deferred salary – pension, unemployment insurance, etc. – and the share income tax coming back indirectly to the households in the form of guaranteed universal access to public services and infrastructures financed by general taxation revenues which developed alongside with the emergence and consolidation of is known as the Welfare of Keynesian State in English-speaking countries or the Social State in Europe.

Fisher was therefore obliged to propose a monetary theory compatible with his falsification of the income stream. His so-called quantitative theory of money is in fact very little quantitative and totally tautological. Like so many other concepts produced by Marginalists, it stems from a manipulation of the simultaneous transformation scheme of Tugan-Baranovsky. (4)

Tugan-Baranovsky attempted to solve the false-problem of transforming value into price production by using quadratic equations. To the two Sectors of Marx’s Simple and Enlarged Reproduction, Sector I of the Means of Production and Sector II of the Means of Consumption, he arbitrarily added a third Sector necessary to solve his equations, that of Gold or the currency. This is the most striking example of a model completely obscuring the reality it claims to analyze. Hence, comes Fisher’s monetary tautology, namely that the amount of money needed is equal to the monetary value of goods and services !!! Of course, he adds a little touch of circulation but only in the sense known then pragmatically by the central banks issuing the metallic or paper money, namely circulation understood as the time of return after the emission … At the ideological level this mystification had the advantage of being congruent with another Marginalist ineptitude which states that the quantity of money needed is determined by supply and demand in a given system, and specifically here the macroeconomic system in three sectors.

This sleight of hand is worth some rather sad or hilarious pages, depending on the point of view, in which Fisher tries to show the difference between a tautology and what he takes for an equality. But if A = A you cannot explain the origin of A by itself. A genesis is always a transformation. But his problems do not end there. With such a monetary theory, the original problem of the congruence between the use-value vector and its monetary expression in exchange value terms returns with a vengeance in the form – for for him generic – of inflation. Now, the Marginalist high priests, if they wish to falsify the reality against the Marxists to better deceive the people and the workers, must also be plausible. They must then provide a few operational rules to the supporters of the capitalist system, even if they have to be revise when their narratives inevitably deviate too much from reality. In fact, the primary function of the pseudo-Nobel Prize for economy is to legitimize these cooking recipes adapted from time to time as needed. For example, corporate and national accounts – GDP – are the result of this search for operational plausibility. As everyone knows, they are not worth much more.

How in this univocal theory of utility to gauge the gap between the quantity of goods or commodities and their monetary expression? In other word how do we distinguish between the quantitative use values (uv) and their corresponding qualitative exchange value (ev)? Here Fisher launched into one of his obsessions, one overdetermined by his initial falsification, namely that of the indexes. The first one he tried to construct and on which he will constantly comes back – one understands exactly why … – is the consumer basket or consumer price index. This is another typical circular « thing ». The fallacy with Irving Fisher’s quantitative theory of money, taken up by all bourgeois economists, is that they conceive of it as a market in which money is determined by supply and demand, with all the ex ante/post hoc problems that this inept Marginalist procedure entails.

We know that in order to draw up the demand curve, we must first give the supply table in prices (!), And vice versa for the supply curve. Now cross the two curves thus obtained – hi-han! – and you are the proud owner of the fair market price appearing at the intersection of the two curves. Moreover, it is clearly wrong to say that according to the « law of the market » where there is demand there will necessarily be a corresponding supply at the right price. This is only true when the demand is solvent. Capitalist society, which has never been as productive as it is today, reconciles huge wastes, sometimes in the form of an « ecological footprint » – see those of Al Gore and Hulot, for instance – with the chronic dissatisfaction of the essential social needs for the majority of the population now victim « once again » of the affirmation of an intolerable philo-Semite Nietzschean inequality. (5)

In fact, this procedure of supply and demand curves can never simultaneously give quantity and value, which should be quite troublesome for a so-called quantitative theory of money. Its circularity is further aggravated by the fact that it proves to be ontologically incapable of explaining the genesis of the inflations. The fact that Fisher devotes so much time to construct necessarily exogenous and historically dependent indexes, shows that he is not fooled by the fact that Marginalism is incapable of giving quantity and price simultaneously or, to put it differently, that it is incapable to reconcile microeconomics and macroeconomics or to put it yet in another way, to distinguish between real economy and speculative economy.

We know exactly the results of this way of looking at things in an epoch of hegemonic speculation during which the speculative interest rate poses as a legitimate profit rate in its own right, thus cannibalizing the whole real economy (ex., the unbearable Roe.) Moreover, the bourgeois economists speak of inflation only in the singular, at most they make the difference between the level it reaches for its various components – inflation, core inflation … Of course, this unfortunate consequence comes from the fact that his income stream blithely confuses salary, profit and rent. We will come back to it later but it will suffice here to note that the real or social salary masses are both necessary and sufficient with their rotations to ensure all the exchanges necessary for the reproduction carried out within the binding framework of the Equations of SR-ER, i.e., for stationary or dynamic general equilibrium.

As reality inevitably deviates from narration, to preserve a plausibility to his class falsification Fisher knows he must invent something to account for inflation. In fact, he invented two: The Consumer Price Index and constant prices for the statistical series given by his famous Fisher Chain which claims to correct prices for inflation with the CPI. Without these supposed constant prices which alone allow comparisons, it would all be like comparing apples and oranges.

The reasoning being circular, it is necessary to ask how is this index constructed? Simply by giving yourself a base year without too much brainstorming on its « price » expression. But without being able to really correct it. Worse, in the framework of the logic induced by the income stream, all the economic agents are supposed to engage in calculations relative to the anticipation of income for the investments made. All this in the context of the market logic that includes the market of supply and demand for money.

In such settings, inflation will inevitably trigger an inflationary spiral that cannot be contained. Especially from the moment when the fractional banking system is set up. From there, the only remedy for the bubbles caused by the inflationary spiral and its induced sheepish anticipations, is the purge effectuated during recurrent crisis. This is also why in 1913 the Federal Reserve System in the US was set up with specific mandates, namely on the basis of its monopoly of the legal currency – legal tender – to manage its issuance and circulation with the aim of supporting economic activity – including employment – and to control inflation.

Of course, the Fed – like all other bourgeois central banks – was never able to define or to control inflation, let alone to smooth Trade cycles. (6) (I refer here to the admission of Janet Yellen …) Indeed, the management of the Fed and of the bourgeois central banks remains entrapped into the Fisherian theory – the adjustment of money by supply and demand.

In fact, the mystifying confusion between money and credit leads bourgeois central banks to develop monetary aggregates in the vain hope of managing them more finely but always in a restrictive class perspective. Thus, with respect to Trades cycles – caused by a sectoral expansion coupled with a sectoral contraction elsewhere – the key interest rates are an aggravating factor for inflation and speculative bubbles. The systemic harmonious allocation of credit cannot be entrusted to the « invisible hand ». The cure can only be the planning of economic growth according to a proportionally symmetrical sectoral expansion of the various sectors and sub-sectors in tune with the overall parameters provided by the Equations of the Simple and Enlarged Reproduction. But this blind bourgeois management of credit is necessary to respect the formal equality of all agents, rich or less rich, with respect to equal access to « money », understood here generically without distinction between money with credit. It will be understood that, in this field, bourgeois democracy has remained what it was originally, namely a Censitarian democracy. As we know original bourgeois democracy was restricted to the wealthy who could pay the tax quota for voting right, the useful French word « censitaire » derives from « le cens », or the tax quota that defined full citizenship endowed with voting rights.

Not surprisingly, Irving Fisher met with self-made misfortune. Having inherited a fortune in his youth, he ends up ruined because he turned out to be wrong in all his economic forecasts, especially on the outbreak of the Great Depression and on the famous Recession in the Depression of 1936-1937 during the New Deal. Whereas the forger Nietzsche ended up hanging madly on the neck of the injured horse, emblematically imploring « Pity! Pity! Pity! », in the end, the ruined forger Irving Fisher made himself the apostle of the 100% Money pseudo-theory, albeit it would not help solve anything at all but would severely curtail economic growth. In fact, to the initial Marginalist confusion of money and credit, it adds that of savings and investment, a double and lamentable confusion shared by all bourgeois economists without exception. The contributions of the forger Irving Fisher are now adopted by all bourgeois economists with a few nuances but no one insists on their origin given the lamentable but emblematic destiny of the character.

The consumption basket according to INSEE.

Philippe Herlin attaches great importance to « purchasing power ». « And that power does not come free of charge » he notes, « it’s the power you get from your work, your income; it consequently immediately activates its inverse: frustration » (p 9). It is also used to calibrate a number of capital-intensive decisions and anticipations, including salary increases and pension increases, which are currently struggling to keep up with the scheduled inflation rate. Herlin recalls that « When it was created in 1945, the statistical agency used an index consisting of thirty-four articles: twenty-nine for foodstuffs, four articles for heating and lighting, an article (soap) for the household keeping, and that’s all. Nothing for manufactured goods and services. But from 1949, the index expanded to 213 articles, it will grow even further, especially in 1970 and now every month, more than 200 000 prices are recorded from the field, 180 000 tariffs collected, about 1000 families of products and services monitored in 30,000 points of sale. » (p 18)

In addition to the choice of its components, the average consumption basket is subject to a « weighting effect » of the components selected according to price trends. For example, if the increase in the price of an item leads to a perceptible decrease in its consumption, the INSEE finds it “and consequently decreases its share in the calculation of the index.” (p 19) In addition «… the products making up the index are kept secret, we only know the categories but not the specific goods and services. » ( p 20-21) Especially, adds Herlin « … as specified by INSEE, are excluded from the index: “Direct taxes, social contributions, interest (including consumer credit)” although they ” are naturally household expenses. But these charges are not consumer purchases and it is also difficult, except for credit, to value them in price terms. » (p 21)

I emphasize again that the index – and its basket – is intended to gauge inflation and not the purchasing power of households, a general confusion to which even Herlin succumbs. The purchasing power of money is distinct from that of households. We will come back to it later. Suffice it to note here that the net capitalist wage – the net pay slip without social security contributions and taxes – will result in better purchasing power and above all in a far greater personal consumption choice when universal access to social services and public infrastructures is provided by public programs managed according to a nation-wide solidarity and mutualist logic. In fact, since the 1980s, inflation has been curbed, but the real purchasing power of households has increased little or indeed declined for the more precarious segments of the population, because of the gradual dismantling of social programs.

The composition and weighting of the basket defined restrictively by bourgeois economists are not insignificant: Herlin rightly points out that housing is included only marginally, through an equivalent rent estimated at 6% of the total. basket. Of course, the average share of housing is closer to 25% and even more in some cities. The square meter in the Paris is valued on average at 9,000 euros and more. It is true that an effort is being made to define a harmonized index. Nevertheless, as Herlin quite rightly points out, housing is valued in Germany according to the estimated rent that the owners would pay themselves on market terms. This produces a higher rate of inflation, 3.7% in 1993 against 2.1% in France the same year. (p 26)

To the « weighting effect » INSEE adds a « quality effect ». Herlin is perfectly right to point out the biases thus introduced. This is the heart of his criticism because it questions productivity and the need for more objective measures to better align the statistical narrative with the perceptions of consumers. « Let’s take an example: the new Apple iPad costs the same price as the old one but – be careful – as it is more powerful than the previous model, the INSEE considers that” you get more for your money “and registered in its base a falling price, lower than the price displayed. In this way, technological goods (telephone, Internet, television, etc.) pull down the price index. (p 26) All or almost all products are concerned, “automotive, services, clothing, food, etc.” » (p 27)

In addition, every year nearly 50% of the products in the index are replaced so that the generalized quality effect concerns ¼ of the basket. (p 27) which leads to a lower rise in the CPI.

We know that the Commodore 64 gave its users a higher computing power than the Manhattan Project although this ancestor of the PC functioned mainly as a connected typewriter. For an identical or largely elastic product, an increase in productivity should lead to a proportional decrease in the unit price. Clearly, a quality effect is easier to spot for production process inputs than for the consumption basket. In fact, even Solow expressed serious doubts about the impact of IT on productivity. Often the quality effect is purely subjective or even worse it is the result of simple changes in appearance more than in substance. This is well known for many « new » pharmaceutical products for which everything changes except active molecules, just to renew patent protections. Herlin is therefore well justified to look for another method of evaluating the respective components of the basket. Let’s see how he does it, noting however that in doing so he moves the problem of inflation to its supposed consequence in terms of consumption.

The consumer basket according to Herlin.

Herlin pays a fine tribute to Jean Fourastié. He deplores the discontinuation of the research group on the evolution of prices in 1978 after Fourastié’s retirement. (p 44) He proposes to emulate what he calls « the method of real equivalents ». (p 41) For him, it is therefore a question of answering the question: « How long does it take in terms of work to acquire a particular product? » (p 40) The work of the Fourastié laborer therefore naturally takes the form of the minimum wage or SMIC. All the more because he rightly recognizes that « there is no perfect neutral value, not even gold. We must therefore look at the history of the minimum wage. » (p. 45)

Aside from the sliding from the purchasing power of money proper to the purchasing power of wages, here precisely lies the fault of the argument. It focuses on the evaluation of purchasing power according to a standard otherwise invariable or at least stable over time. Herlin knows this since he immediately adds: « At certain times, the SMIC has grown faster than the rest of the wages, at others less. This must be known even if, ultimately, it will have little influence on purchasing power, as we will have the opportunity to see it. » (p 45) Basically, if I understand correctly, to understand the statistical evolution of the purchasing power of the SMIC, we must succeed in having a subjective idea of this evolutionary history, in short, we are going around in circles.

Readers of Book I of Capital will recall the essential analysis that Marx expounds in distinguishing « particular equivalent » – any commodity can play this role – « general equivalent » – gold, silver and money are types of goods which are easy to transport and handle and, above all, to divide without changing their nature in their aliquot parts – and the « universal equivalent », this latter being therefore entitled to serve as a measurement standard for all goods including itself as a merchandise, thereby scientifically defining their commensurability. Only human labor force can serve as the universal equivalent being the only use-value vector capable of transforming other use values into commodities, that is, categories belonging to the economic world defined by the exchange value. The minimum wage is an approximation of this universal equivalent but only an approximation.

We will see later why and how, taking into account the scientific theory of productivity – which neither Fourastié nor Herlin can fully comprehend – that it is necessary to replace the reference to the work of the laborer by the reference to « abstract work » and « socially necessary working time », the commensurability being made possible by the unitary working time necessary for the production of each commodity.

Here is the operative definition of Herlin: « The real price of a good is obtained in dividing its recorded price by the SMIC of the time ». (p 105)

This gives a comparative evaluation in fractions of SMIC but by correcting from time to time according to its evolution. The SMIC may vary for economic reasons related to the sharing of productivity gains or for political reasons, such as governmental intervention familiarly known as « coup de pouce » !

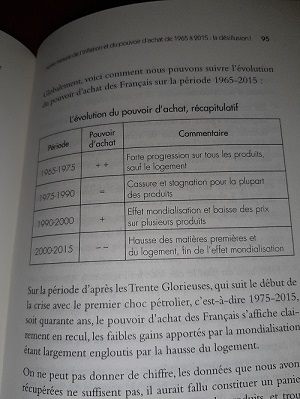

These nonetheless useful approximations are neatly summed-up in two summary tables covering the period 1965-2015. (pp 95-98)

Here is the first one:

xxx

Here is the second:

Obviously Herlin feels that his measurement standard is elastic. To avoid going around in circles, he takes refuge in an apology of competition, which alone, in his view, can guarantee « technical progress ». He poses the equation « purchasing power = technical progress » then he falls back on this quotation from Fourastié: « Technical progress is the crucial factor for the standard of living.» (p 112) He does it without realizing the confusion between « purchasing power » and « standard of living ».

Competition becomes the demiurge that ensures technical progress, therefore productivity. He says: « Technical progress does not fall from the sky, it needs a competitive environment. » (p 112) He added very wisely: « The sole increase in wages cannot be enough to increase purchasing power, if it is not accompanied by an increase in productivity. In fact, a too rapid increase in the SMIC – higher than the median wage – is reflected … by an increase in the number of employees paid the minimum wage. » (p 113) Here Herlin is seating between two chairs, a competition as the demiurge and a SMIC that is politically decided at least in part.

But he is French and moreover he has read Fourastié. Although he judges « competition too often hindered » (p 121) he also insists on « the failures of competition » (p 139) due to monopoly and oligopoly, to collusion prone capitalism, to a simplistic – European – conception that prevents the assertion of « national champions », to « naivety in the face of international competition: many countries do not play the game fairly and distort the rules to their advantage .» (p140) and finally to « bureaucratization: in this domain, – he says – the European Union is doing very well with an accumulation of texts characterised by excessive legalism, which de facto plays to the advantage of large companies …» (idem)

In short, we have already emphasized the fact that he does not distinguish between the technical composition and value composition of capital. We note here that this confusion is aggravated by the fact that he ignores the laws of motion of capital, namely the centralization and the concentration of capital, or, in Marginalist terms, the logic of economies of scale and of mergers. In addition, if productivity is to be related to the rise in « wage purchasing power », the gains should be shared. The reader of Fourastié notes that « This sharing (of added value) is of the order of two-thirds for labor and one-third for capital. » (p116) Of course, this report having deteriorated to the disadvantage of the workers, Herlin is here embarked on the monetarist wagon of the « minimum State » which he does not suspect, even for a moment, to be at the service of the very competition and the very speculation that are the true agents of this anti-economic deterioration. As incredible as it may seem in these times of regressive and anti-constitutional taxation, Herlin is here affirming a creed that Fourastié would find very strange, him who sang the socio-economic prowess of the « Thirty Glorious »: « We want to conceal the important tapping operated by the State on the wealth created by the enterprises, as if it were necessary to remain in a frontal opposition between the employees and the bosses, but without wondering about the level of the public expenditure … » (p 117) Thus the poor sharing of added value would be due to the over-size of the State !!! But according to what criteria?

This attack on the role of the State in the economy may seem contradictory since the effectiveness of the socio-economic regulation embodied by the indicative and incentive planning, known as French planning, has unfortunately been replaced by the Reagan-Monetarist LOLF devised by De Boissieu who was Jeffrey Sachs’ accomplice in Russia’s destruction during the regime of the pitre Yeltsin. We know that Sachs had to change the name of his agency to erase his tracks and escape from possible prosecution. The contradiction might seem even stronger if we take into account the fact that Herlin pointed out that INSEE did not take into account social contributions – i.e., institutionalized savings which play a major and powerful anti-cyclical role in economic regulation – and this after having duly underlined the undervaluation of the share assigned to housing in the average basket.

Faith does not know contradiction. Although Herlin takes due note of the fact that there are 2.6 million empty dwellings in France, including 1 million in Île de France, he nevertheless criticises the « SRU law requiring municipalities with more than 3,500 inhabitants to offer 25% social housing (because it) is a disguised tax: the developer is currently reselling at a loss the social housing of his operation, and must therefore make up for it on housing sold on the market. » (146)

Of course, this problem would look vastly different if the State itself had not drastically diminished its role in the construction of the necessary social housing and if it had not increasing abdicated its role in the management of existing HLMs. Or, again, if the State had not allowed the massive entry of speculation – equity funds etc – into the sector, which pushes rents up while emptying the hearts of cities of their working class. The so-called « merchants of sleep » are rightly denounced. This is aggravated today by the ease with which the courts support these speculators by forcing the evacuation of apartments and by throwing the less pecuniary occupants in the street. Hence, no one is surprised when Herlin pushes his argument so far as to back-up the deregulation of taxis and so on and so forth …

The purchasing power of money according to the quantitative scientific – Marxist – theory of money.

We have seen that despite Herlin’s confusion, the purchasing power of money is tied to the CPI. Marginalists who were aware of the shortcomings of their narration tried to give themselves statistical series in “constant” prices, plausible enough to support the decision-making of economic agents, especially in their anticipations. To understand the deception, it will suffice to recall here that the currency has for them a price determined by the market, that is to say by the Supply and Demand for the currency, but nevertheless this fair market price must be corrected retroactively by the CPI … ( This does not seem to bother anyone.)

From the scientific, therefore Marxist, point of view to speak of the purchasing power of money is to begin with the end. In fact, the scientific quantitative theory of money tells us that there is an essential distinction between the currency or money used for buying and selling and credit, which, for its part, is an anticipation of investment. Money, the general equivalent, serves to facilitate economic exchanges allowing goods to circulate while realizing their exchange value so as to allow the reproduction of the system in a stationary or dynamic manner. It also tells us that there are two monetary masses, real or social, that are necessary and sufficient to ensure all the exchanges of a given economic system without arbitrary slowdown.

The stationary reproduction system – Simple Reproduction (RS) – being:

SI = c1 + v1 + pv1 = M1

SII = c2 + v2 + pv2 = M2

Social capital = (c1 + c2) + (v1 + v2) + (pv1 + pv2) = (M1 + M2)

The Equations of the RS being:

c2 = (v1 + pv1)

M1 = (c1 + c2)

M2 = (v1 + pv1) + (v2 + pv2)

The real money mass necessary and sufficient to ensure exchanges is equal to the real salary mass, here (v1 + v2) in the social capital. Exchanges are always and by definition bilateral, so the number of rotations of this real salary mass will be: S = money supply = real salary mass. R = number of rotations; R = C/v + pv/v – where C = (c + v) here in the function of production of social capital (M1 + M2) € = value in euros of the total product = S x R In this example, the two sectoral production functions SI and SII – under which all the other sub-sectors and branches can be subsumed, the filières being cross-sectorial – produce under the same conditions, either the same organic composition of the capital (v/C, where C = (c + v)) and the same rate of surplus value or labor exploitation (pv/v).

Assuming here full employment, the exchange value of the labor force – the universal equivalent – is equal to its monetary value – the general equivalent – given by the real wage mass. In such a system, the role of the Central Bank consists only of issuing the necessary and sufficient monetary denominations to ensure all exchanges without unnecessary friction, thus to issue the right amount of S taking into account the rotations. Public credit should be a central part of Planning and managed by the ministries for their respective sectors and branches, thus respecting the symmetrically proportional allocation of credit defined by the SR-ER equations. When dealing with dynamic equilibrium the allocation of credit would be made according to the priorities set by the Equations of Enlarged Reproduction. We have shown, for instance in Tous ensemble and in more details in the Synopsis of Marxist Political Economy – v. the Books-Books section of my old Jurassic site www.la-commune-paraclet.com – that the introduction of a productivity increase in a single sector does not change the coherence of the RS system under consideration, because the modification of the organic composition of capital produced by the rise in productivity modifies the rate of surplus value in a proportionally inverse fashion. The Marxist theory of productivity – which I demonstrated – dispels the false problem of the transformation of values into prices of production and many other forgeries, for example that of the tendency of the rate of profit to fall always given in abstraction of the inverse tendency, which Marx himself had nonetheless laid out in the material used posthumously for his Book III of Capital. Indeed, one should not confuse rates and volumes of profit. In short, conceptually speaking, the case of sectors sharing the same production conditions is no longer to be considered as a special case, since coherence is maintained thanks to the scientific theory of productivity. An increase in productivity implies that the modified production function for v/C and pv/v will be able to produce more of one specific or highly elastic product during the same working time. Concretely speaking, this means that more products will be produced with fewer physical workers, the increase in productivity having the effect of structurally intensifying the work of the employed workers. (7)

Productivity is a structural intensification of labor caused by a better organic composition of capital – new techniques, the organization of a more efficient immediate production process, etc. That said, it is clear that the incessant increase in productivity, inevitable in a competitive regime – and in any case equally sought for in a socialist mode of production in order to free up working time by shortening it – will contribute to « freeing » a certain numbers of workers. These will be reduced to unemployment, at least if the introduction of new sectors or intermediate sectors does not allow their productive redeployment – « déversement » to use A. Sauvy’s phrase – or until the various forms of Reduction of the Working Week – RWW – have not helped reduce it. With the development of the capitalist system, we witnessed two parallel phenomena, the rural exodus and the accelerated substitution of the extended family by the nuclear family. The question is then raised of the support, at least minimum, of active populations reduced to unemployment – « through no faults of their own » as was so rightly formulated by the American industrial workers claiming their rights in the 20s and 30s. The capitalist solution to this problem was motivated by the recurrent desire to reduce the working classes to the physiological minimum. It consisted in making the workers themselves pay for it. This is clearly evidenced, among others, by the pitre Robert Solow and his « razor-hedge equilibrium » designed to reverse the social trends induced by Keynesianism with the support of the ethico-political defense of social rights as fundamental rights by Lord Beveridge. But this was also accomplished in a more mystified way through monetary management by means of the manipulation of inflation. This inflationary strategy was more efficient before the institutionalization of the deferred salary in the forms of pension funds and of unemployment insurance funds, the public organization of the deferred salary contributing to greatly reduce its adverse effects.

To take into account the Reserve Army of unemployed, the real salary mass (S) has to be transformed into a social salary mass (Ss). An additional issue of the basic monetary aggregate is thus added to S according to well-defined and carefully-embedded criteria of bourgeois morality. Supposedly to avoid inducing idleness – read: to force the unemployed to accept any job at the lowest price – support for the unemployed is kept below the lowest wage granted to the active labor force or below the minimum wage when it exists. The latter having to oscillate around the physiological level for the same bourgeois reasons. If, following Marx, we define the unemployed in the CPM as the Reserve Army of Capital (RA) we obtain this: Let us suppose a system SR A of departure in which SI and SII operate according to the same v/C and the same rate pv/v.,

We would have in A:

SI = c1: 80 € v1: 20 € pv1: 20 € = M1: 120 €

80Mp / 80h 20Mp / 20h 20Mp / 20h = 120Mp / 120h

SII= c2: 40 € v2: 10 € pv2: 10 € = M2: 60 €

40Cn / 40h 10Cn / 10h 10Cn / 10h = 60Cn / 60h

———————————————————————————-

(v1 + v2) = 30

Here one Cn is worth one Mp and the productive conditions being identical, the labor is from the outset homogeneous labor according to the terminology used by Emmanuel Arghiri (what Marx calls « abstract work ») and therefore immediately comparable. Let us show that the same is true when productivity differs from one sector to another as long as its rule is respected.

That is, the system SR A ‘such that productivity would have increased by 1/4 in SI;

We would have:

SI = c1: 84 € v1: 16 € pv1: 20 € = M1: 120 €

105Mp / 84h 20Mp / 16h 25Mp / 20h = 150Mp / 120h

SII= c2: 36 € v2: 9 € pv2: 9 € = M2: 54 €

36cn / 36h 9cn / 9h 9Cn / 9h = 54cn / 54h (45Mp)

(v1 + v2) = 25 (RA is worth in euros = 2.5 assuming « freed » workers receive ½ of the active workers’ wages.

The real salary mass S when it incorporated RA thus becomes the social salary mass, namely Ss = 25 euros + 2.5 euros = 27.5 euros.

The structural inflation rate, the main inflation rate, is defined by Ss/S = 27.5/25 = 1.1. Exchanges via the rotations of the social salary mass will generalize inflation without changing the employment contract, so that we will have the following price schedule:

SI= c1: 92.4 € v1: 17.6 € pv1: 22 € = M1: 132 €

105Mp / 84h 20Mp / 16h 25Mp / 20h = 150Mp / 120h

SII= c2: 39.6 € v2: 9.9 € pv2: 9.9 € = M2: 59.4 €

36cn / 36h 9cn / 9h 9Cn / 9h = 54cn / 54h (45Mp)

Explanation: The salary is always paid at the end of the production process. It is paid in money, the sum of which is supposed to correspond to the stipulations of the contract of employment. The total (v1 + v2) in Cn is distributed through the exchanges between (v1, v2 and RA) and, in so doing, generalizes inflation to the whole system. Thus v1 should be able to buy 16 Cn, but because of inflation his nominal wage will be worth only 14.54 Cn; Similarly v2 will buy 8.18 Cn instead of 9 Cn and RA will receive 2.27 Cn.

As long as the salaries will not be indexed to the rate of inflation, here the structural rate, they will be inexorably undermined, reproduction cycle after reproduction cycles. Of course, possible salary increases will mitigate this systemic inflationary haircut. Indeed, in the next cycle, the essential ratios, v/C and pv/v, remain unchanged as well as the labor contract by which v1 is supposed to receive 16 Cn and v2, 9 Cn.

The crucial popular conquest which allowed the historic incorporating of deferred salary – and taxes – to the gross pay slip in the employment contract offers the solution of the problem in real terms. But this is true only if it is sufficient to cover needs, especially those of the pension scheme and unemployment insurance. This is transparent with the pay-as-you-go or « repartition » system, although public contributory systems – in the sense that they are not traded on the stock-exchange … – play the same role. Moreover, the latter would allow the constitution of Workers’ Funds ideal for the accumulation of public capital and thus capable to transform private property into public or cooperative property very quickly as it was explained in my Tous ensemble inspired by R. Meidner on this specific aspect. The transition would be quickly accomplished if one only thinks of the 20 billion euros annually devoted to the CICE which translates into exemption from social contributions for the benefit of capital. In any case, residual indexation or a fair rise in wages will still be necessary, if only because of the existence of other forms of inflation.

With the CPM, these corrections are implemented only empirically and blindly, following popular, union and political pressures. Capitalist logic is reifying, inhuman; it persists in treating the worker as a simple factor of production that can be exchanged at any time in its monetary form – including now on the global stock market. Witness the ruthless abolition of social safety nets by current monetarists and neo-liberals, first and foremost the increasing privatization of pension and unemployment insurance schemes. Note that the pay-as-you-go or « repartition » system was adopted following the stock market ruin of the private pension regimes that prevailed in the 1930s.

It remains to explain the current low inflation rate. It is due to the statistical falsification as shown by the shadowstats or by Herlin. However, it will not have escaped anyone that the monetarist battle against inflation followed the savage dismantling of social programs and the adoption of workfare by R. Reagan, a socio-economic counter-revolution immediately imitated everywhere else. The Cola clause is a thing of the past. Today, even officially programmed inflation is no longer compensated; retirees know it well since the compensation now promised by French leaders will amount to a meager 0.3%.

In Tous ensemble I have noted that this rate of structural inflation transforms the exchange value equilibrium into a « exchange value-price equilibrium » that can always be corrected by the return to full employment either by the redeployment of the manpower or by the RWW to the extent allowed by the exchange rate reflecting microeconomic productivity and macroeconomic competitiveness. It will be noticed that by knowing the genesis of the inflations, in the plural, one can go easily back to the underlying exchange value expression. Marginalist and Fisherian constant prices are thus a hogwash resulting from a series of consciously accomplished falsifications. Within the CPM this structural inflation – as well as other monetary inflations – simply makes it possible to charge the « maintenance » of the non-active labor force to the active labor force without going through the more politically risky redistribution of the social surplus value in the form of deferred salary and other social safety nets. This is achieved automatically by the currency devaluation realised through the exchange in relation to an unchanged total exchange value. We have said that there are other forms of inflation than just structural inflation. We refer the reader to our Synopsis of Marxist Political Economy. We will confine ourselves here to briefly draw attention to the role played by competition in the production of the divergences between exchange value and price, sending the reader back to the same freely accessible book in the Books-Books section of my old Jurassic site www.la-commune-paraclet.com .

Take our canonical Marxist schemas into two Sectors of Mp and Cn. We know that the coherence of this scheme is summarized by the SR-ER Equations for the entire reproductive cycle. In fact, these Equations formalize what Marx had brilliantly stated as a social demand in his Parisian Manuscripts of 1844. A consistent planning will take into account these Equations for the anticipations related to the investments necessary for Enlarged Reproduction. Now submit the two production functions in SI and SII to competition, that is to say to uncoordinated choices – except by possible sociological market studies – and mainly motivated by intra-industry competition. The search for individual productivity will be the main driver of this competition. But the result of the ensuing productions will never be optimal when checked against the constraints of the SR-ER Equations. Never mind these contradictions, the CPM is driven by the logic of concentration-centralization of capital, and business accounting is tailor-made. For example, the management of inventories which, if they do not disappear pure and simple, are re-evaluated according to the prevailing production conditions when they are brought back on the market. In the end, since the Mp and Cn must be exchanged with each other, all these blind mechanisms are overdetermined by the SR-ER Equations. There is always an ex post capitalist equilibrium but, of course, it is never socially optimal. That being said, in order to properly evaluate price expressions, all subsectors contributing to the final realization of the commodity should be included in the Schemes. Starting with the extraction of raw materials and including services, including bureaucratic and financial services, as well as transportation, marketing and sale/purchase operations. This realization involve all the circuits of commodity capital, production capital and money capital, since exchanges at each level are mediated by money. Of course, the search for the optimization of input into the process of immediate production is part of the logic of the accumulation of capital. This is done in relation to competitors. However, multinationals and oligopolistic transnationals firms sometimes adopt a variety of strategies aimed at the elimination of other players from their sector. (8) Nevertheless, as far as the exchange value or the price expression are concerned, it is the actual use of the inputs which counts and not their possible « optimum » (?) use.

As a result, the socially necessary labor time by unit of the product offered for sale is the basis for judging the structure of relative prices and, in the end, of the actual standard of living in a given system. Of course, to intervene in the real economy, this supposes that one can know the origin of monetary excesses – inflation, etc. – including that caused by the nominal wage, and the salary form that is actually spent. This is why workers, pensioners and citizens in general, who have no say in the allocation of resources, require at least the indexation of their income. They know full well that they will otherwise be silently stripped off through the inflations, in addition to their direct exploitation at work. In other words, while maintaining their other trade-union or class demands, they certainly cannot afford to underestimate the monetary deviations that still eat away their standard of living. The laws of motion of capital, besides productivity, are essentially summed up by the joint tendencies of concentration and centralization of capital. They are aggravated by the monetary management of the bourgeois central bank. The latter, in particular through its so-called uniform guiding rates of interest – not to mention its plans for the recurrent bailout of private capital – has one and only one function, that of ensuring the formal equality of access of private economic agents to money and credit, albeit confusing the two. Of course, it is a Censitarian equality, the size of agents being decisive here. As we said above, this explains the recurrent conjunctural crises, since Trade cycles are the result of a speculative expansion in certain sectors accompanied by contractions in others, especially as foreign trade cannot always correctly mediate these contradictions.

It remains that since competition abolishes itself in the medium and the long term, as Marx notes in its Parisian Manuscripts of 1844, the explanation for prices and profit must be found elsewhere. Nonetheless, competition is the behavioral rule through which the CPM works, a rule aptly characterised by some as the « the acquisitive mind ». It is over-determined by the relentless pursuit of the greater productivity and therefore the continued accumulation of capital. At the systemic level this translates into the contradictions induced by this social blindness subordinated to the logic of private egoism, otherwise known since Adam Smith as the operation of the « invisible hand ». The result in terms of SR-ER or in terms of stationary or dynamic equilibrium being the great and inevitable waste associated with the CPM, while a number of essential social needs are less unanswered because they are not deemed solvent. Unfortunately even R & D follows this logic of private accumulation. In spite of the erratic and disordered productions due to the « invisible hand », the SR-ER Equations remain decisive for forcing the equilibrium necessary for the reproduction. These Equations define the social demand and thus overdetermine – to borrow a term from the great Louis Althusser – equilibrium. Except that with the CPM this equilibrium is not only ex post, it is also infra-social, to the point that often one can speak literally of an « equilibrium of the cemetery ». (See the hundreds of thousands of deaths associated with the monetarist reforms, which do not concern only the deaths caused in Chile, Latin America or Africa, but also, lately, in Greece etc. See :THE BODY ECONOMIC: why austerity kills, by David Stuckler and Sanjay Basu, HarperCollins Publishers LTD, 2013. A critical review. In http://www.la-commune-paraclet.com/Book%20ReviewsFrame1Source1.htm#thebodyeconomic .)

In my Synopsis I have shown the main monetary effects that are related to the blind operation of capitalist competition – i.e., to the expression of the « invisible hand » in the allocation of the resources of the Community. Here too, just as for structural inflation, knowing the cause of monetary deviations, one can more or less accurately assess their impact. This task would be made much easier thanks to the development of Marxist statistics based on the production function and the SR-ER Equations. The same goes for the imported inflation already mentioned in my Tous ensemble, which essentially places the focus on the exchange rate of the domestic currency and consequently on the adequacy of the insertion of the National Social Formation in the World Economy according to the parameters set by microeconomic productivity and macroeconomic competitiveness, simply because no country can live long beyond its means. Thanks to the Marxist quantitative theory of money, we therefore know what the purchasing power of money is. Now we have to go back to the other essential problem, namely the one improperly termed the « purchasing power of wages » which covers the problem of the equity of capitalist distribution-redistribution as embodied in the « structure of v » or, if one prefers, in the « global net income » of the households that defines the standard of living. In short, the « structure of v » will be all the more accurate the more closely it will reflect the structure of the SR-RE, including by taking into account the insertion of the Social Formation into the Capitalist World Economy. It is immediately realized that the « structure of v » is inadequate in the CPM. It is sacrificed to the logic of private-economic accumulation producing conjunctural crises – trade cycles – and structural crises – overproduction/under-consumption.

With the Social or Welfare State, the « structure of v » took the form of the “global net income” of households, which is a little more equitable that the sole capitalist individual salary coterminous with classical liberal capitalism. This better redistribution of the surplus value between labor and capital was totally challenged by the current monetarists and neo-liberals and this led to the greatest depression since the Great Depression unleashed in 1929. According to available figures some 7% to 10 or 11% of GDP was transferred from labor to capital since the 1980s, years tragically marked by the seal of the neo-liberal monetarist counter-reform; and this transfer was carried out without any compensation for labor apart from increased work precariousness. The only interludes to this regression, unequaled since the 20-30’s, were the « Programme Commun » of the French Left until the « turning point of rigor » of 1983 and the RWW – RTT in French – implemented by the « gauche plurielle ». Let’s see this in more detail.

The socially necessary working time per unit of product is the standard of universal measurement of relative prices, not the work of the laborer or the SMIC.

While Adam Smith was thinking in terms of complex work – trades – to be broken down into a simple amount of work by the modern division of labor – pin factory – Fourastié adopted the work of the laborer as a standard of measurement. He was especially concerned about the effect of machinery and technology on productivity to raise the standard of living of citizens. He wrote beautiful pages comparing the average longevity and standard of living prevailing at the time of his grandmother with those of his time. But he did not have a scientific theory of productivity. He tried, however, to approach the question rigorously on the basis of diachronic and synchronic “empirical” facts carefully amassed.

The work of the laborer made it possible to analyze these facts since it could be supposed that the work of the unskilled laborer remained stable in time and space. In fact, the Capitalist Mode of Production – CPM – is based as productivity, which is a structural intensification of work, as the dominant form of surplus-value extraction. Before the CPM, all previous modes of production were based on the extraction of absolute surplus value – the duration of labor – sometimes using the intensity of work but in a transient fashion. Fourastié tried to consolidate his analytical point of departure by focusing on the study of certain productions that remained unchanged until the beginning of the modern era. His most famous example is the production of mirrors. Having thus established the work of the laborer as the standard of measurement it became possible to decompose the different works into salary scales useful for the comparisons. Without a scientific theory of productivity, this approximation remains very random. And it is becoming increasingly so as capitalist productivity continues to assert its grip on the National Social Formation, thus reducing the old modes of production that previously coexisted with the CPM into historical residues with little economic impact. This is particularly the case in the countryside with the assertion of agricultural capitalism, strongly accelerated by the CPM. The “Baconian empiricism” (Koyre’s expression) which characterizes the expression « simple labor » or « work of the laborer » must give way to the concepts of abstract labor and of socially necessary labor time for reproduction, the first of which concerns to the function of production, the process of immediate production, the second expressing the same concept at the macroeconomic level of Simple and Enlarged Reproduction. In the process of immediate production formalized by the production function: c + v + pv = M, a specific use of the factors of production asserts itself. It is analysable in a given society – i.e., in the context of its « moral » or civilizational, or better, parametric, conditions – as the organic composition of capital (v/C) with its systematically associated surplus value (pv/v).

This organization of work and production operates an internal division of labor, so that the trades involved appear in the formalization of the production function as abstract work. In other words, it is no longer the trade or the specific complex work that matters at this level but the working collective to which it belongs. However, since the production function is controlled by the capitalist who owns the means of production, it is at this level that is waged a bitter battle to dispossess the worker of his « secrets » and his «craftsmanship », that is to say his ability to transform other use values into commodities. The objective of the capitalist on this « contested terrain » is to mechanically decompose and recompose tasks in a more subordinate manner – Taylorism, micro-Taylorism – in order to remove all bargaining power from specialized workers. To understand the passage from abstract work, which has become a scientific “concrete thought” and no longer a Baconian empirical datum, to the socially necessary work, it will suffice to refer to the diagrams presented above which introduce productivity in SI. In SI, we take C = (c1 + v1) = 100 before and after the introduction of productivity to facilitate comparison and the analysis of the mutation caused by the rise of productivity. At departure v1: 20 euros = 20 Mp. After the introduction of the productivity v1 = 16 euros = 20 Mp but as v1 must exchange its Mp in means of consumption (Cn) and that now we went from 1 Mp = 1 euro to 1 Mp = 0.8 euros the exchange of Mp of v1 in Cn will give 16 Cn. Which is congruent with the fact that the productivity intensifies the work force structurally, causing the same work force to produce more although it will now represents proportionally fewer physical workers. At this stage we can briefly emphasize the essential difference between the classical labor law of value and that of Marx. Without Karl Marx, the classical law of value is incapable of explaining the genesis of profit. Here is how I summed up the thing in my « Hi-han: the bourgeois economist’s donkish visual hallucinatory: What is not scientific is not Marxist, and vice versa.» (9):

« Adam Smith, starting from an incomplete labor law of value, stumbled on a partial production function written c + v = M, that is constant capital plus labor = product, which forced him to admit the illegitimacy of profit beyond the amount of the manager’s salary («They like to reap where they have never sown » he wrote with some disdain, p 47, ed. Sutherland, 1993). Continuing the reasoning, Marx restores the complete function of production on the basis of his own scientifically elucidated labor law of value: the production function then becomes c + v + pv = M, i.e., constant capital + variable capital + surplus value (or profit) = M. In this way, Marx will expose the mystery of capitalist profit and accumulation, a discovery which all bourgeois ceaselessly tried to obscure since then. Marx does this masterfully without breaking the basic economic equality between the sum of the inputs and the outputs of the production function, equality without which the economy would irretrievably be doomed to irrationality. » This incompleteness also characterizes, I do not say the neo-Ricardians who are a band of verbose pitres without the least substance, but Piero Sraffa himself. Sraffa was the friend and correspondent of Gramsci, a fact which undoubtedly influenced his preference for classical political economy. Indeed, the secret of his attempt to rehabilitate classical political economy against the various Marginalist narratives, in particular those due to the economists that Joan Robinson denounced with a calculated descriptive precision as « Keynesian bastards », such as Hicks, Samuelson and Solow in the first place, is revealed by the title of his masterpiece Production of Commodities by means of Commodities, at least for those who can read. Of course, this referred to a basic or more complex consumer basket, in other words an indirect reformulation of the socially necessary labor of the Karl Marx’s reproduction schemes. Except that Sraffa, no more than Smith, is able to explain the genesis of profit. He is therefore obliged to use a version of the simultaneous transformation of Tugan-Baranovsky giving the rate of profit exogenously.

The introduction of inflation – price diverging relative to the exchange value – does not change this over-determination by the underlying SR-ER Equations. In fact, as can be seen, my diagrams return both quantities, exchange values and prices in an entirely coherent fashion. The ultimate verification is provided by the argument that Marx had masterfully expounded in the Chapter of Capital, Book I, entitled « The Last Hour of Senior ». This chapter sounds like an anticipated criticism of all the falsifications of Marginalism. Thanks to the consistent introduction of productivity into the production function and the SR-ER Equations, labor – abstract and socially necessary labor – remains entirely homogeneous, and this remains true for every part of the product, a logical requirement that Marx emphasizes in the key chapter mentioned. It is therefore the socially necessary labor time per unit of output – thus taking into account the scientific theory of productivity – which serves as a yardstick. Which is very different from the « simple labor » time in abstraction of parametric conditions v/C and pv/v. At this socially necessary labor time are associated precisely the quantities produced as well as their exchange values and their price expressions, taking into account the inflations whose origins are now known.

“Structure of v”, “global net income” of the households and labor contract.

We can then return scientifically to the question of the « purchasing power of wages » or SMIC, a somewhat confusing wording as we saw above, to ask the real question that goes to the heart of the system and its contradictions : namely the equity of the “structure of v” in the production function inserted into the Equations of Simple and Enlarged Reproduction. What is really involved is the use and sharing of the wealth created in the production process. In short, any economic system will be all the more coherent as the components of the « structure of v » faithfully reflect the Equations of the SR-ER, taking into account the insertion of the SF in the World Economy.