Take a glance at the following graphs. Notice how pitiful are all paid mainstream academic economists and journalists when they talk about « inflation » in the singular. The market is supposed to give you the « right market price » by crossing Supply and Demand. But then crossing Supply and Demand also gives you inflation because there is more Demand –read : salary mass – than Supply – read: the total amount of goods and services available. However, today, when you buy things, you buy at a price, indeed at « a market price » which incorporates inflation. We are told a lot of crap, you might conclude, and you would be right.

(Clarification added on November 24, 2022: Inflation in the generic sense of the term refers to a gap between the exchange value of a commodity and its market price that oscillates around it. As Karl Marx already said in his Parisian Manuscripts of 1844, in the long term – more precisely in a cycle of reproduction – these oscillations cancel each other out. Consequently, the market cannot provide a scientific explanation of the exchange value that is the phenomenon, the market price being only its epiphenomenon brought about by capitalist competition. Marginalism is based on the falsification of the theory of exchange value, in particular of the exchange value of labor power, which refers to the extraction of surplus-value in the production process and consequently to exploitation. To support this falsification, utility replaced the concept of exchange value. The marginal utility of a commodity is a subjective ideological construction, elastic and contrary to logical coherence, as shown by the ex-ante/ex-post problem that emerges from the intersection of the Supply and Demand curve that is supposed to give the market price. This subjectivism makes no sense except to forge a certain plausibility by claiming that capitalist logic – that of the capitalist acquisitive mind – always prevails diachronically and synchronously. Even so, a psychological phenomenon is not quantifiable. On this basis, one cannot grasp the central problem of economics, which is the commensurability of different goods with each other. This led to the obligatory subjectivist falsification of all social disciples, who were gradually brought under the close academic, social and political dependence of the Austrian School. Behavior would therefore be identical in a slave society, a feudal society, a capitalist society, a potlatch society, a liberal capitalist society of the origins, or the present hegemonic speculative capitalism. This is absurd, and this is why no bourgeois economist knows and cannot know what inflations are: they are outside his narrative and pseudo-conceptual field. CPI-inflation is an empirical construct of the falsifier Irving Fisher, who approaches the salary mass through the construction of the average consumption basket without distinguishing between exchange value and price. This construction is therefore a priori incapable of saying anything scientific about inflations. This is why, in order to preserve a trace of plausibility – without which he would not be followed – the falsifier Irving Fisher is obliged to introduce his construction of constant prices, which simply consists of using a year as a base of 100 to make comparisons, which, of course, does not resolve anything from a conceptual point of view. All this is explained in my work, including the Methodological Introduction. For the three main types of inflation as they are strongly impacted by the nonsense of the Paris Agreement, see: http://rivincitasociale.altervista.org/inflation-a-new-absurd-ecologist-bourgeois-cycle-is-announced-with-a-hike-in-prices-going-hand-in-hand-with-wage-deflation-but-this-is-given-as-inflation-12-may-2021/ )

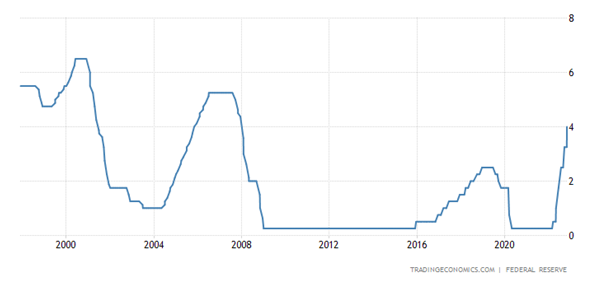

For a scientific explanation of inflations – in the plural – see the references provided below. For now, just take a look at the graphs below; they concern both the USA and the EU: QE never caused any inflation – in a CPI sense of the word. Indeed, until very recently, at the FED and the ECB, they were desperate to get 2% – or hovering around 2 %. And of course, they did not get CPI-inflation when they started tapering!!! They started getting some with the Accord of Paris and the climatic shibboleth aimed at freezing economic development of emerging countries at 1990 with the CO2 excuse – life on Earth is carbon based, CO2 is beneficial to vegetation … And this was before the sanctions imposed on Russia. Now they do have inflation with attempted tapering, but they do not have a clue of why this is happening …

Economists and political leaders do not know what inflations are but they sure know how to use « inflation » to shave your wages month after month and to transfer the cost of their rising public debt on the shoulders of domestic and foreign creditors.

Today, though, they will not dare apply their textbooks which they know are not worth the paper they are written on because this would simply mean raising interest rates well above the official inflation rate with the vague hope of lowering CPI-inflation. In other words, they think that they need a recession, as deep as necessary, to lower « inflation ». But they could not tell you why they think so, other than because they ideologically believe to reach this objective somehow by lowering Demand – despite decades of bubbling markets and of labor precariousness and wage deflation! For them as for Milton Friedman « inflation is always and everywhere a monetary phenomenon ». And therefore they content themselves to moderately track Core inflation. Which boils down to the same socio-economic disaster but one induced at a slower pace – like citizens-frogs in slowly boiling water. Especially as the Treasury and the Ministers of Economy and Finance are clueless and are not doing what they would be supposed to do. In particular, reinstating the full Cola Clause on all revenues, aiming at full-time full-employment – with proper social contributions to finance Social Security and other safety nets –and coming back to public credit in order to finance the public debt and to nationalise strategic public enterprises which provide public goods and services or commons.

Today, as dramatically illustrated by the recent UK financial and margin calls crisis, the Western Central Banks are sailing blind, pragmatically trying to conciliate high but negative interest rates with new liquidity pouring, while still talking of tapering.

You would expect academics to start questioning their own mainstream dogmas and avoid occulting economic science, be it developed by following and elucidating the scientific work of Karl Marx. Including on the Left. Deference to self-proclaimed authority is for the domestics and the pitres who are still entrapped in the proverbial Cavern. But we live in a strange World in which intellectual honesty is indeed a rare commodity. Apparently, so is academic deontology which is not respected by occulting true scientific works in order to safe baseless class and cast narratives. With their baseless and falsified narratives, mainstream economists seem to have been the prime example to follow for doctors, researchers and bureaucrats working for Big Pharma or for the IPCC. Unfortunately, ordinary citizens pay the highest price of this « servitude volontaire ».

Paul De Marco, former professor of International Relations – International Political Economy.

United States Fed Funds Rate, https://tradingeconomics.com/united-states/interest-rate

United States Inflation Rate, https://tradingeconomics.com/united-states/inflation-cpi

QUANTITATIVE EASING: I was initiated by the then FED’s Chair B Bernanke in Q1, 2008.

TAPERING: «Then in December 2013, the Fed announced tapering of purchases under QE3. The purchases concluded in October 2014. », see https://americandeposits.com/history-quantitative-easing-united-states/

QUANTITATIVE TIGHTENING :

« Here’s a rundown of what appears to be in the cards and how it differs from the 2017-2019 “QT” period.

Earlier start

The Fed appears poised to kick off this QT round just one meeting after lifting its benchmark short-term interest rate for the first time since 2018. » https://economictimes.indiatimes.com/markets/stocks/news/explained-the-feds-qt-plan-then-and-now/articleshow/90697360.cms

XXX

Euro Area Interest Rate, https://tradingeconomics.com/euro-area/interest-rate

Euro Area Inflation Rate, https://tradingeconomics.com/euro-area/inflation-cpi

QUANTITATIVE EASING started in 2015 but Trichet had started pouring out liquidities in August 2007 claiming he was the first to do so … he made sure not to say that he was operating outside his ECB mandate …

TAPERING The ECB started considering it by the end of 2021 but like the FED it finds itself between a rock and a hard place as explained in my essay : « Credit without collateral in the epoch of negative real interest rates » Oct 29-Nov 7, 2022 in http://rivincitasociale.altervista.org/credit-without-collateral-in-the-epoch-of-negative-real-interest-rates-oct-29-nov-7-2022/

References (The original in French are also available in the same sites):

1 ) Methodological introduction and Synopsis of Marxist Political Economy , both are available in the Livres-Books sections of my old experimental site www.la-commune-paraclet.com

For a quick summary see: « The pseudo -economic science of the bourgeoisie: here is why we should quickly change economic paradigm », in http://rivincitasociale.altervista.org/the-pseudo-economic-science-of-the-bourgeoisie-here-is-why-we-should-quickly-change-economic-paradigm/

2 ) « Credit without collateral in the epoch of negative real interest rates » Oct 29-Nov 7, 2022, in http://rivincitasociale.altervista.org/credit-without-collateral-in-the-epoch-of-negative-real-interest-rates-oct-29-nov-7-2022/

3 ) « Inflation: a new absurd ecologist bourgeois cycle is announced with a hike in prices going hand in hand with wage deflation but this is given as inflation », 12 may 2021/ in http://rivincitasociale.altervista.org/inflation-a-new-absurd-ecologist-bourgeois-cycle-is-announced-with-a-hike-in-prices-going-hand-in-hand-with-wage-deflation-but-this-is-given-as-inflation-12-may-2021/

4 ) « Purchasing power, standard of life, socially necessary working time and the « global net income » of the households », 2-31 Dec. 2018, in http://rivincitasociale.altervista.org/purchasing-power-standard-of-life-socially-necessary-working-time-and-global-net-income-of-the-households-2-31-dec-2018/

5 ) « GDP: Marginalist narration tool against the Welfare of peoples and the prosperity of Nation-State », May 24 2020, http://rivincitasociale.altervista.org/gdp-marginalist-narration-tool-against-the-welfare-of-peoples-and-the-prosperity-of-nation-states-may-24-2020/ .

6 ) « Paris Agreement, climate, decarbonisation and the problems with ETS: the climate crime against emerging countries and against the vast majority of humanity to be frozen at the unequal development level of 1990 », in http://rivincitasociale.altervista.org/paris-agreement-climate-decarbonization-and-the-problems-with-ets-the-climate-crime-against-emerging-countries-and-against-the-vast-majority-of-humanity-to-be-frozen-at-the-unequal-development-lev/

7 ) « For an open multilateral world without monetary suzerainty, meddling in internal affairs and extraterritoriality: for bilateral credit lines and public credit », April 7, 2022, in http://rivincitasociale.altervista.org/for-an-open-multilateral-world-without-monetary-suzerainty-meddling-in-internal-affairs-and-extraterritoriality-for-bilateral-credit-lines-and-public-credit-april-7-2022/

8 ) « The dismantling of the Social State or of the Anglo-Saxon Welfare State and monetarist neoliberal policies seen from the angle of the labor contract », October 4, 2016-April 9, 2020, in http://rivincitasociale.altervista.org/the-dismantling-of-the-social-state-or-of-the-anglo-saxon-welfare-state-and-monetarist-neoliberal-policies-seen-from-the-angle-of-the-labor-contract-october-4-2016-april-9-2020/

9 ) « Health-care between cuts and corruption victim of choice for neoliberal and monetarist fiscal federalism », May 2016, translated in April 6, 2020 in http://rivincitasociale.altervista.org/health-care-between-cuts-and-corruption-victim-of-choice-for-neoliberal-and-monetarist-fiscal-federalism-may-2016-translated-april-6-2020/